LAST UPDATE: 01-april-2025

Lecico is a leading producer of export-quality sanitary ware in the Middle East and one of the largest tile producers in Egypt and Lebanon, with over 45 years of experience in the industry and decades of experience as an exporter to developed markets.

| Fiscal Years | |||

| Fiscal Year | Period Ending | Report Date | Restatement Type |

|---|---|---|---|

| FY 2022 | Dec-31-2022 | Mar-01-2023 | Reclassified |

| FY 2023 | Dec-31-2023 | Mar-03-2024 | Reclassified |

| FY 2024 | Dec-31-2024 | Mar-02-2025 | Original |

| Current/LTM | Apr-01-2025 | Apr-01-2025 | Current/LTM |

| Key Financials | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Total Revenues | 3,273.8 M | 4,842.9 M | 6,644.7 M | 6,644.7 M |

| YoY Growth % | 23.90 % | 47.93 % | 37.20 % | 37.20 % |

| Gross Profit | 520.8 M | 1,488.9 M | 1,875.2 M | 1,875.2 M |

| Gross Profit Margin | 15.91 % | 30.74 % | 28.22 % | 28.22 % |

| EBITDA | 100.4 M | 1,032.6 M | 1,293.8 M | 1,293.8 M |

| EBITDA Margin | 3.07 % | 21.32 % | 19.47 % | 19.47 % |

| Net Income | (3.2) M | 446.3 M | 890.3 M | 890.3 M |

| Net Income Margin | (0.10) % | 9.22 % | 13.40 % | 13.40 % |

| Diluted EPS | (0.04) | 5.58 | 11.13 | 11.13 |

| YoY Growth % | – | – | 99.50 % | 99.50 % |

| Price / Earnings – P/E | – | 4.7 x | 2.9 x | 2.3 x |

| Capital Structure | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Market Capitalization | 555.2 M | 1,999.9 M | 2,589.6 M | 2,053.6 M |

| Cash & Equivalents | 498.0 M | 456.3 M | 352.2 M | 352.2 M |

| Total Debt | 1,680.5 M | 1,913.7 M | 1,617.5 M | 1,617.5 M |

| Preferred Equity | – | – | – | – |

| Minority Interest | 57.3 M | 76.3 M | 122.0 M | 122.0 M |

| Enterprise Value – EV | 1,753.9 M | 3,533.5 M | 3,976.9 M | 3,440.9 M |

| Cash Flow Analysis | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Cash from Operations | 169.0 M | 137.3 M | 537.1 M | 537.1 M |

| YoY Growth % | 256.08 % | (18.77) % | 291.31 % | 291.31 % |

| Capital Expenditure | (103.8) M | (264.4) M | (285.0) M | (285.0) M |

| YoY Growth % | 58.84 % | 154.80 % | 7.77 % | 7.77 % |

| Revenues | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Total Revenues | 3,273.8 M | 4,842.9 M | 6,644.7 M | 6,644.7 M |

| YoY Growth | 23.90 % | 47.93 % | 37.20 % | 37.20 % |

| Finance Division Revenues | – | – | – | – |

| Insurance Division Revenues | – | – | – | – |

| Other Revenues | – | – | – | – |

| Gross Profit | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Cost of Revenues | 2,752.9 M | 3,354.0 M | 4,769.5 M | 4,769.5 M |

| Gross Profit (Loss) | 520.8 M | 1,488.9 M | 1,875.2 M | 1,875.2 M |

| YoY Growth | 8.94 % | 185.86 % | 25.95 % | 25.95 % |

| Operating Income & Expenses | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Selling, General & Admin Expenses | 507.7 M | 520.0 M | 668.0 M | 668.0 M |

| R&D Expenses | – | – | – | – |

| Depreciation & Amortization | – | – | – | – |

| Other Operating Expenses | 10.5 M | 30.6 M | 56.3 M | 56.3 M |

| Operating Income | 2.7 M | 938.3 M | 1,150.9 M | 1,150.9 M |

| Net Interest Expense | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Interest Expense | (100.1) M | (248.8) M | (275.0) M | (275.0) M |

| Interest and Investment Income | 5.0 M | – | 6.9 M | 6.9 M |

| Earnings Before Taxes (EBT) | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Income (Loss) on Equity Affiliates | – | – | 1.0 M | 1.0 M |

| Other Non-Operating Income (Expenses) | (104.2) M | – | – | – |

| Assets | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Total Cash And Short Term Investments | 498.0 M | 456.3 M | 352.2 M | 352.2 M |

| Cash And Equivalents | 498.0 M | 456.3 M | 352.2 M | 352.2 M |

| Short Term Investments | – | – | – | – |

| Trading Asset Securities | – | – | – | – |

| Total Receivables | 832.6 M | 1,050.0 M | 1,285.5 M | 1,285.5 M |

| Accounts Receivable | 483.7 M | 758.8 M | 872.2 M | 872.2 M |

| Other Receivables | 135.7 M | 187.0 M | 265.3 M | 265.3 M |

| Inventory | 1,238.2 M | 1,597.0 M | 2,543.4 M | 2,543.4 M |

| Restricted Cash | – | – | – | – |

| Prepaid Expenses | 14.7 M | 17.4 M | 41.0 M | 41.0 M |

| Other Current Assets | 103.0 M | 112.4 M | 117.4 M | 117.4 M |

| Total Current Assets | 2,686.4 M | 3,233.0 M | 4,339.5 M | 4,339.5 M |

| Net Property Plant And Equipment | 1,997.6 M | 2,204.6 M | 3,378.2 M | 3,378.2 M |

| Gross Property Plant And Equipment | 3,782.2 M | 4,285.3 M | 6,004.8 M | 6,004.8 M |

| Accumulated Depreciation | (1,784.7) M | (2,080.7) M | (2,626.6) M | (2,626.6) M |

| Long-term Investments | 0.0 M | 0.0 M | 0.0 M | 0.0 M |

| Goodwill | – | – | – | – |

| Other Intangibles | 10.9 M | 17.4 M | 29.7 M | 29.7 M |

| Loans Receivable Long-Term | 0.5 M | 0.4 M | – | – |

| Deferred Tax Assets Long-Term | – | – | – | – |

| Deferred Charges Long-Term | – | – | – | – |

| Other Long-Term Assets | – | – | – | – |

| Total Assets | 4,695.5 M | 5,455.4 M | 7,747.4 M | 7,747.4 M |

| Liabilities | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Accounts Payable | 464.7 M | 428.6 M | 755.9 M | 755.9 M |

| Accrued Expenses | 262.2 M | 367.6 M | 437.1 M | 437.1 M |

| Current Portion of Long-Term Debt | 71.4 M | 100.0 M | 200.0 M | 200.0 M |

| Current Portion of Leases | 16.4 M | 23.8 M | 35.4 M | 35.4 M |

| Current Income Taxes Payable | 41.4 M | 151.6 M | 280.3 M | 280.3 M |

| Unearned Revenue Current, Total | – | – | – | – |

| Other Current Liabilities | 213.8 M | 205.5 M | 270.0 M | 270.0 M |

| Total Current Liabilities | 2,317.2 M | 2,664.6 M | 2,897.2 M | 2,897.2 M |

| Long-Term Debt | 273.9 M | 317.4 M | 355.9 M | 355.9 M |

| Long-Term Leases | 71.5 M | 85.0 M | 107.7 M | 107.7 M |

| Unearned Revenue Non Current | – | – | – | – |

| Deferred Tax Liability Non Current | 111.2 M | 312.1 M | 520.4 M | 520.4 M |

| Other Non Current Liabilities | 21.3 M | 3.1 M | 9.6 M | 9.6 M |

| Total Liabilities | 2,795.1 M | 3,382.3 M | 3,890.8 M | 3,890.8 M |

| Common Equity | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Common Equity | 1,843.1 M | 1,996.9 M | 3,734.6 M | 3,734.6 M |

| Common Stock | 400.0 M | 400.0 M | 400.0 M | 400.0 M |

| Additional Paid In Capital | 181.2 M | 181.2 M | 181.2 M | 181.2 M |

| Retained Earnings | (319.9) M | 126.4 M | 991.3 M | 991.3 M |

| Treasury Stock | – | (25.4) M | – | – |

| Comprehensive Income and Other | 1,581.8 M | 1,314.7 M | 2,162.1 M | 2,162.1 M |

| Total Equity | 1,900.4 M | 2,073.2 M | 3,856.6 M | 3,856.6 M |

| Total Liabilities And Equity | 4,695.5 M | 5,455.4 M | 7,747.4 M | 7,747.4 M |

| Supplemental Items | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| ECS Total Shares Outstanding on Filing Date | 80.0 M | 76.8 M | 80.0 M | 80.0 M |

| ECS Total Common Shares Outstanding | 80.0 M | 76.8 M | 80.0 M | 80.0 M |

| Book Value / Share | 23.04 | 26.00 | 46.68 | 46.68 |

| Tangible Book Value | 1,832.2 M | 1,979.5 M | 3,704.9 M | 3,704.9 M |

| Tangible Book Value Per Share | 22.90 | 25.77 | 46.31 | 46.31 |

| Total Debt | 1,680.5 M | 1,913.7 M | 1,617.5 M | 1,617.5 M |

| Net Debt | 1,182.5 M | 1,457.4 M | 1,265.3 M | 1,265.3 M |

| Equity Method Investments | 0.0 M | 0.0 M | 0.0 M | 0.0 M |

| Operating & Non-Operating Items | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Depreciation & Amortization, Total | 109.5 M | 115.4 M | 175.0 M | 175.0 M |

| Depreciation & Amortization | 109.5 M | 115.4 M | 175.0 M | 175.0 M |

| Amortization of Goodwill and Intangible Assets | – | – | – | – |

| Net Income | (3.2) M | 446.3 M | 890.3 M | 890.3 M |

| Cash from Operations – Net Income | (3.2) M | 446.3 M | 890.3 M | 890.3 M |

| Depreciation & Amortization, Total (repeated) | 109.5 M | 115.4 M | 175.0 M | 175.0 M |

| (Gain) Loss From Sale Of Asset | 27.1 M | (2.8) M | (0.0) M | (0.0) M |

| (Gain) Loss on Sale of Investments | 6.9 M | – | – | – |

| Amortization of Deferred Charges, Total | 1.2 M | 2.8 M | 4.1 M | 4.1 M |

| Asset Writedown & Restructuring Costs | – | – | – | – |

| Stock-Based Compensation | – | – | – | – |

| Other Operating Activities, Total | 248.7 M | 204.6 M | (214.8) M | (214.8) M |

| Change In Accounts Receivable | (286.9) M | (27.0) M | (268.5) M | (268.5) M |

| Change In Inventories | (297.8) M | (227.2) M | (1,025.0) M | (1,025.0) M |

| Change In Accounts Payable | 333.9 M | (440.8) M | 940.4 M | 940.4 M |

| Change in Unearned Revenues | – | – | – | – |

| Change In Income Taxes | – | – | – | – |

| Change in Other Net Operating Assets | 29.7 M | 65.9 M | 35.6 M | 35.6 M |

| Cash from Operations (final) | 169.0 M | 137.3 M | 537.1 M | 537.1 M |

| Cash from Investing | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Capital Expenditure | (103.8) M | (264.4) M | (285.0) M | (285.0) M |

| Sale of Property, Plant, and Equipment | 19.2 M | 3.6 M | 0.0 M | 0.0 M |

| Cash Acquisitions | – | – | – | – |

| Divestitures | – | – | – | – |

| Investment in Mkt and Equity Securities, Total | – | – | – | – |

| Net (Increase) Decrease in Loans Orig / Sold | – | – | – | – |

| Other Investing Activities, Total | – | – | – | – |

| Cash from Investing (net) | (87.1) M | (264.8) M | (291.1) M | (291.1) M |

| Cash from Financing | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Total Debt Issued | 423.3 M | 218.9 M | 752.8 M | 752.8 M |

| Short Term Debt Issued, Total | 423.3 M | 140.2 M | – | – |

| Long-Term Debt Issued, Total | – | 78.6 M | 752.8 M | 752.8 M |

| Total Debt Repaid | (33.4) M | (107.6) M | (1,102.7) M | (1,102.7) M |

| Short Term Debt Repaid, Total | – | – | (469.0) M | (469.0) M |

| Long-Term Debt Repaid, Total | (33.4) M | (107.6) M | (633.7) M | (633.7) M |

| Issuance of Common Stock | – | – | – | – |

| Repurchase of Common Stock | – | (25.4) M | – | – |

| Common & Preferred Stock Dividends Paid | (46.8) M | – | – | – |

| Common Dividends Paid | (46.8) M | – | – | – |

| Preferred Dividends Paid | – | – | – | – |

| Special Dividends Paid | – | – | – | – |

| Other Financing Activities | (89.2) M | 30.0 M | – | – |

| Cash from Financing (net) | 254.0 M | 115.9 M | (350.0) M | (350.0) M |

| Net Change in Cash | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Foreign Exchange Rate Adjustments | – | – | – | – |

| Miscellaneous Cash Flow Adjustments | – | – | – | – |

| Net Change in Cash | 335.8 M | (11.7) M | (104.0) M | (104.0) M |

| Supplemental Cash Flow Items | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Free Cash Flow | 65.2 M | (127.2) M | 252.1 M | 252.1 M |

| Free Cash Flow per Share | 0.82 | (1.66) | 3.15 | 3.15 |

| Cash Interest Paid | 105.1 M | 248.8 M | 281.9 M | 281.9 M |

| Cash Income Tax Paid (Refund) | 55.3 M | 41.4 M | 201.4 M | 201.4 M |

| Change In Net Working Capital | 260.2 M | 417.0 M | 620.6 M | 620.6 M |

| Net Debt Issued / Repaid | 390.0 M | 111.2 M | (350.0) M | (350.0) M |

| Valuation Metrics | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Sales | Revenues | – | – | – | – |

| EV / Sales (LTM) | 0.5 x | 0.7 x | 0.6 x | 0.5 x |

| EV / Sales (NTM) | – | 0.7 x | 0.5 x | – |

| Price / Sales (LTM) | 0.2 x | 0.4 x | 0.4 x | 0.3 x |

| Price / Sales (NTM) | – | 0.4 x | 0.3 x | – |

| Earnings | – | – | – | – |

| EV / EBITDA (LTM) | 15.6 x | 3.4 x | 3.0 x | 2.6 x |

| EV / EBITDA (NTM) | – | 3.6 x | 2.5 x | – |

| EV / EBIT (LTM) | – | 3.8 x | 3.5 x | 3.0 x |

| EV / EBIT (NTM) | – | – | – | – |

| Price / Earnings (LTM) | – | 4.7 x | 2.9 x | 2.3 x |

| Price / Earnings (NTM) | – | 9.0 x | 3.9 x | – |

| Book Value | – | – | – | – |

| Price / Book (LTM) | 0.3 x | 1.0 x | 0.7 x | 0.5 x |

| Price / Tangible Book Value (LTM) | 0.3 x | 1.0 x | 0.7 x | 0.6 x |

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

| Market Capitalization | 555.2 M | 1,999.9 M | 2,589.6 M | 2,053.6 M |

| Cash & Short Term Investments | 498.0 M | 456.3 M | 352.2 M | 352.2 M |

| Total Debt | 1,680.5 M | 1,913.7 M | 1,617.5 M | 1,617.5 M |

| Preferred Equity | – | – | – | – |

| Minority Interest | 57.3 M | 76.3 M | 122.0 M | 122.0 M |

| Enterprise Value | 1,753.9 M | 3,533.5 M | 3,976.9 M | 3,440.9 M |

| Enterprise Value Multiples | ||||

| EV / Sales | 0.5 x | 0.7 x | 0.6 x | 0.5 x |

| EV / EBITDA | 15.6 x | 3.4 x | 3.0 x | 2.6 x |

| EV / EBIT | – | 3.8 x | 3.5 x | 3.0 x |

| Capitalization | ||||

| Total Capital | 3,580.9 M | 3,986.8 M | 5,474.1 M | 5,474.1 M |

| Total Common Equity | 1,843.1 M | 1,996.9 M | 3,734.6 M | 3,734.6 M |

| Total Preferred Equity | – | – | – | – |

| Total Debt | 1,680.5 M | 1,913.7 M | 1,617.5 M | 1,617.5 M |

| Minority Interest | 57.3 M | 76.3 M | 122.0 M | 122.0 M |

| Returns | ||||

| Return on Total Capital | 0.05 % | 15.50 % | 15.21 % | 15.21 % |

| Total Debt / Total Capital | 46.9 % | 48.0 % | 29.5 % | 29.5 % |

| Total Debt / Equity | 88.4 % | 92.3 % | 41.9 % | 41.9 % |

| Total Debt / EBITDA | 15.0 x | 1.8 x | 1.2 x | 1.2 x |

| Long-Term Debt / Total Capital | 9.6 % | 10.1 % | 8.5 % | 8.5 % |

| Returns | ||||

| Return on Assets | 0.04 % | 11.55 % | 10.90 % | 10.90 % |

| Return On Equity | 0.74 % | 23.80 % | 31.01 % | 31.01 % |

| Return on Total Capital | 0.05 % | 15.50 % | 15.21 % | 15.21 % |

| Return on Common Equity | (0.19) % | 23.24 % | 31.07 % | 31.07 % |

| Margins | ||||

| EBITDA Margin | 3.07 % | 21.32 % | 19.47 % | 19.47 % |

| EBITA Margin | 0.08 % | 19.37 % | 17.32 % | 17.32 % |

| EBIT Margin | 0.08 % | 19.37 % | 17.32 % | 17.32 % |

| EBT Margin | – | – | – | – |

| EBT Excl. Non-Recurring Items Margin | – | – | – | – |

| Gross Profit Margin | 15.91 % | 30.74 % | 28.22 % | 28.22 % |

| SG&A Margin | 14.21 % | 10.39 % | 9.94 % | 9.94 % |

| Net Income Margin | (0.10) % | 9.22 % | 13.40 % | 13.40 % |

| Net Avail. For Common Margin | (0.10) % | 9.22 % | 13.40 % | 13.40 % |

| Normalized Net Income Margin | 1.62 % | 7.90 % | 9.70 % | 9.70 % |

| Asset Turnovers | ||||

| Receivables Turnover (Average Receivables) | 7.6 x | 7.8 x | 8.1 x | 8.1 x |

| Fixed Assets Turnover (Average Fixed Assets) | 1.8 x | 2.3 x | 2.4 x | 2.4 x |

| Inventory Turnover (Average Inventory) | 2.5 x | 2.4 x | 2.3 x | 2.3 x |

| Asset Turnover | 0.8 x | 1.0 x | 1.0 x | 1.0 x |

| Days Outstanding Inventory (Avg) | 146.8 | 154.3 | 158.9 | 158.9 |

| Short-term Liquidity | ||||

| Current Ratio | 1.2 x | 1.2 x | 1.5 x | 1.5 x |

| Quick Ratio | 0.5 x | 0.5 x | 0.5 x | 0.5 x |

| Days Sales Outstanding (Average Receivables) | 48.0 | 46.8 | 44.9 | 44.9 |

| Days Payable Outstanding (Avg) | 44.3 | 43.9 | 37.9 | 37.9 |

| Cash Conversion Cycle (Average Days) | 150.5 | 157.2 | 165.9 | 165.9 |

| Operating Cash Flow to Current Liabilities | 0.1 % | 0.1 % | 0.2 % | 0.2 % |

| Return on Invested Capital (ROIC) | ||||

| Net Operating Profit After Tax (NOPAT) | (61.0) M | 724.3 M | 838.4 M | 838.4 M |

| Invested Capital, Average | – | 3,783.8 M | 4,730.5 M | 5,474.1 M |

| Return on Invested Capital (ROIC) | – | 19.14 % | 17.72 % | 15.32 % |

| Net Operating Profit After Tax (NOPAT) – repeated | (61.0) M | 724.3 M | 838.4 M | 838.4 M |

| EBIT | 2.7 M | 938.3 M | 1,150.9 M | 1,150.9 M |

| Income Tax Expense | 63.7 M | 214.0 M | 312.5 M | 312.5 M |

| Net Operating Profit After Tax (NOPAT) – again | (61.0) M | 724.3 M | 838.4 M | 838.4 M |

| Average Invested Capital (Components) |

Long Term Debt: 273.9 M Short Term Debt: 1,318.7 M Total Equity: 1,900.4 M Current Portion of Leases: 16.4 M Long Term Leases: 71.5 M |

Long Term Debt: 317.4 M Short Term Debt: 1,487.4 M Total Equity: 2,073.2 M Current Portion of Leases: 23.8 M Long Term Leases: 85.0 M |

Long Term Debt: 355.9 M Short Term Debt: 1,118.5 M Total Equity: 3,856.6 M Current Portion of Leases: 35.4 M Long Term Leases: 107.7 M |

Long Term Debt: 355.9 M Short Term Debt: 1,118.5 M Total Equity: 3,856.6 M Current Portion of Leases: 35.4 M Long Term Leases: 107.7 M |

| Invested Capital | 3,580.9 M | 3,986.8 M | 5,474.1 M | 5,474.1 M |

| Invested Capital, Average | – | 3,783.8 M | 4,730.5 M | 5,474.1 M |

| Debt Analysis | ||||

| Total Debt / Equity | 88.4 % | 92.3 % | 41.9 % | 41.9 % |

| Total Debt / Capital | 46.9 % | 48.0 % | 29.5 % | 29.5 % |

| Long-Term Debt / Equity | 18.2 % | 19.4 % | 12.0 % | 12.0 % |

| Long-Term Debt / Capital | 9.6 % | 10.1 % | 8.5 % | 8.5 % |

| Total Liabilities / Total Assets | 59.5 % | 62.0 % | 50.2 % | 50.2 % |

| Interest Rate Coverage | ||||

| EBIT / Interest Expense | 0.0 x | 3.8 x | 4.1 x | 4.1 x |

| EBITDA / Interest Expense | 1.1 x | 4.2 x | 4.7 x | 4.7 x |

| (EBITDA – Capex) / Interest Expense | 0.1 x | 3.2 x | 3.7 x | 3.7 x |

| Debt Coverage | ||||

| Total Debt / EBITDA | 15.0 x | 1.8 x | 1.2 x | 1.2 x |

| Net Debt / EBITDA | 10.5 x | 1.4 x | 1.0 x | 1.0 x |

| Total Debt / (EBITDA – Capex) | 199.9 x | 2.4 x | 1.6 x | 1.6 x |

| Net Debt / (EBITDA – Capex) | 140.7 x | 1.8 x | 1.2 x | 1.2 x |

| Bankruptcy Risk | ||||

| Altman Z-Score | 0.80 | 1.75 | 2.04 | 2.04 |

Sources

- Bloomberg Terminal

- Reuters

- Investopedia

- Mckvay

- MarketWatch

- Trading Economics

- Acuity Knowledge Partners

- Koyfin

- Cboe Global Markets

- TradingView

- Central Bank Website

Disclaimer

The information, content, and recommendations provided on this platform are intended solely for educational and informational purposes. Under no circumstances should they be construed as personalized investment advice, nor do they constitute a solicitation to buy, sell, or hold any financial instruments.

1. No Guarantee of Profit:

Trading in financial markets involves substantial risk, and there is no guarantee of profit or protection against losses. Past performance is not indicative of future results, and the potential for loss is real.

2. Independent Decision-Making:

All investment decisions are your sole responsibility. You are strongly encouraged to perform your own due diligence, research, and seek advice from a qualified financial professional before making any investment or trading decisions.

3. Market Risks:

Financial markets are inherently volatile and subject to numerous factors, including economic conditions, geopolitical events, and unforeseen circumstances. These factors may cause rapid and significant changes in market conditions that may impact your investments.

4. No Liability:

Mckvay Consulting and any associated parties shall not be held liable for any direct, indirect, or consequential damages resulting from reliance on the information provided. Any use of this platform is at your own risk.

5. Educational Purpose Only:

The content provided is designed to educate and inform about general market trends, analysis, and strategies. It is not intended to offer specific investment recommendations or actionable directives.

6. Accuracy of Information:

While we strive to provide accurate and up-to-date information, we cannot guarantee the completeness, accuracy, or reliability of the data or recommendations. Numbers, statistics, and projections may contain errors or be outdated. Always verify data from multiple sources before making decisions.

7. Risk of Loss:

You acknowledge that trading in financial instruments carries a high level of risk and may result in the loss of your entire investment. You should only invest money you can afford to lose.

8. Past Performance:

Historical data, performance charts, and any backtesting results provided are not predictive of future performance. Past results should not be used as an indication of future success.

9. No Endorsement:

The information provided does not imply endorsement or recommendation of any particular product, service, or financial instrument. Any action taken based on the provided content is solely at the discretion of the user.

10. Changes to Information:

The content, data, and recommendations on this platform may change without notice. We are not responsible for keeping the information current or for any losses arising from the use of outdated content.

11. External Links:

Any external websites or third-party links provided are not under the control of Mckvay Consulting. We are not responsible for the content, availability, or accuracy of such external sites.

12. No Warranty:

The platform, its content, and any services offered are provided “as is,” without any warranties, express or implied, including but not limited to the accuracy, completeness, or fitness for a particular purpose.

13. Consultation with Professionals:

It is essential to consult with qualified professionals, including but not limited to financial advisors, tax consultants, or attorneys, before making any investment decisions, particularly if you are unfamiliar with the risks of financial markets.

14. Simulated or Hypothetical Performance:

Simulated performance results or hypothetical returns may not reflect actual trading results and are often designed with the benefit of hindsight. These results may not account for the potential impact of financial market factors, such as transaction costs or liquidity constraints.

15. No Control Over Market Events:

Mckvay Consulting cannot control or predict unforeseen market events, and no one can predict market movements with certainty. Therefore, the possibility of significant losses due to unexpected market developments exists.

By using this platform, you acknowledge that you have read, understood, and agreed to the terms outlined in this disclaimer. You accept the inherent risks associated with trading and investing, and you agree to trade responsibly and within your financial capacity.

This disclaimer includes the professional tone and additional points to cover a wider range of legal and risk-related considerations, including the possibility of errors in data and the need for independent verification.

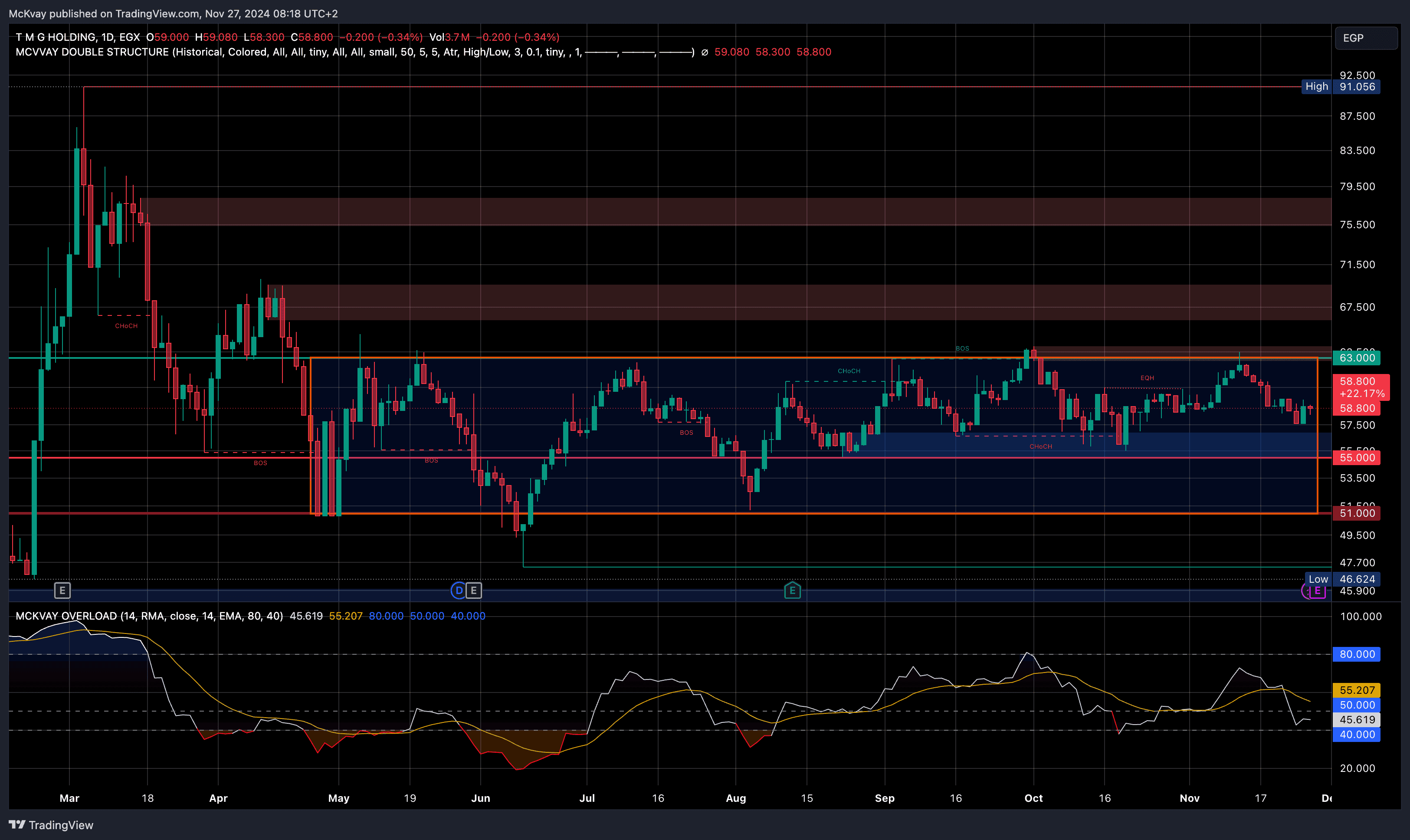

TMG Holding (EGX: TMGH) – FINANCIAL & Technical OUTLOOK, Forecast & Future Scenarios, AND Major Trend Analysis.

TMG Holding (EGX) Technical & Strategic Forecast TMG Holding (EGX) Technical & Strategic Forecast Date: April 26, 2025 📑 Table of Contents Introduction Major Trend Analysis…

Oriental Weavers (ORWE) – institutional-grade Financial and Technical analysis across weekly, daily, AND (4H) timeframes.

ORWE Market Analysis ORWE Technical Analysis Executive Summary The Oriental Weavers (ORWE) stock is showing clear signs of a bullish reversal on the medium-term horizon. Technical…

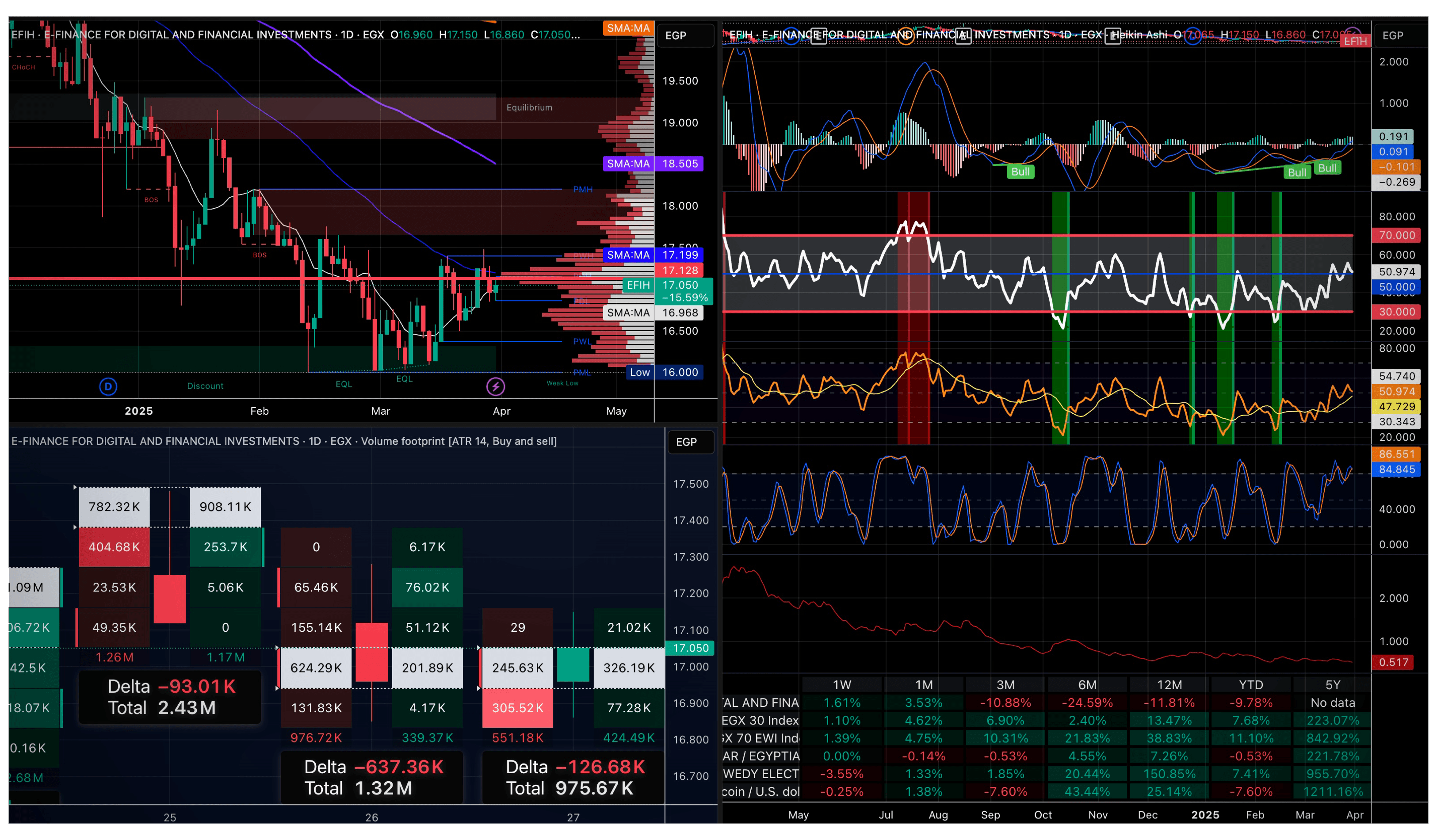

STOCK LOOK – technical & financial Outlook on EFIH (E-Finance for Digital and Financial Investments) AND Market Comparison & Performance Metrics.

Technical Analysis of EFIH (E-Finance for Digital and Financial Investments) Technical Analysis of EFIH (E-Finance for Digital and Financial Investments) 1. Trend Analysis Overall Trend: The…

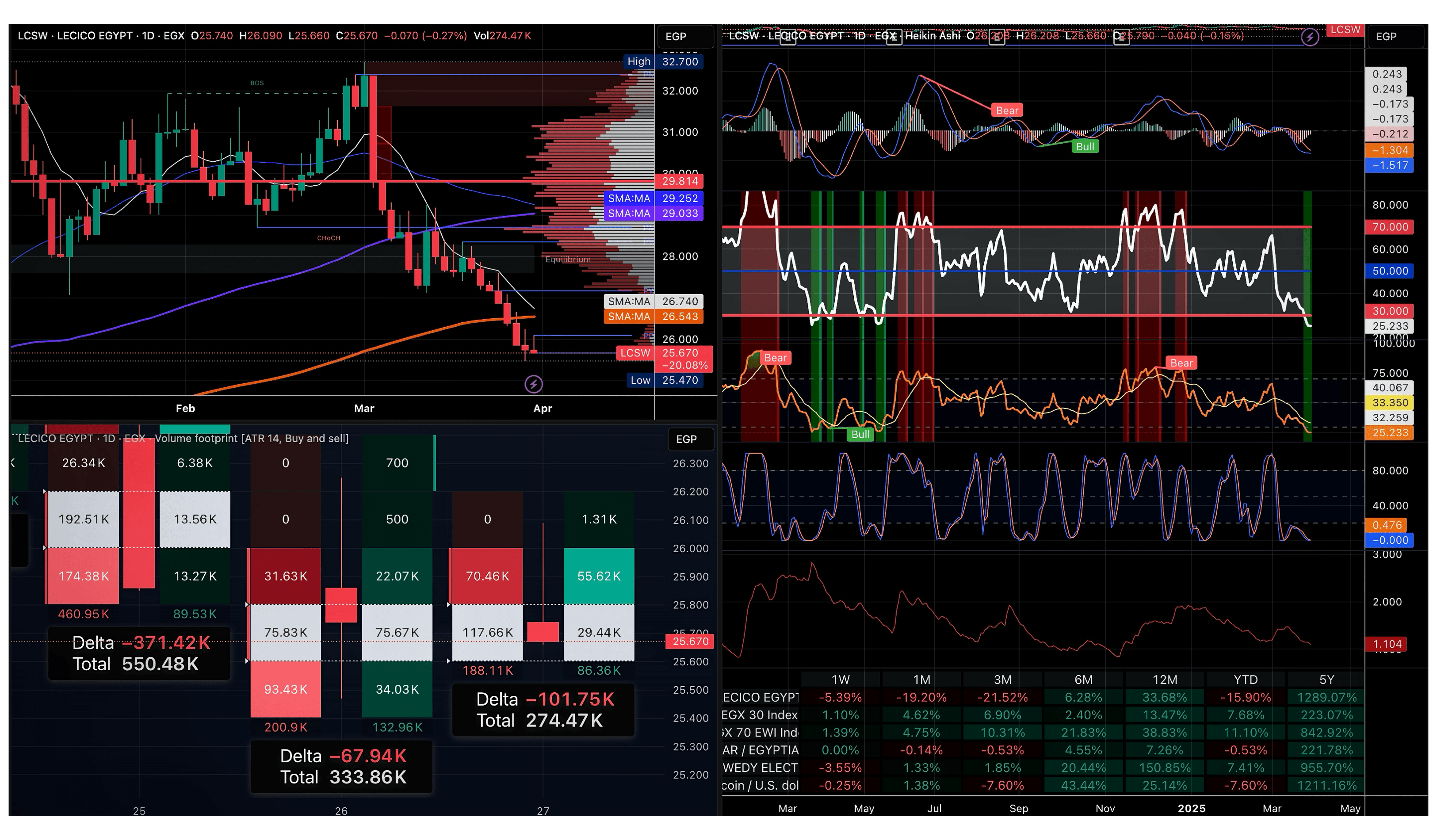

STOCK LOOK – LECICO EGYPT (LCSW) technical & financial Outlook on a DAILY timeframe, AND Market Comparison & Performance Metrics.

Friday Payday Report: Market Maker Playbook Price Action & Trend Analysis Stock: LECICO EGYPT (LCSW) Timeframe: Daily (1D) Current Price: 25.670 Change: -0.27% (-0.070) High of…

TMGH ~ Stock Look

Talaat Moustafa Group Holding (TMGH) has demonstrated robust financial performance and strategic growth in 2024, solidifying its position as a leading real estate developer in Egypt….

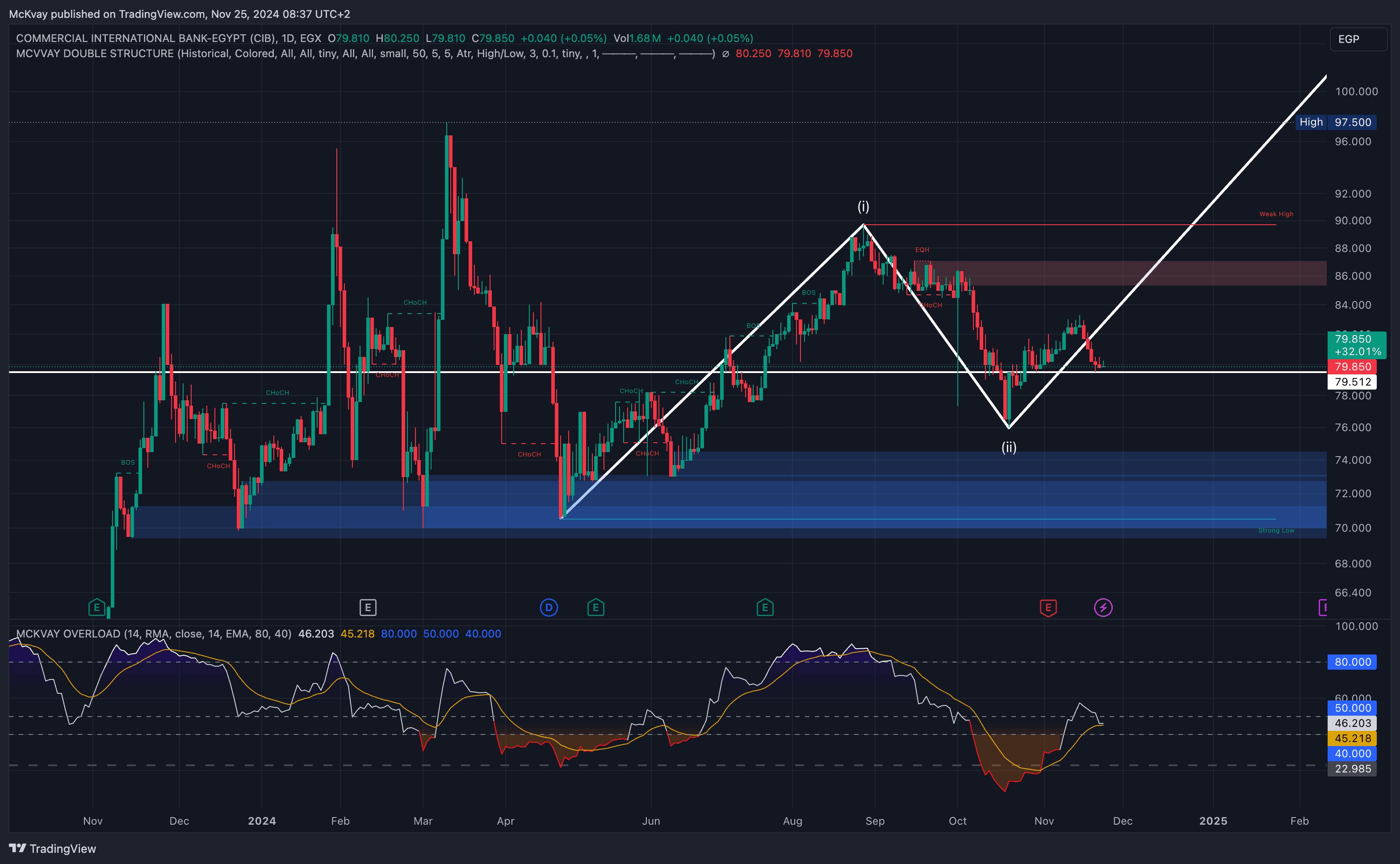

COMI ~ Stock look

Commercial International Bank (CIB): A leading private-sector bank in Egypt, offering a wide range of financial products and services. 24TH OF NOV 2024 COMI Key Performance…

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions