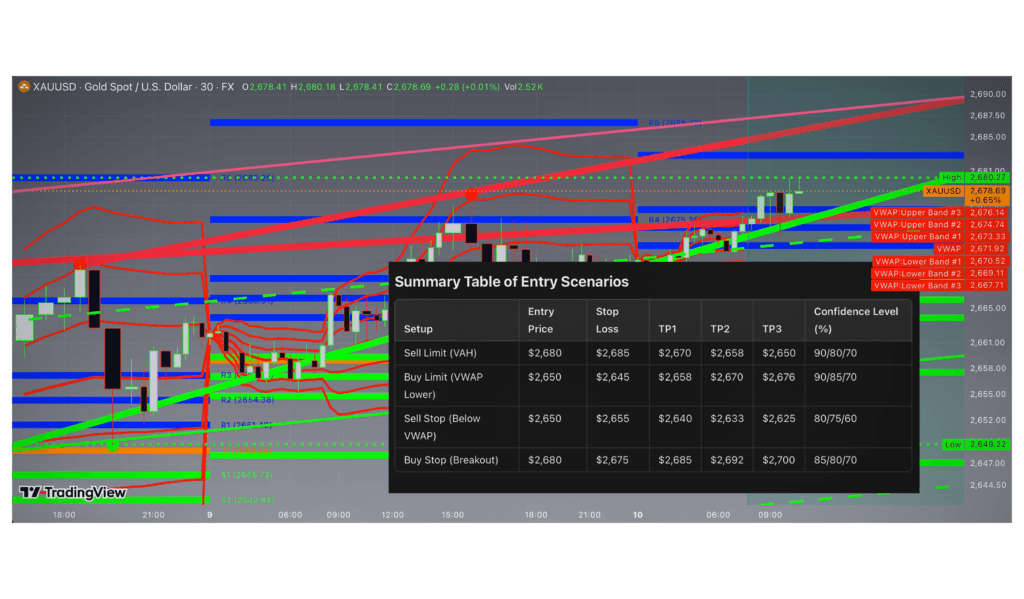

Gold Trading Strategy for Tokyo Session (XAUUSD) between $2,650 – $2,680

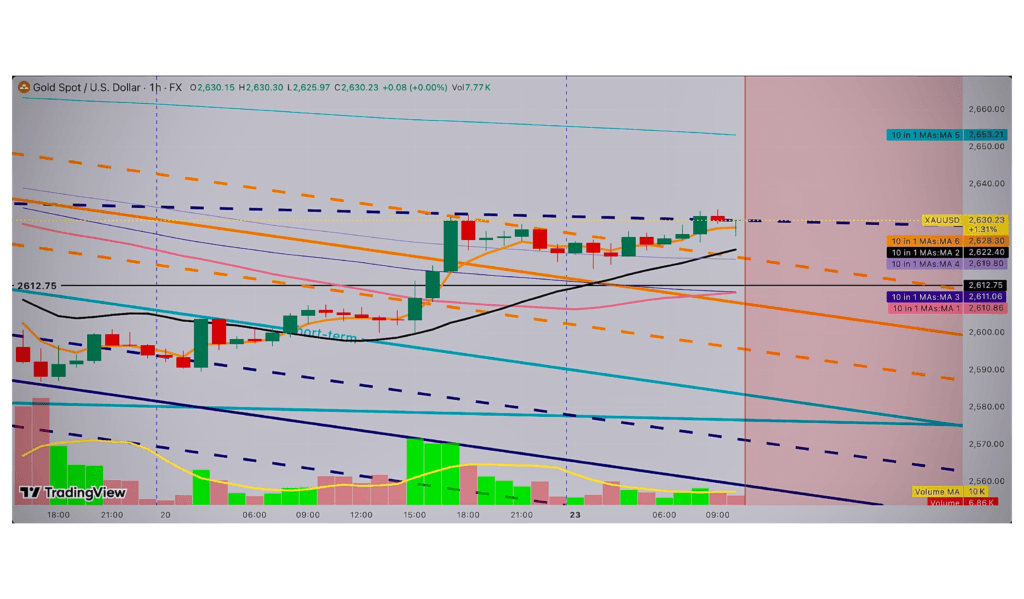

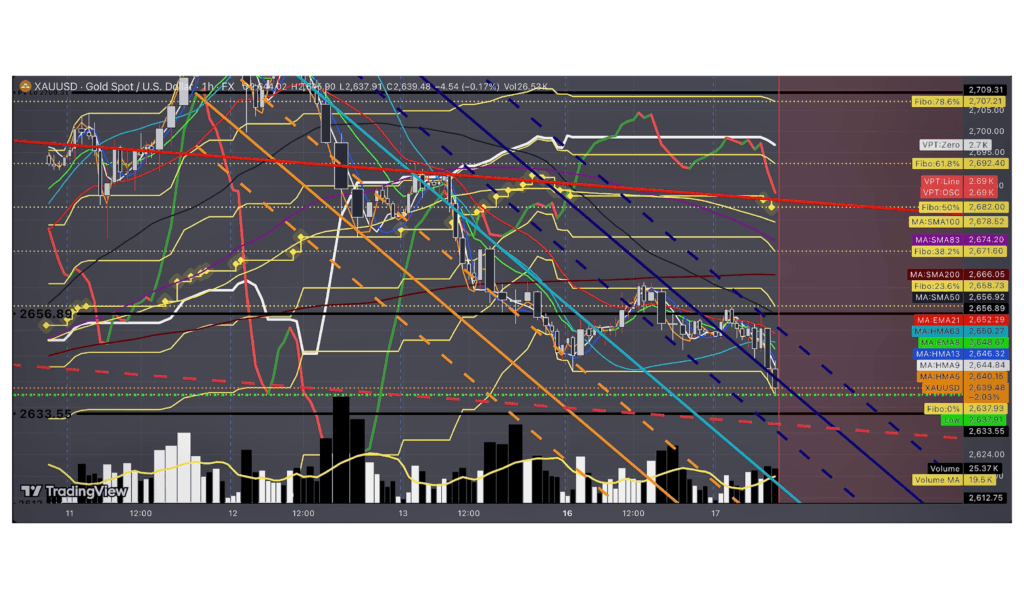

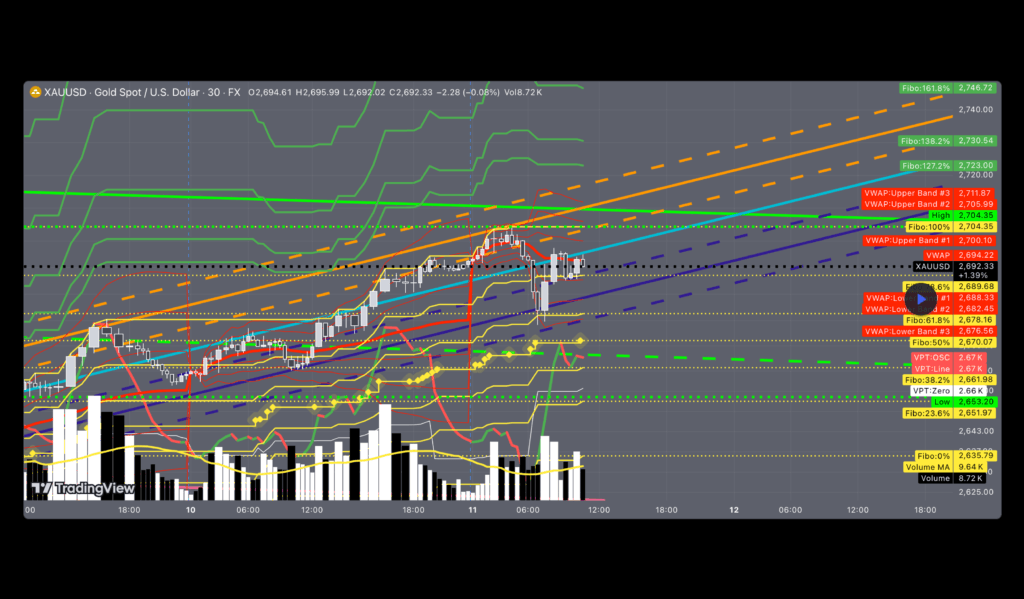

a href=”https://www.tradingview.com/chart/XAUUSD/mAHLibxp/”> Gold (XAU/USD) Analysis Overall Market Context Description XAU/USD is currently ranging between $2,650 (VWAP Lower Band) and $2,680 (VAH). Institutional Liquidity Resistance $2,680 Support $2,650 Current Trend The uptrend remains intact above $2,670 (POC), but there are short-term signs of weakness. Strategy Overview Liquidity Traps Above $2,680 to trigger sell positions. Below $2,650 […]

Gold Trading Strategy for Tokyo Session (XAUUSD) between $2,650 – $2,680 Read More »