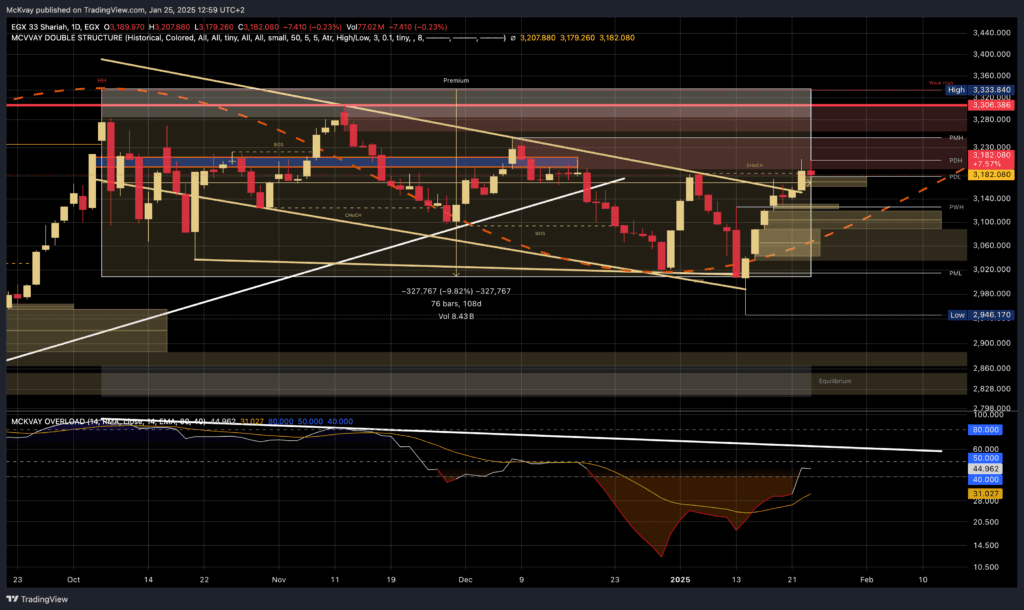

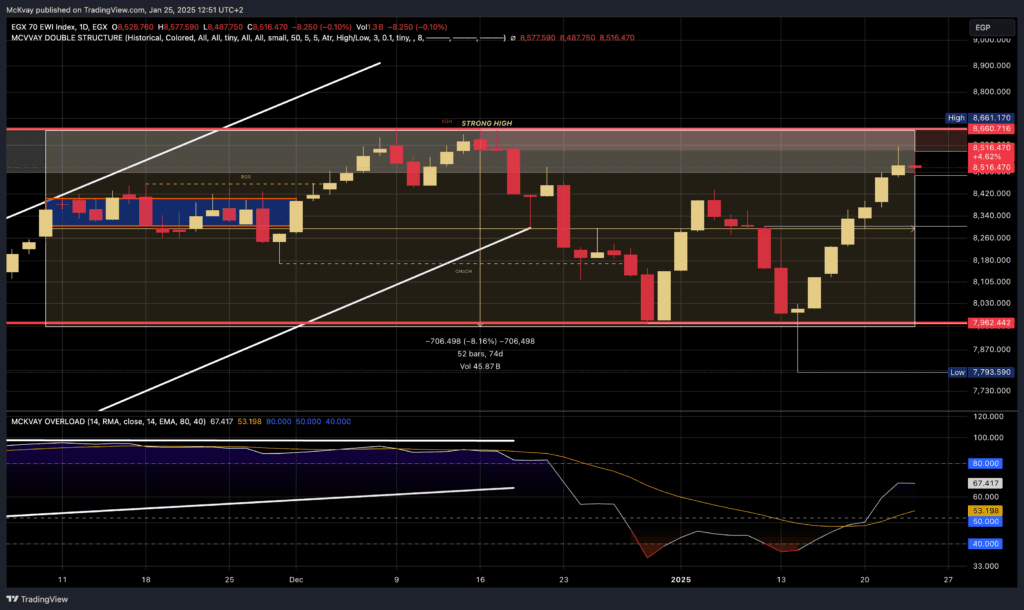

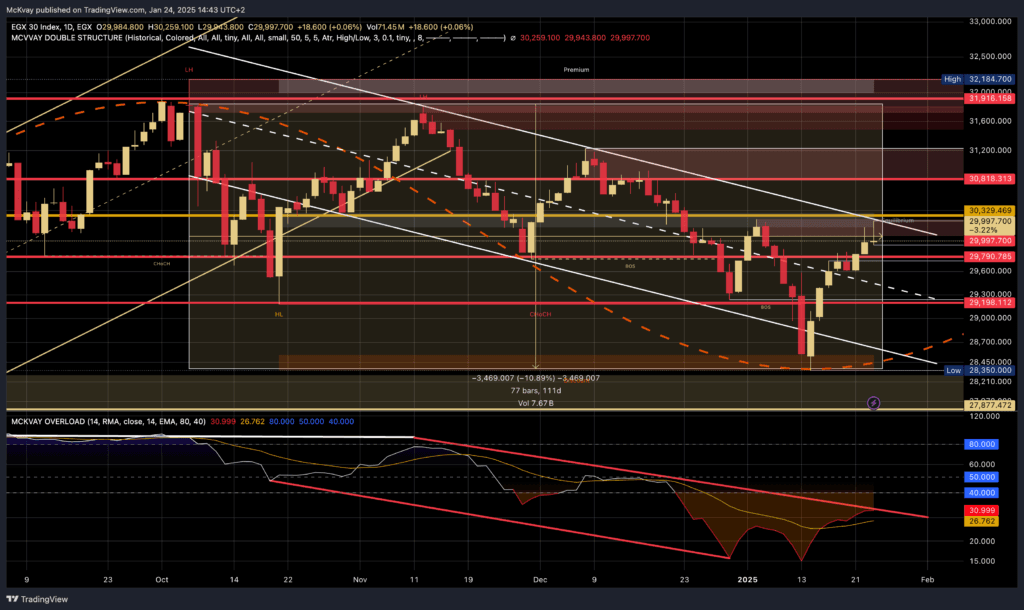

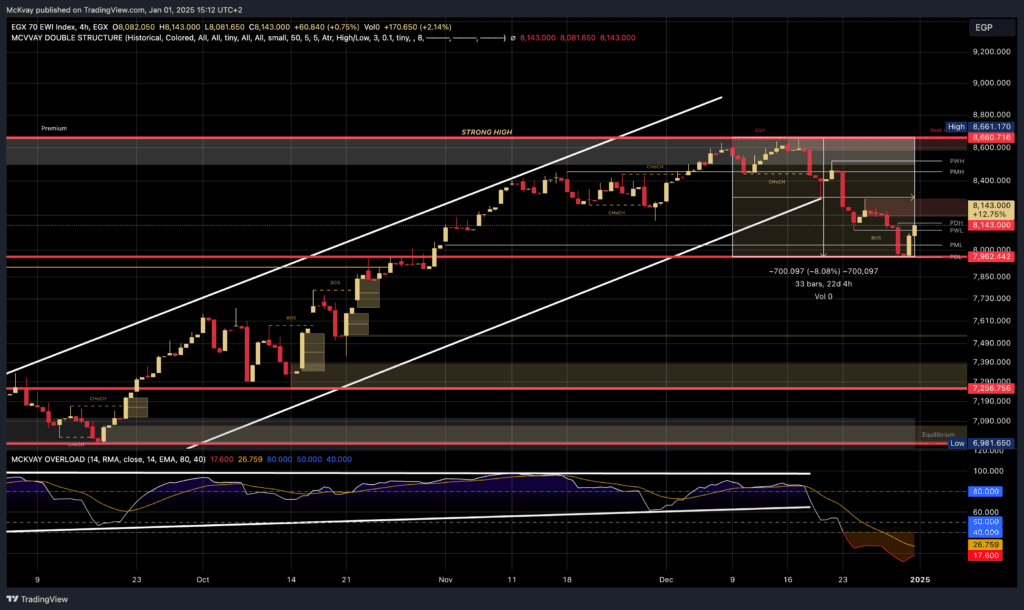

EGX30 Index Weekly Overview On a 1D, 1W, and 4H Time-Frame. Indicators Summary & Forecast.

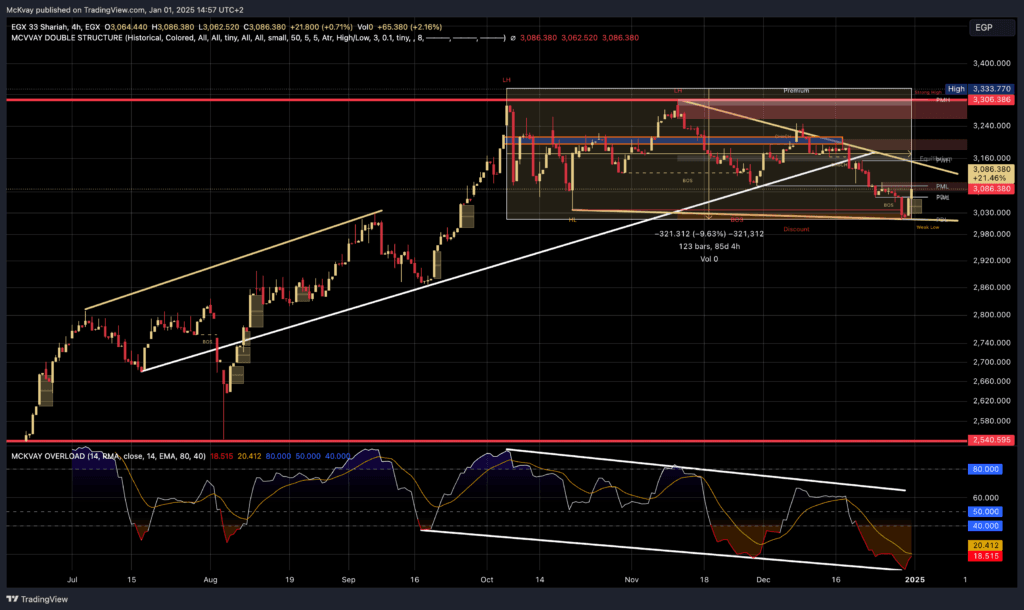

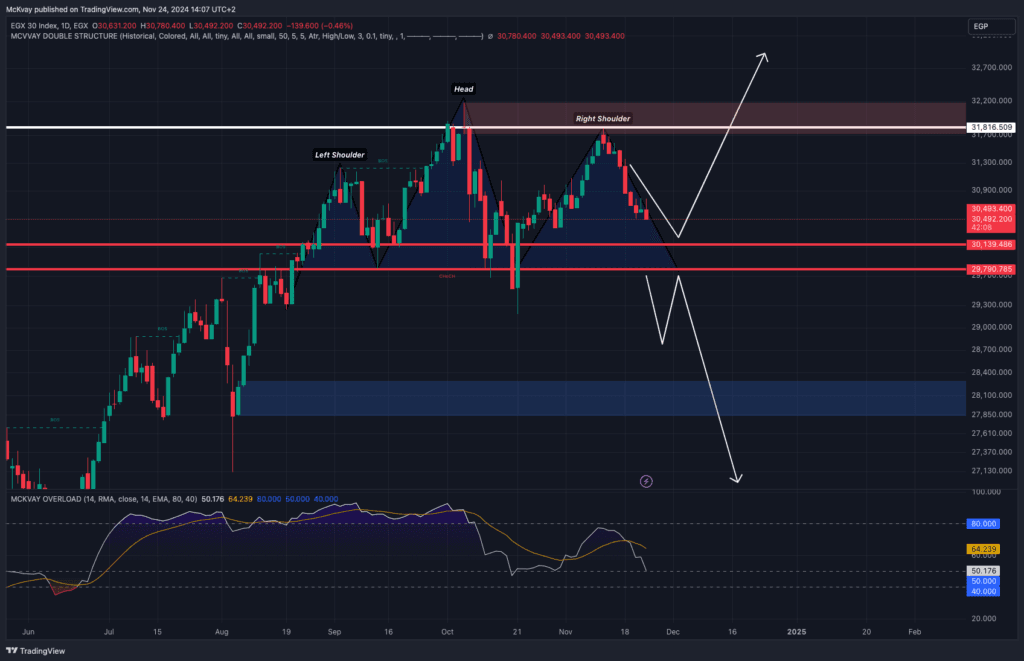

Expanded EGX30 Technical Analysis Report Expanded EGX30 Technical Analysis Report Market: EGX30 Index (EGP) Published: April 19, 2025 Analyst Commentary: Multi‑timeframe, indicator‑supported breakdown with emphasis on structure, momentum, and projected zones. 1. Weekly Chart Breakdown (Top Left) 🟢 Bullish Candle Formation: The current weekly candle closed higher than the previous one, forming a bullish continuation after bouncing […]