Weekly Institutional Liquidity Map | Supply & Demand | Stop Hunt Zones | Tactical Outlook

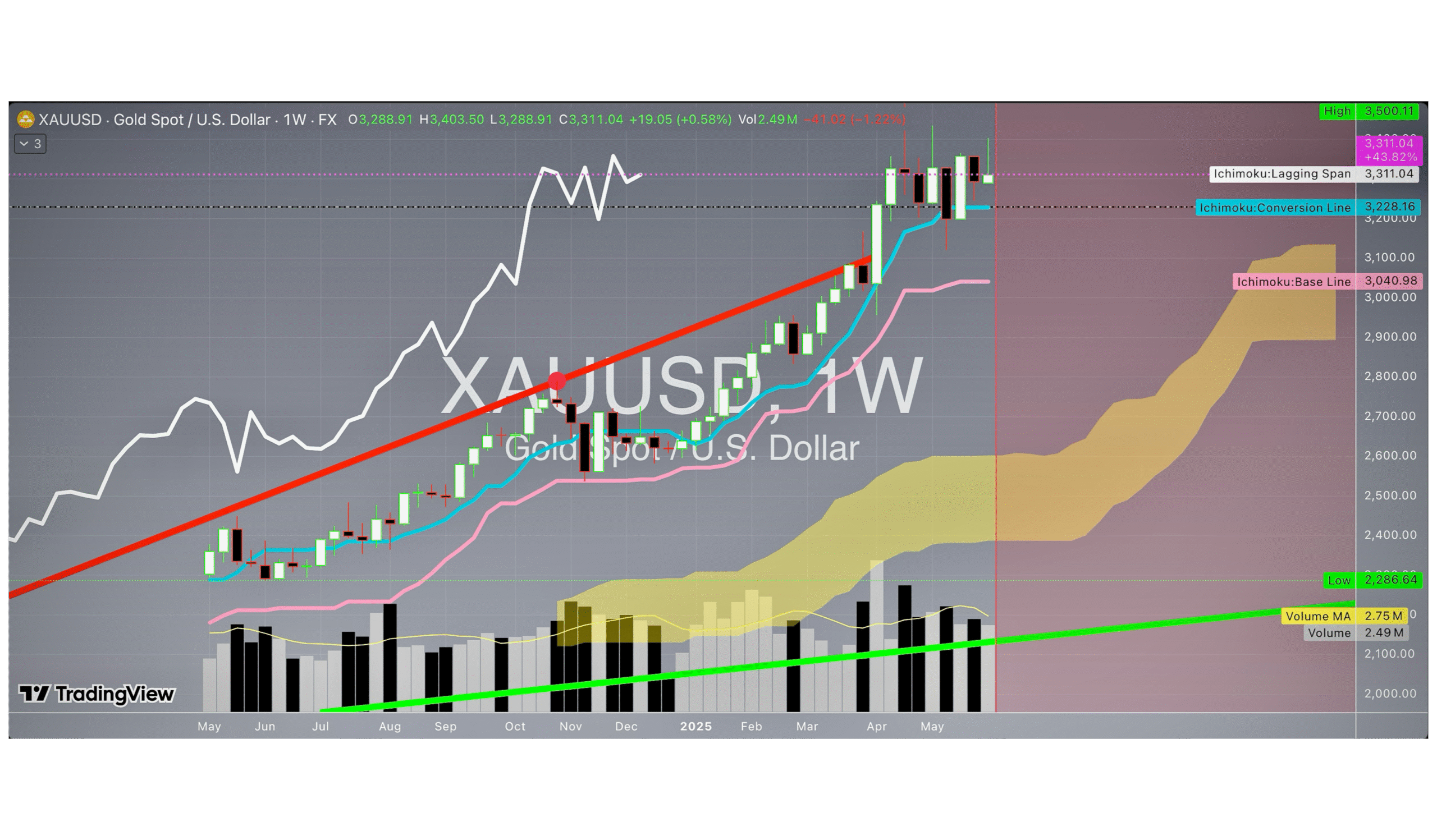

The market is entering a critical inflection zone this week. Institutional players are actively manipulating liquidity to build positions while retail gets chopped in both directions. Smart traders should focus on liquidity maps rather than signals. Here’s the full kill zone for this week:

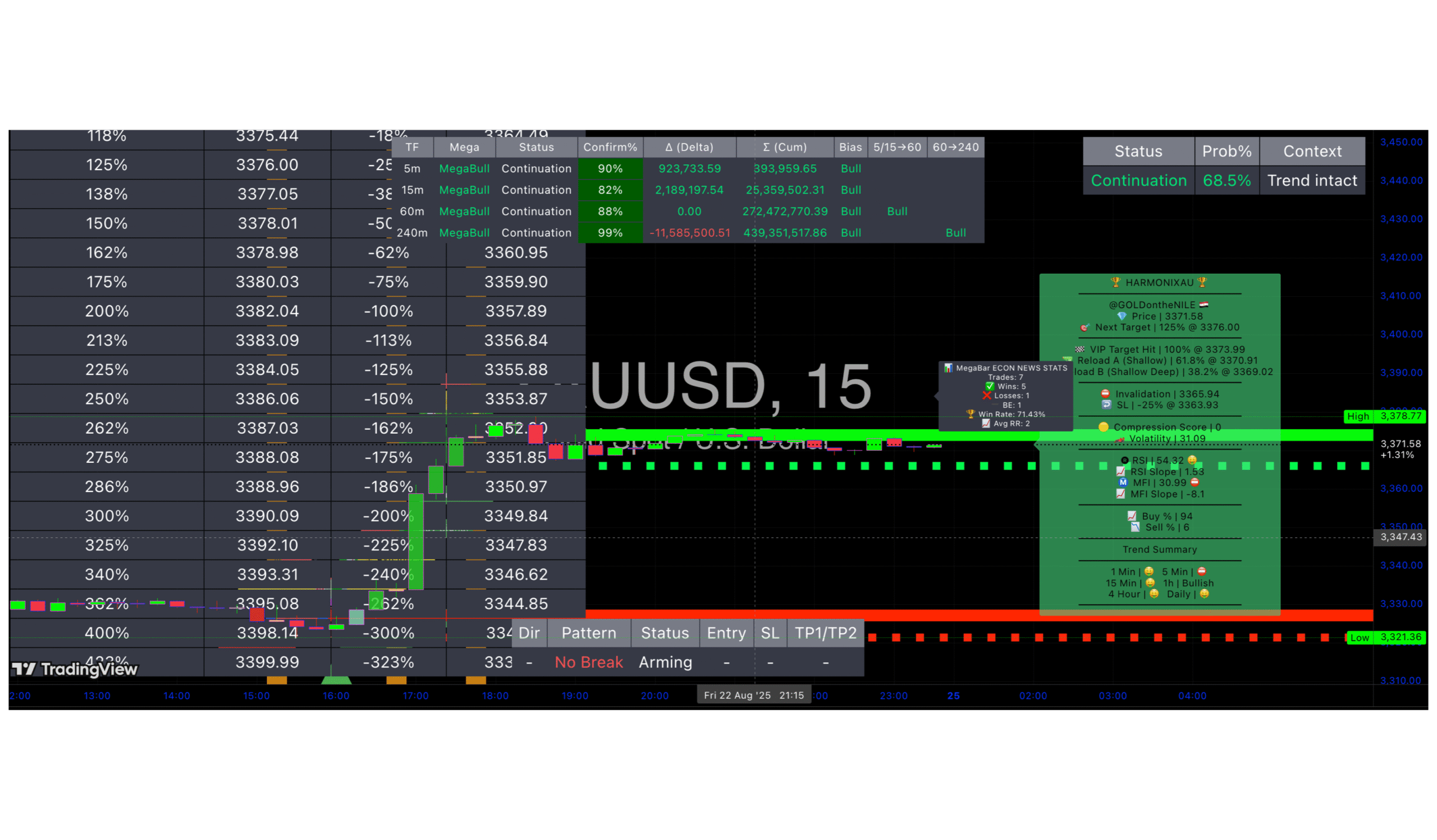

📍 Liquidity Mapping

- Market remains under heavy distribution from prior highs.

- Institutional algorithms targeting lower liquidity voids for clean fills.

- Volatility expected to increase as macro uncertainty grows (Taco Trump risk factor).

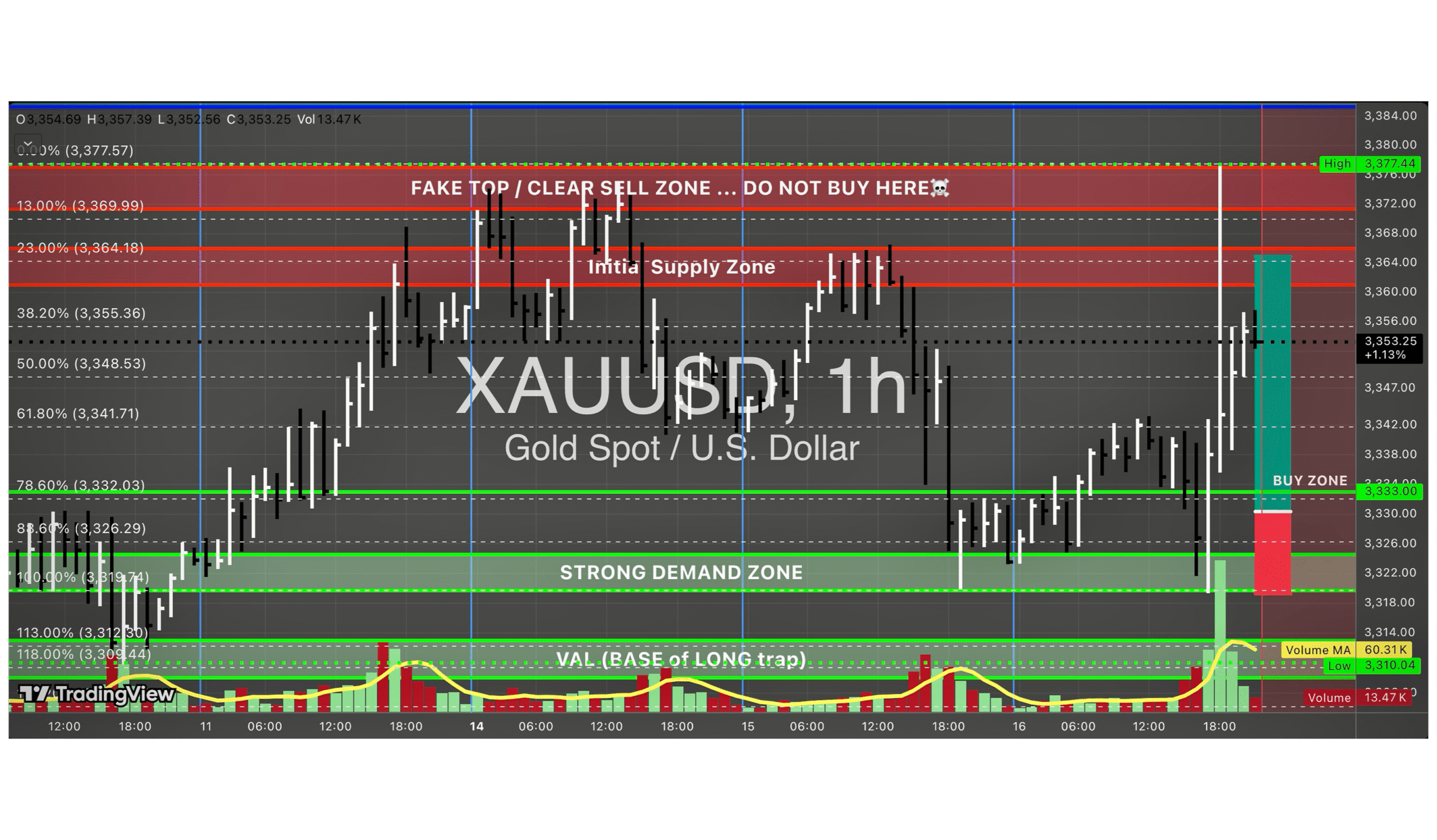

🔴 Supply Zones (Institutional Sell Areas)

| Zone | Range |

|---|---|

| Major Supply Zone | 3400 – 3450 |

| Secondary Supply Zone | 3320 – 3350 |

Expect liquidity spikes into these zones to trigger aggressive institutional short entries. Look for reversal wicks, rejection candles, and volume spikes for confirmation.

🔪 Stop Hunt Zones (Liquidity Traps)

| Zone | Range |

|---|---|

| Upper Stop Hunt | 3340 – 3360 |

| Lower Stop Hunt | 3280 – 3300 |

Algos will likely run stops above recent highs and lows to trap breakout traders. These zones are perfect for fading failed breakouts.

🟢 Demand Zones (Institutional Buy Areas)

| Zone | Range |

|---|---|

| Primary Demand Zone | 3200 – 3250 |

| Extreme Demand Zone | 3100 – 3120 |

Strong probability that institutional buy programs activate near these levels for mean-reversion plays. Watch volume confirmation, order flow shifts, and reaction strength.

📈 This Week’s Tactical Playbook

- Bias: Short rallies into supply zones.

- Strategy: Fade stop hunts; ride momentum into demand zones.

- Risk Management: Tight stops above liquidity grabs; scale out at key liquidity pools.

MORE IN-DEPTH ANALYSIS

XAUMO MegaBar Suite Deluxe A complete intraday framework built for XAUUSD (Gold)

Xauusd (Gold Spot) Trap at 3,377 | XAUMO Thursday Setup

XAUUSD (Gold Spot) – XAUMO Weekly Institutional Liquidity Map | Supply & Demand

Xauusd (Gold Spot) Liquidity Map – June 2nd Battle Plan

XAU/USD (Gold Spot) Strategy – Ride with the Market Maker, Not Against Him

XAUMO – Xauusd (Gold Spot) x Heikin Ashi Chikou Fusion Strategy (Full Calibration)

XAUMO – XAUUSD (gold spot) Tactical Execution Plan – May 4, 2025

XAUMO (XAUUSD – GOLD SPOT) – Tactical Breakdown – April 30, 2025

XAUMO – XAUUSD (GOLD SPOT) | Tactical Market Report – Friday, April 25, 2025

XAUMO/XAUUSD (GOLD SPOT) STRATEGY UPDATE — FRIDAY, APRIL 11, 2025

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions