XAUMO XAUUSD Tactical Execution Plan – May 4, 2025 (GMT+3)

LETHAL VERSION | STRIKE–DEFEND–KILL MODE

Session Context – Market Liquidity Reality Check

| Sydney | Low liquidity – ignore |

| Tokyo (02–06) | CLOSED – holiday |

| HK + Shanghai (06–10) | CLOSED – zero liquidity |

| Frankfurt (10–12) | Europe partial, London CLOSED – fake moves possible |

| NY Open (14:30) | First real liquidity |

| NY+Frankfurt (16–18) | ONLY session worth striking |

| Post-NY (after 21:00) | Dead zone – no new entries |

XAUMO Final Tactical Map

| Zone | Range / Level | Notes |

|---|---|---|

| Red | 3,254–3,269 | Bearish rejection |

| Yellow | 3,240–3,254 | Trap / sweep |

| Green | 3,270+ | Breakout activation |

Final Directives

STRIKE: 15:00–16:00 | DEFEND: 17:00–18:00 | SCALP: 10:00–12:00 (if trap confirmed) | SWING: if 3,270 breakout real

1. Price Action Pattern

- “M” top across TFs = double‐top rejection

- Rejection wicks at 3,254–3,269

- Tight, indecisive candles = supply absorption

2. Range-Bound Behavior

Trapped between 3,254 (mid-resistance) & 3,230 (liquidity support). Chop zone 3,240–3,254: fakeouts clear stops.

3. Indicator Analysis

| RSI | 37–48 (bearish–neutral) |

| Bollinger Bands | Tightening → volatility compression |

| ADX | 22–32; DI– dominant |

4. Trend Analysis

Short-term flat to down; no HH above 3,270. Any pump without volume = fake.

5. Volume Analysis

Volume declining; big candle + low volume = false move. Real strike needs >700K.

6. S&R Zones

Resistance: 3,269–3,270

Support: 3,230 → 3,211 → 3,193

7. Momentum Analysis

Flat to negative; no bullish divergence; all momentum indicators <50.

8. Wave Analysis

Wave 1 ↓ → A–B–C ↑ → Wave 3 upcoming (bearish if 3,230 breaks).

9. Volatility Analysis

ATR/RSI high but declining; expect breakout at NY Open (15:00–16:00).

Hypothetical Order

| Type | Entry | SL | TP1 | TP2 | TP3 | Conf. |

|---|---|---|---|---|---|---|

| Sell Stop | 3,230 | 3,245 | 3,211 | 3,193 | 3,179 | 87% |

Justification: RSI<40, bearish wave, liquidity break, slam candle + volume/momentum.

Backup Setup

If 3,270 breaks with volume + RSI>50 → go LONG. Otherwise SELL remains prime.

Hour-by-Hour WAR PLAN (Cairo GMT+3)

| Time | Context | Action |

|---|---|---|

| 09–10 | Pre-London (Asia dead) | Do NOTHING; watch for sweep below 3240 |

| 10–11 | Frankfurt open | Scalp only on engulfing; Buy Stop 3250 or Sell fade 3260 trap |

| 11–12 | EU Fade | Sell Limit 3260–3265 or prep breakout at 3269.5 |

| 12–14 | Pre-NY build | Mark VWAP; trust only volume breaks |

| 14–15 | Pre-NY drift | Buy Stop 3270 retest or Sell Limit fake 3270 |

| 15–16 | NY Open — STRIKE | Buy 3,270/ Sell 3,230 based on volume + RSI |

| 16–17 | NY momentum | Hold/add on pullbacks |

| 17–18 | NY fade | Defend profits; no new entries |

| After 18 | NY drift | Zero entries; exit/adjust only |

MORE IN-DEPTH ANALYSIS

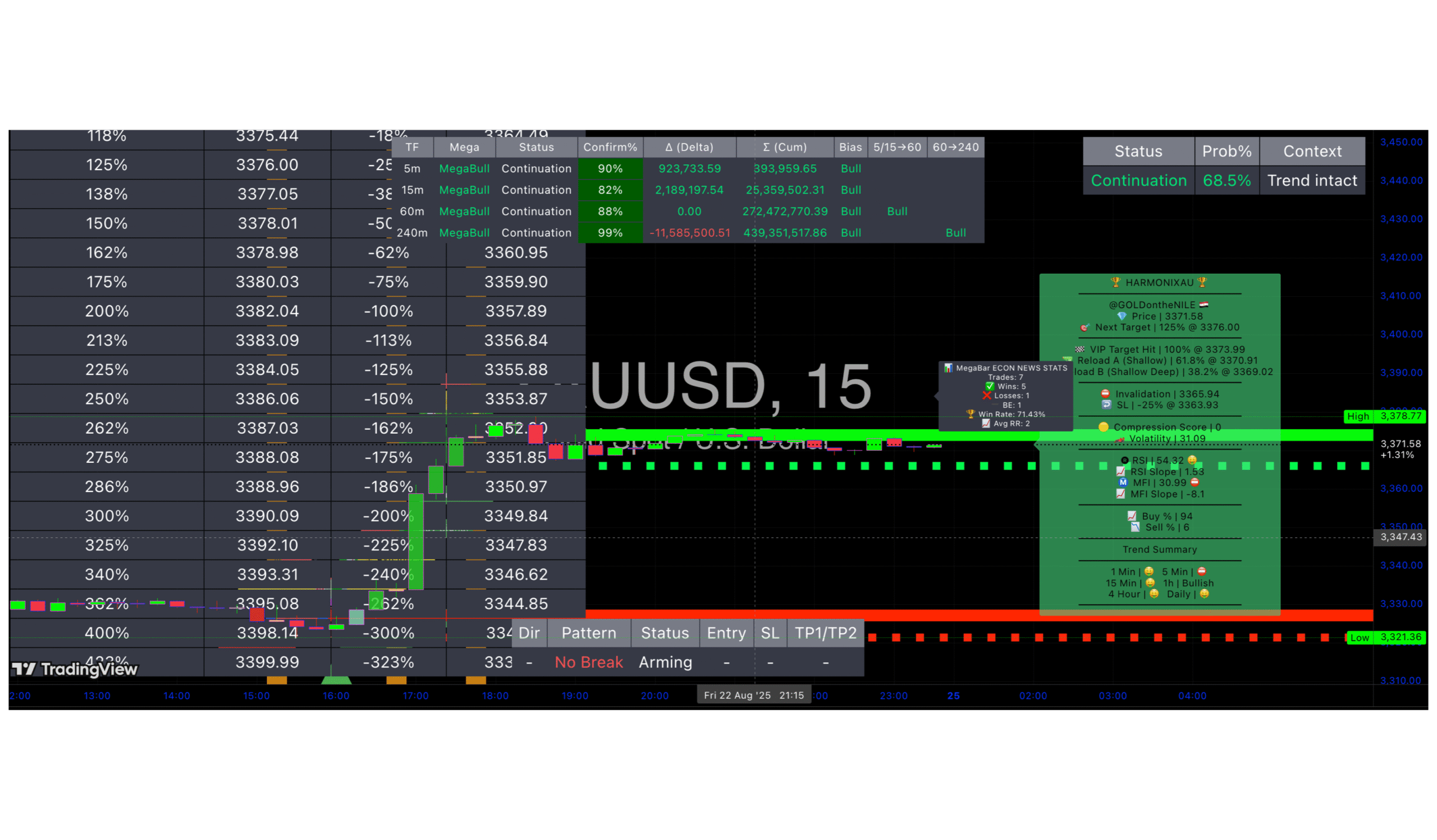

XAUMO MegaBar Suite Deluxe A complete intraday framework built for XAUUSD (Gold)

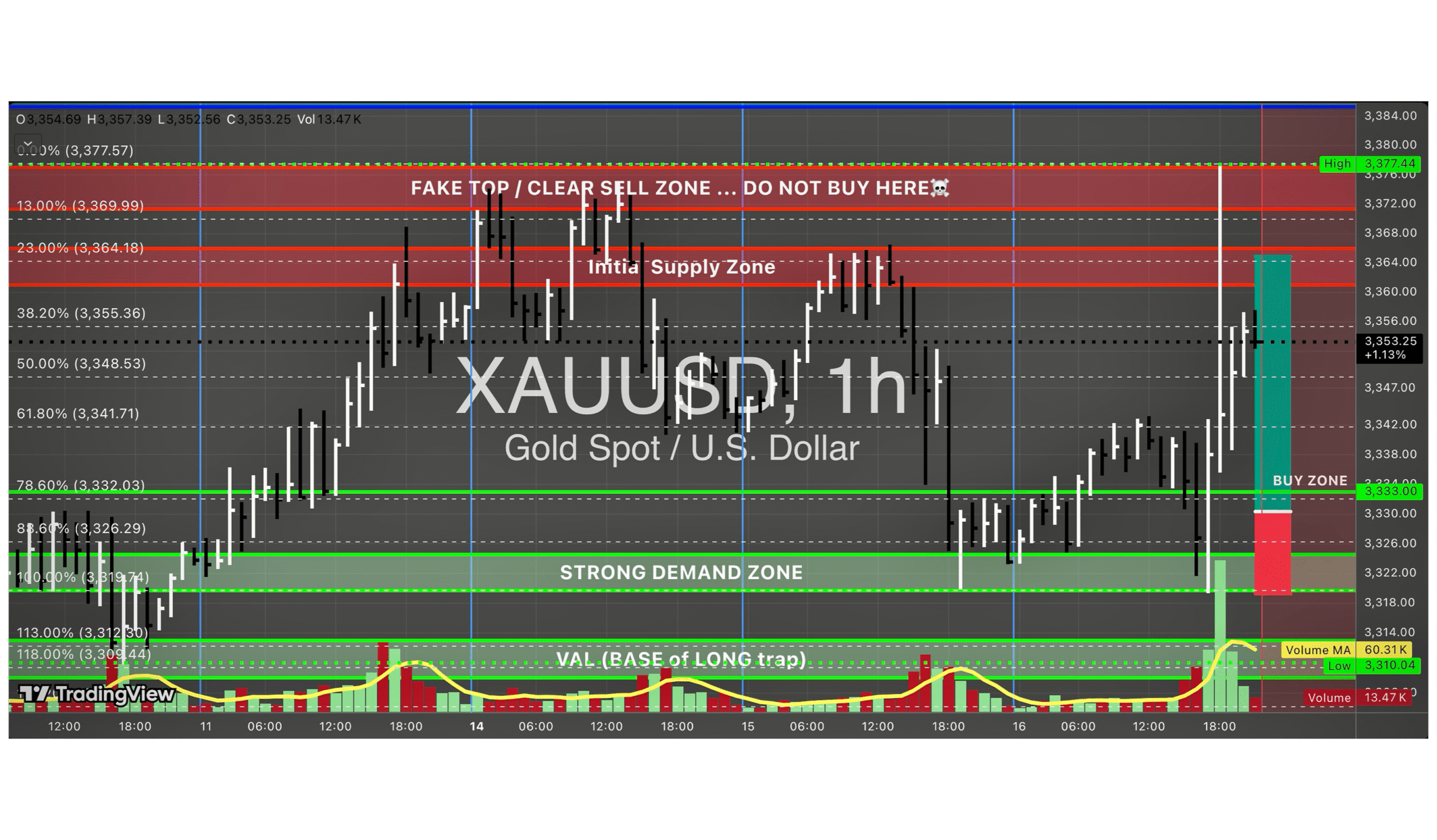

Xauusd (Gold Spot) Trap at 3,377 | XAUMO Thursday Setup

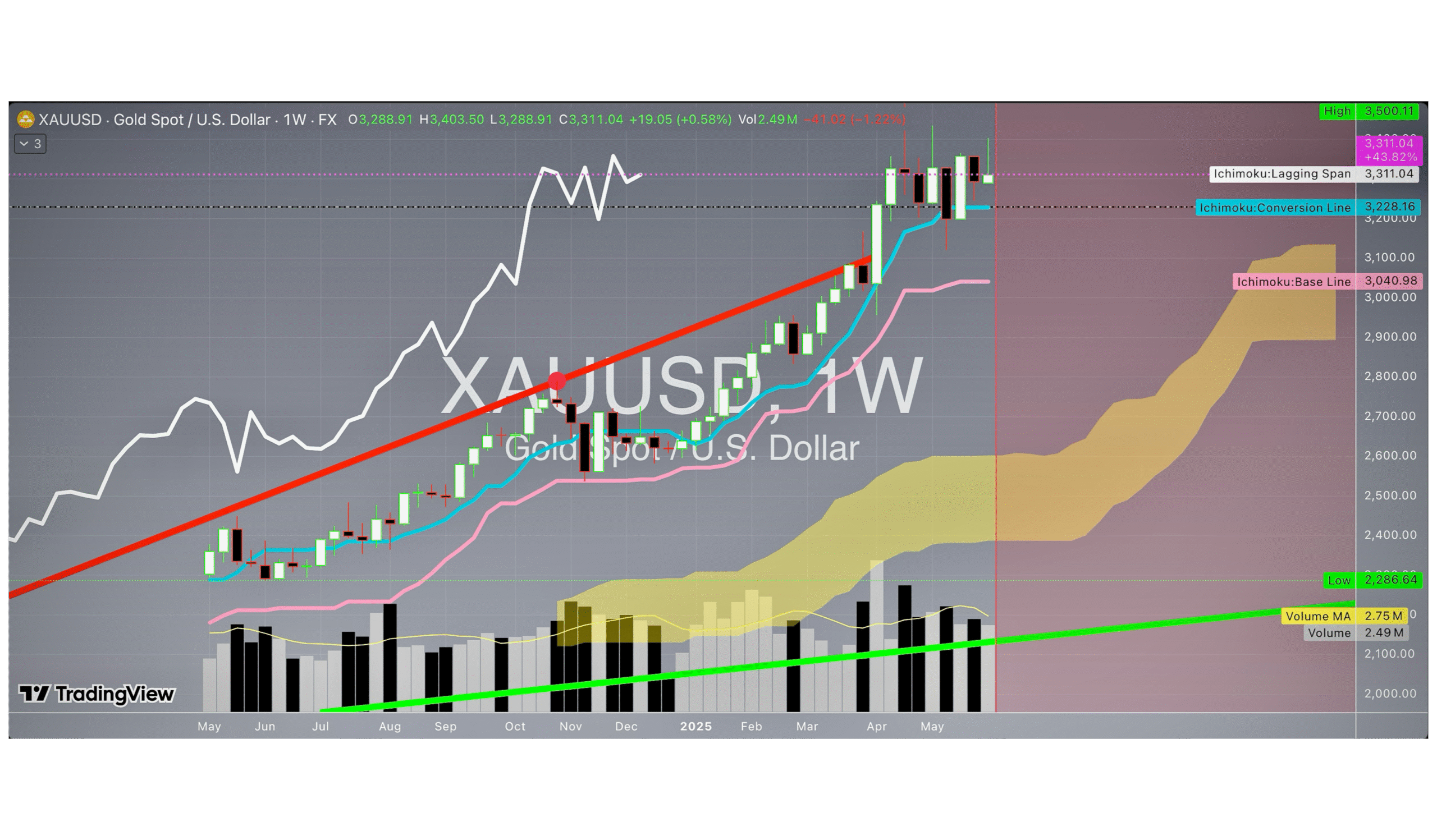

XAUUSD (Gold Spot) – XAUMO Weekly Institutional Liquidity Map | Supply & Demand

Xauusd (Gold Spot) Liquidity Map – June 2nd Battle Plan

XAU/USD (Gold Spot) Strategy – Ride with the Market Maker, Not Against Him

XAUMO – Xauusd (Gold Spot) x Heikin Ashi Chikou Fusion Strategy (Full Calibration)

XAUMO – XAUUSD (gold spot) Tactical Execution Plan – May 4, 2025

XAUMO (XAUUSD – GOLD SPOT) – Tactical Breakdown – April 30, 2025

XAUMO – XAUUSD (GOLD SPOT) | Tactical Market Report – Friday, April 25, 2025

XAUMO/XAUUSD (GOLD SPOT) STRATEGY UPDATE — FRIDAY, APRIL 11, 2025

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions