لغة البنوك المركزية وتأثيرها علي أسواق المال | الصقور والحمائم – HAWKISH VS. DOVISH

https://youtu.be/29FDN-pi7Cc?si=AL4-O4IWPX4eroKl لغة البنوك المركزية وتأثيرها علي أسواق المالDownload MORE IN-DEPTH ANALYSIS 26th of SEP 2025 Mckvay MCKVAY GOLD Search Social Email Instagram Copyright © 2025 Mckvay. All rights reserved.Terms And Conditions

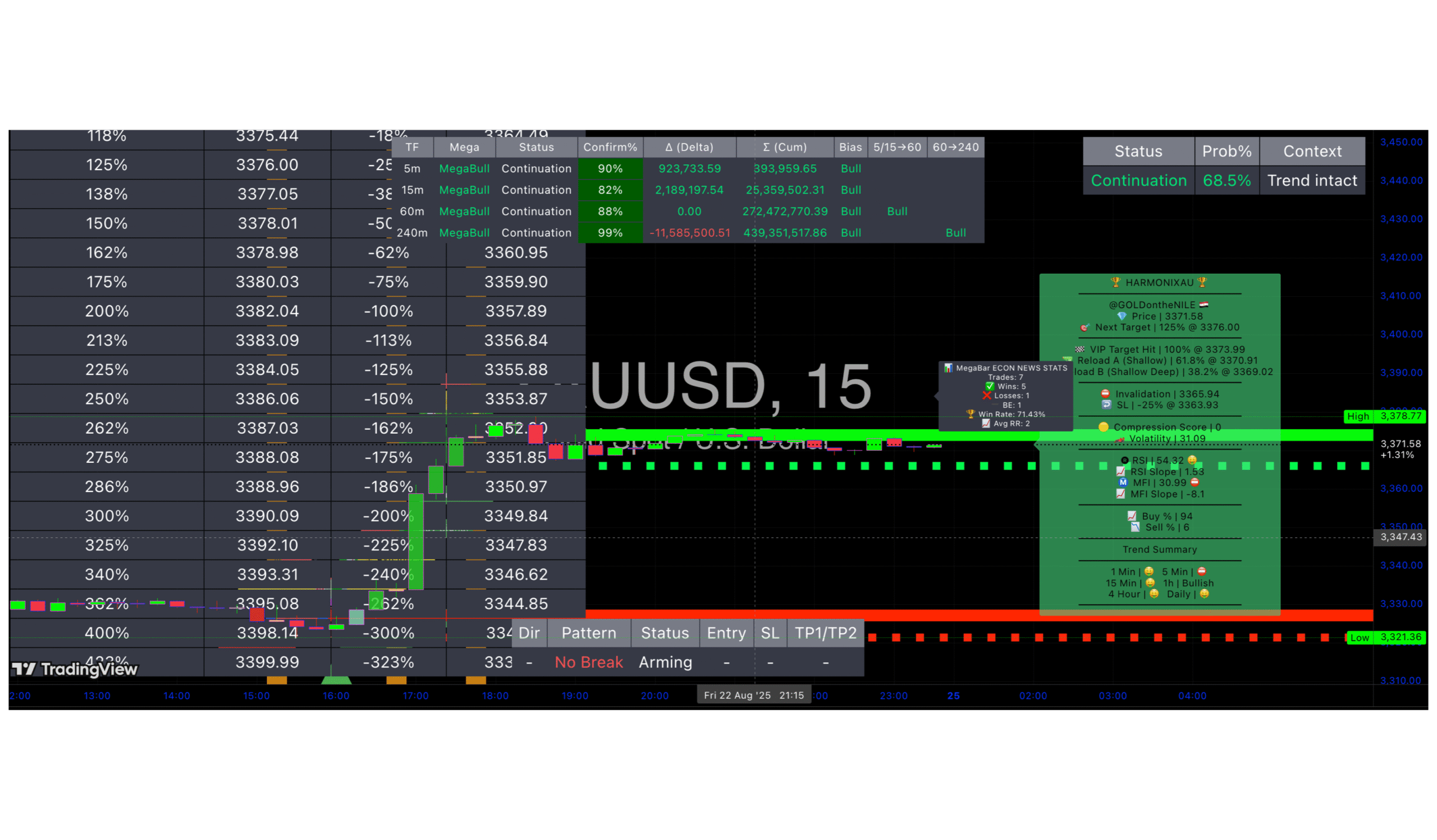

XAUMO MegaBar Suite Deluxe A complete intraday framework built for XAUUSD (Gold)

XAUMO MegaBar Suite Deluxe | Institutional-Grade Intraday Framework XAUMO MegaBar Suite Deluxe is a complete intraday framework built for XAUUSD (Gold) that turns complex market behavior into a clear, rule-based decision process. It helps retail traders understand what’s…

Xauusd (Gold Spot) Trap at 3,377 | XAUMO Thursday Setup

💥🔥 Let’s Crush the Market – Updated Zones for Thursday & Friday, July 17–18, 2025 🔥 Current Market Status – XAU/USD Gold broke violently to 3,377.25 then snapped back—clear distribution trap, not a clean breakout. 🟢 Support /…

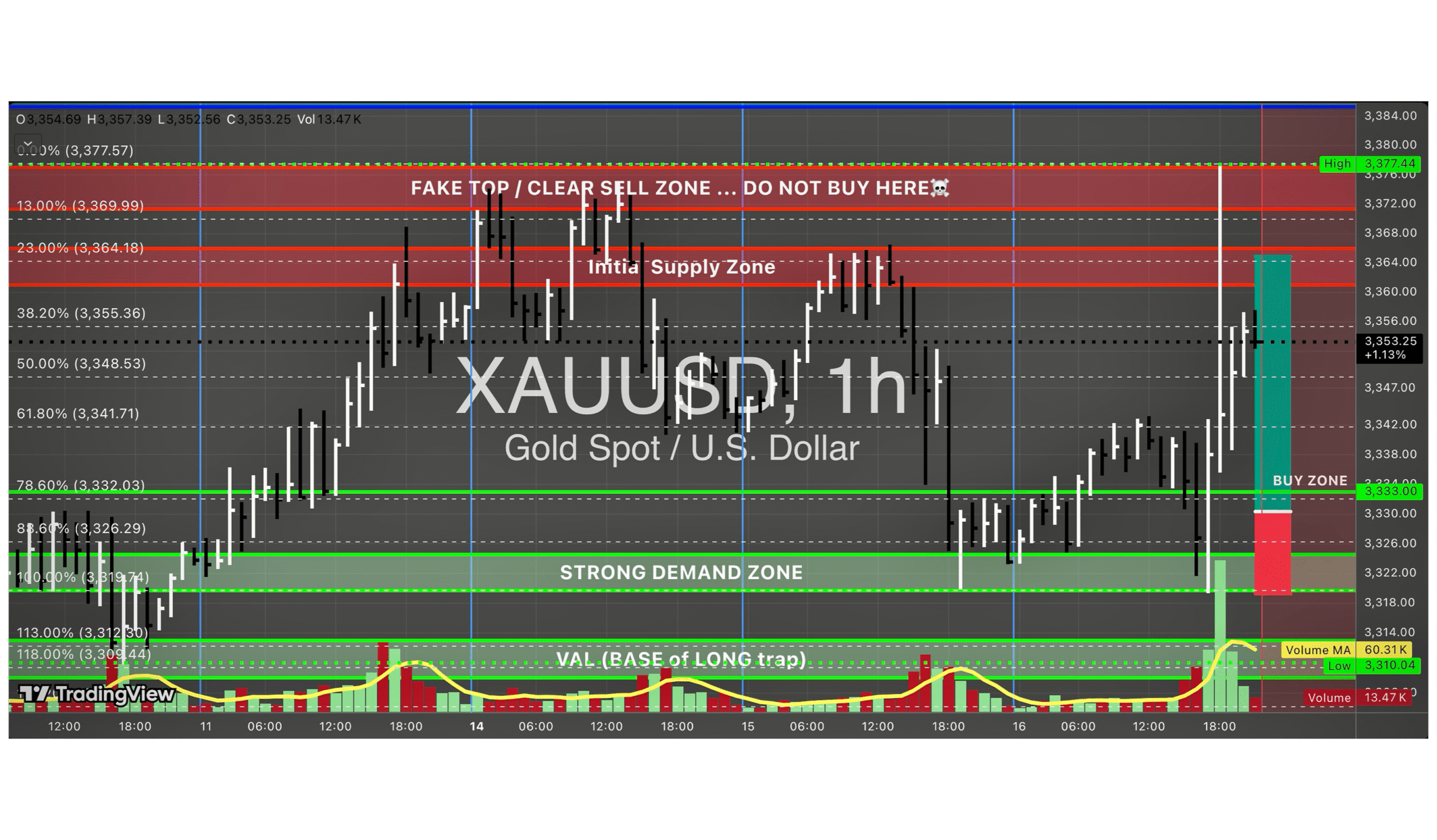

XAUUSD (Gold Spot) – XAUMO Weekly Institutional Liquidity Map | Supply & Demand

Weekly Institutional Liquidity Map | Supply & Demand | Stop Hunt Zones | Tactical Outlook The market is entering a critical inflection zone this week. Institutional players are actively manipulating liquidity to build positions while retail gets chopped…

Xauusd (Gold Spot) Liquidity Map – June 2nd Battle Plan

🟡 XAU/USD Liquidity Map – June 2nd Battle Plan Here’s The advanced liquidity projection for GOLD (XAU/USD) for Monday, June 2nd — fully aligned with institutional order flow, stop hunt zones, and smart money positioning. 💥 Key Zones…

XAU/USD (Gold Spot) Strategy – Ride with the Market Maker, Not Against Him

XAUMO Tactical Execution Plan – Institutional Grade Timeframe-Synced Strategic Confluence: XAU/USD 5M + 15M (Trigger Zone) EMA/HMA/SMA Stack: All bearish — price below EMA21, HMA5 rolling down = trend aligned. Ichimoku Cloud: Below Kumo, flat Kijun — choppy…

XAUMO – Xauusd (Gold Spot) x Heikin Ashi Chikou Fusion Strategy (Full Calibration)

Timeframe-Synced Strategic Confluence: XAU/USD ⸻ 5M + 15M (Trigger Zone) EMA/HMA/SMA StackAll bearish — price below EMA21, HMA5 rolling down Ichimoku CloudBelow Kumo, flat Kijun — choppy bearish bias Stoch RSICrossover from oversold — minor bounce brewing Chikou…

XAUMO – XAUUSD (gold spot) Tactical Execution Plan – May 4, 2025

XAUMO XAUUSD Tactical Execution Plan – May 4, 2025 (GMT+3) LETHAL VERSION | STRIKE–DEFEND–KILL MODE Session Context – Market Liquidity Reality Check SydneyLow liquidity – ignore Tokyo (02–06)CLOSED – holiday HK + Shanghai (06–10)CLOSED – zero liquidity Frankfurt…

XAUMO (XAUUSD – GOLD SPOT) – Tactical Breakdown – April 30, 2025

1. XAUMO Tactical Map Red Zone – Bearish Rejection (Sell Trap Zone) Upper Limit: 3314.60–3318.00 Strong historical rejection + VWAP & Ichimoku base rejections. Yellow Zone – Liquidity Sweep Trap Area Zone: 3297.50–3306.00 Price bounced repeatedly from this…

TMG Holding (EGX: TMGH) – FINANCIAL & Technical OUTLOOK, Forecast & Future Scenarios, AND Major Trend Analysis.

TMG Holding (EGX) Technical & Strategic Forecast TMG Holding (EGX) Technical & Strategic Forecast Date: April 26, 2025 📑 Table of Contents Introduction Major Trend Analysis Elliott Wave Breakdown Fibonacci Levels & Key Zones Liquidity Maps (Buy-side/Sell-side) Volume…

XAUMO – XAUUSD (GOLD SPOT) | Tactical Market Report – Friday, April 25, 2025

Overall Market Outlook & Session Plan The market is currently moving in a clear distribution zone, between 3,337 and 3,346. There’s strong evidence of a bull trap near the 3,346 high. Price is failing to stay above the…

Oriental Weavers (ORWE) – institutional-grade Financial and Technical analysis across weekly, daily, AND (4H) timeframes.

ORWE Market Analysis ORWE Technical Analysis Executive Summary The Oriental Weavers (ORWE) stock is showing clear signs of a bullish reversal on the medium-term horizon. Technical analysis from multiple angles (price structure, indicators, volume, and wave patterns) supports…

EGX30 Index Weekly Overview On a 1D, 1W, and 4H Time-Frame. Indicators Summary & Forecast.

Expanded EGX30 Technical Analysis Report Expanded EGX30 Technical Analysis Report Market: EGX30 Index (EGP) Published: April 19, 2025 Analyst Commentary: Multi‑timeframe, indicator‑supported breakdown with emphasis on structure, momentum, and projected zones. 1. Weekly Chart Breakdown (Top Left) 🟢 Bullish Candle…

XAUMO/XAUUSD (GOLD SPOT) STRATEGY UPDATE — FRIDAY, APRIL 11, 2025

XAUMO STRATEGY UPDATE — FRIDAY, APRIL 11, 2025 Breakout confirmed — bulls in full control. MM just swept above $3,200 — now entering overdrive. We’re in the middle of a classic institutional markup phase, triggered by breakout above…

GOLD (XAUUSD) Technical Breakdown (1H + 4H Combo) – Tokyo Session Outlook. APRIL 3, 2025

Market Analysis Report Gold Market Analysis – Tokyo Session Outlook 1. Price Action – Tension’s High 4H: Classic Evening Star showing up. That’s a solid bearish reversal — sellers are circling. 1H: Weak bullish candle trying to break…

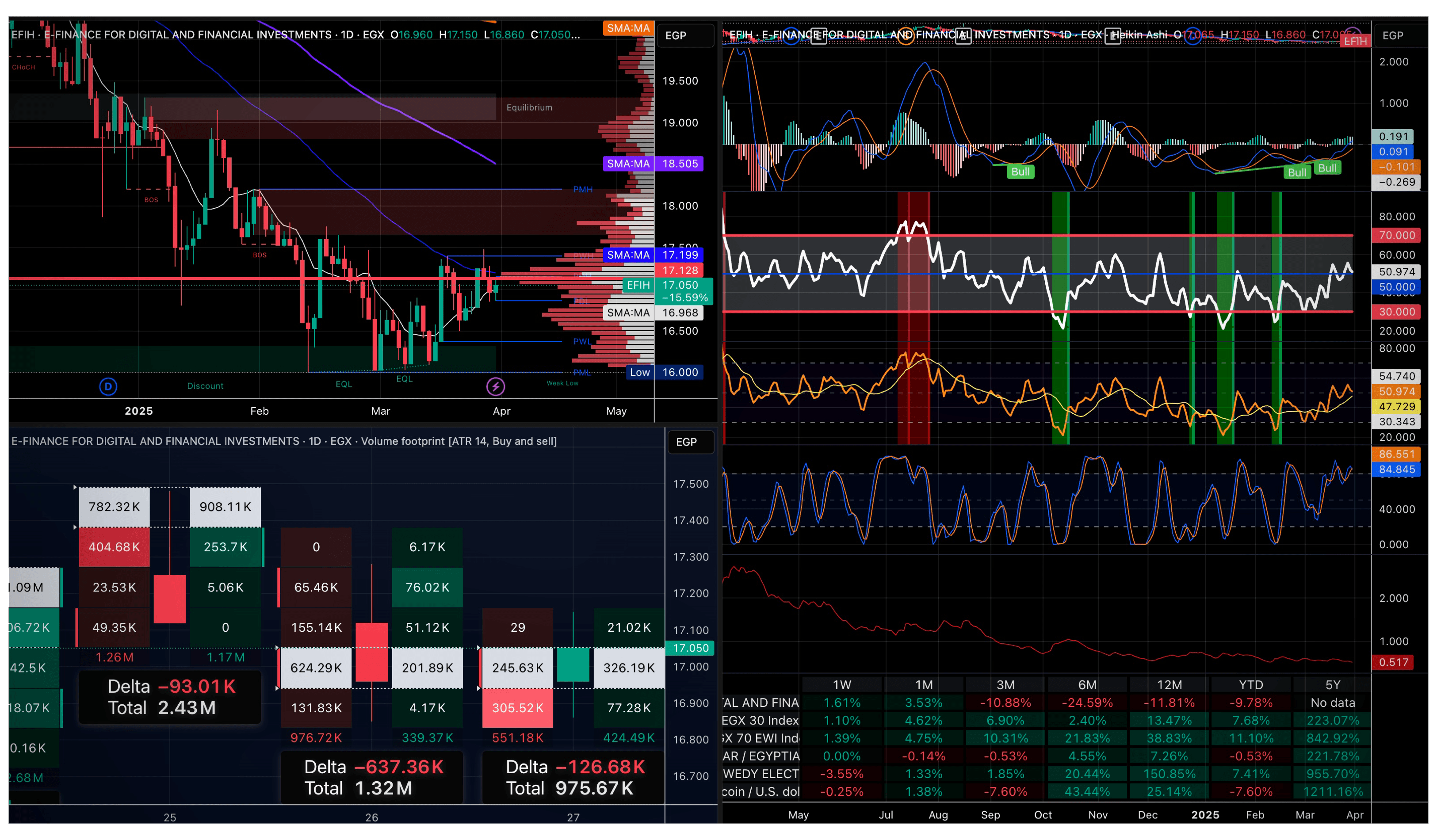

STOCK LOOK – technical & financial Outlook on EFIH (E-Finance for Digital and Financial Investments) AND Market Comparison & Performance Metrics.

Technical Analysis of EFIH (E-Finance for Digital and Financial Investments) Technical Analysis of EFIH (E-Finance for Digital and Financial Investments) 1. Trend Analysis Overall Trend: The stock has been in a downtrend since reaching highs around 27 EGP….

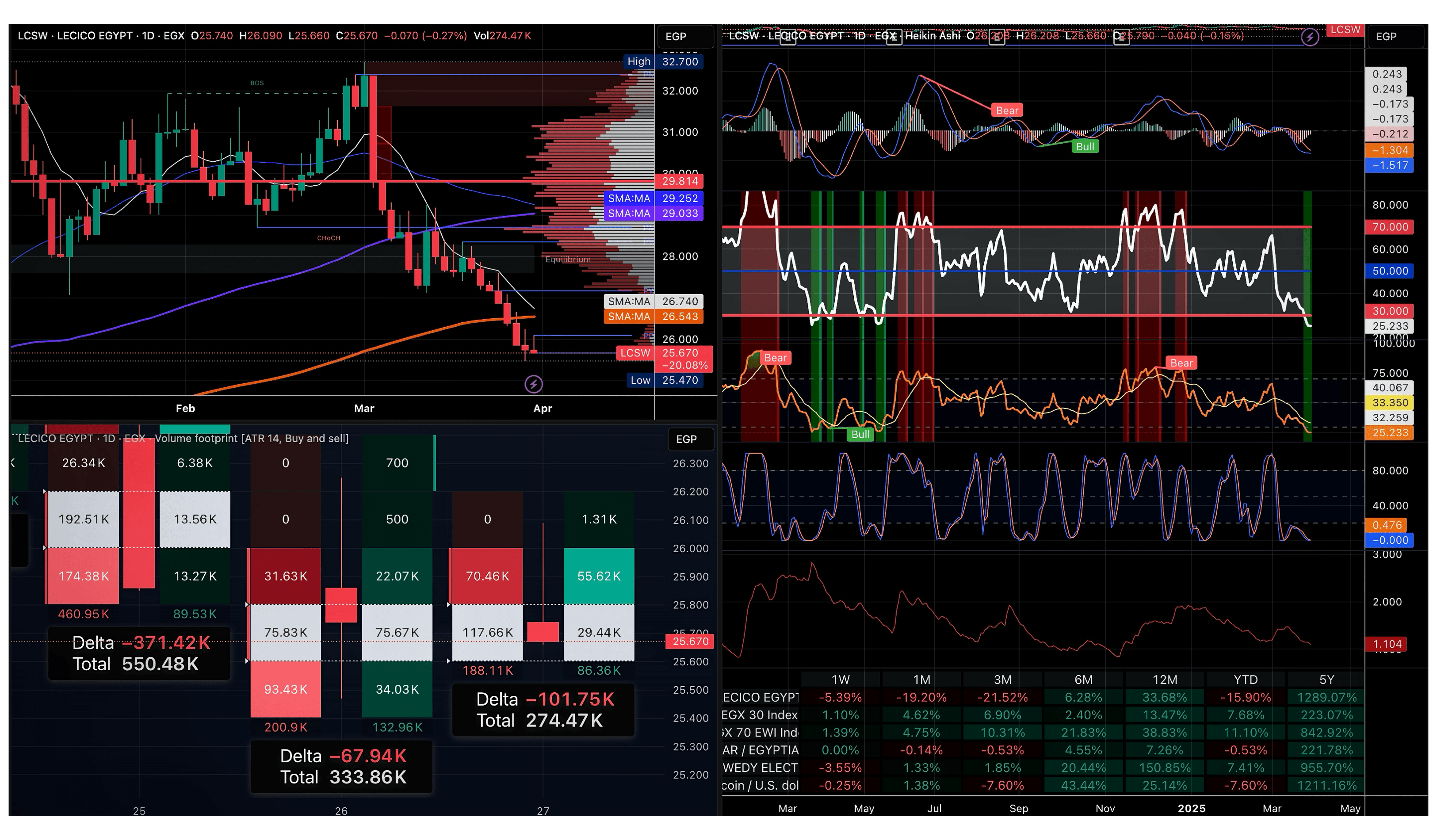

STOCK LOOK – LECICO EGYPT (LCSW) technical & financial Outlook on a DAILY timeframe, AND Market Comparison & Performance Metrics.

Friday Payday Report: Market Maker Playbook Price Action & Trend Analysis Stock: LECICO EGYPT (LCSW) Timeframe: Daily (1D) Current Price: 25.670 Change: -0.27% (-0.070) High of the Day: 26.090 Low of the Day: 25.470 Trend Overview: The stock…

Gold (XAUUSD) Analysis – A Strategic Trading Approach

Gold Analysis: A Strategic Trading Approach Gold remains a strong long-term investment, but success in trading requires in-depth knowledge and precise analysis. Below is a structured strategy based on technical and analytical insights to determine entry and exit…

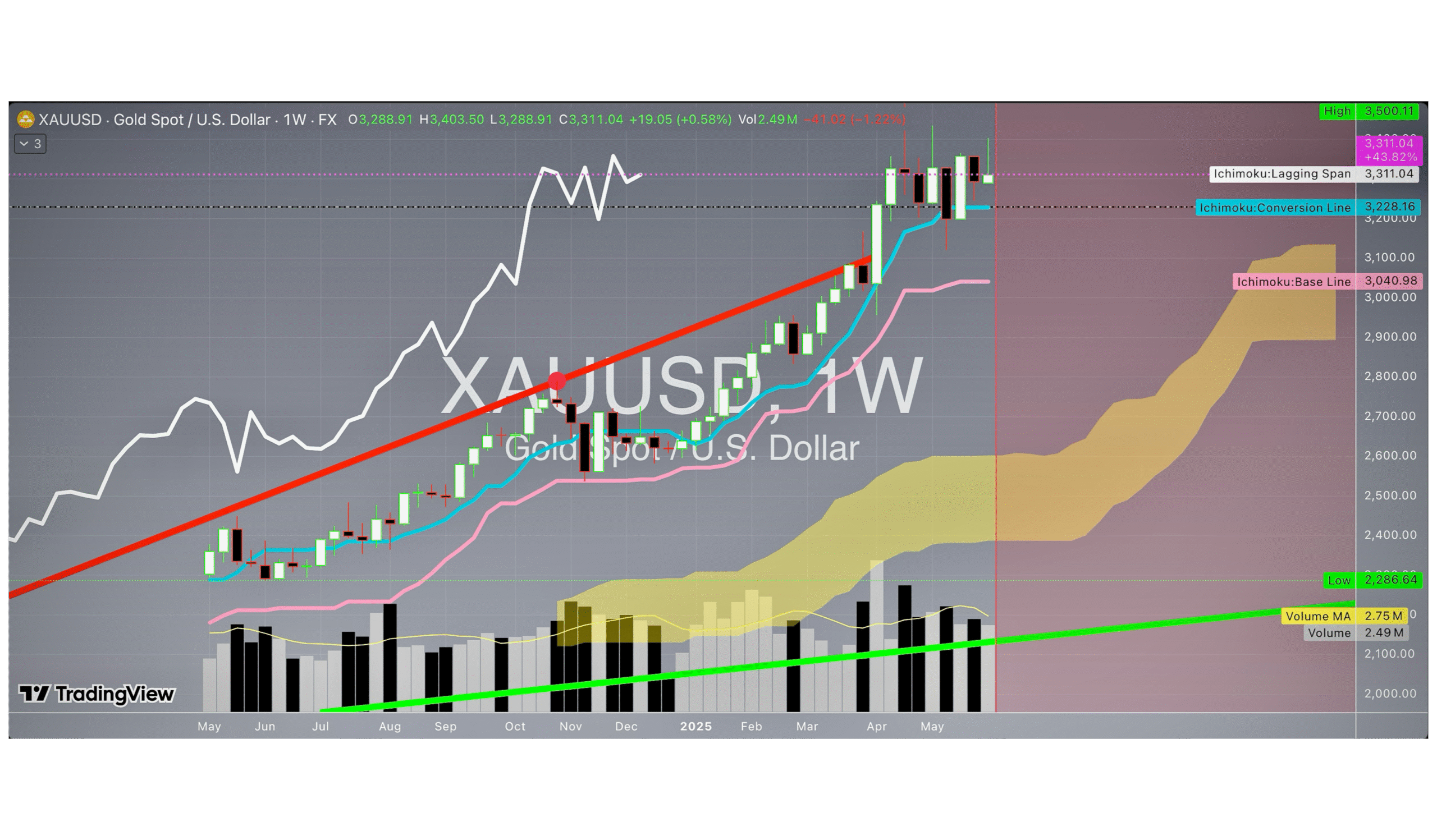

XAUMO Weekly Report – Institution-Grade Gold (XAU/USD) Analysis – March 9, 2025

XAUMO Weekly Report – March 9, 2025 XAUMO Weekly Report – March 9, 2025 Institution-Grade Gold (XAU/USD) Analysis 📌 Executive Summary Gold (XAU/USD) remains in a structural uptrend, but near-term resistance is forming as China’s worsening deflation amplifies…

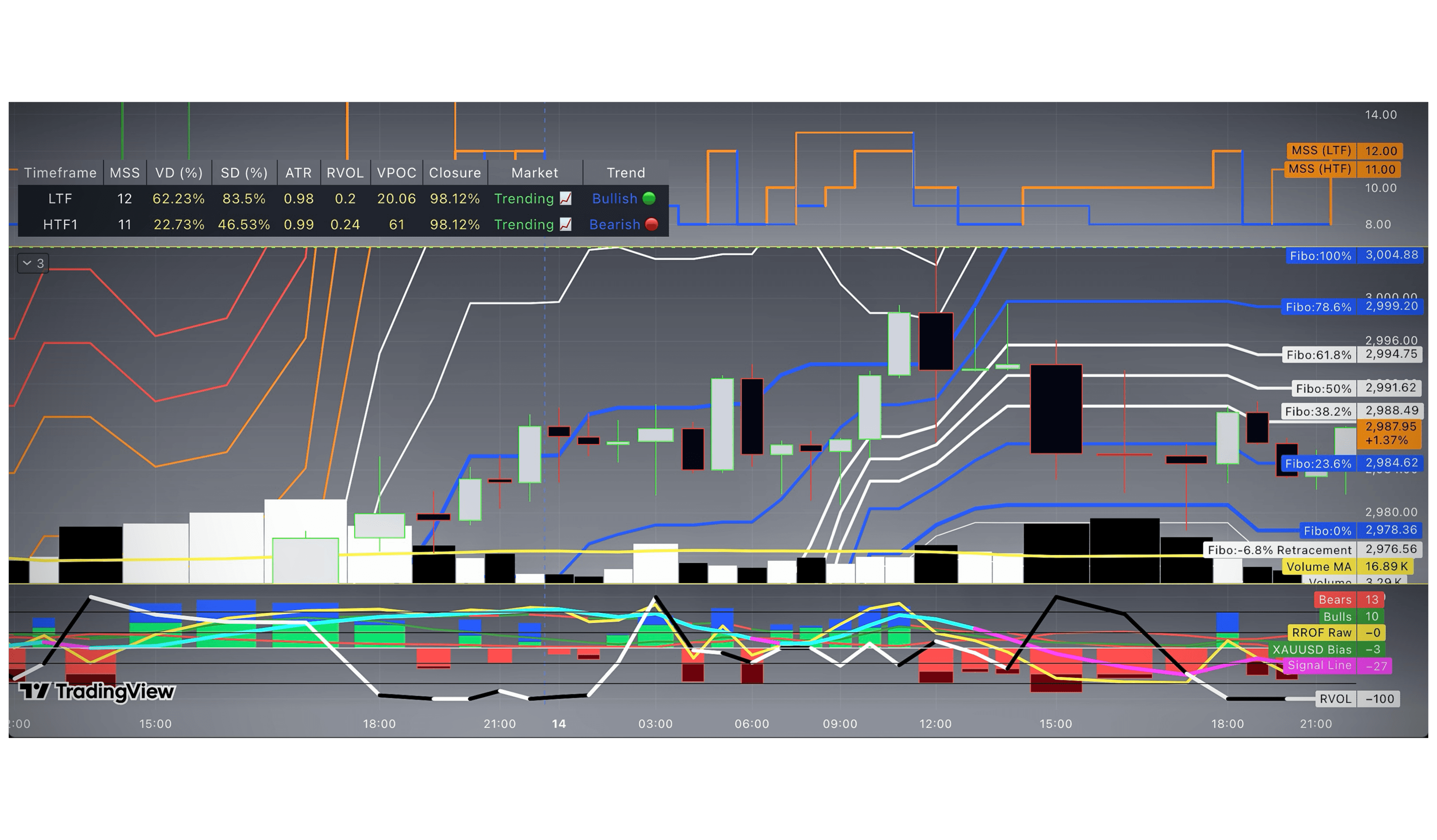

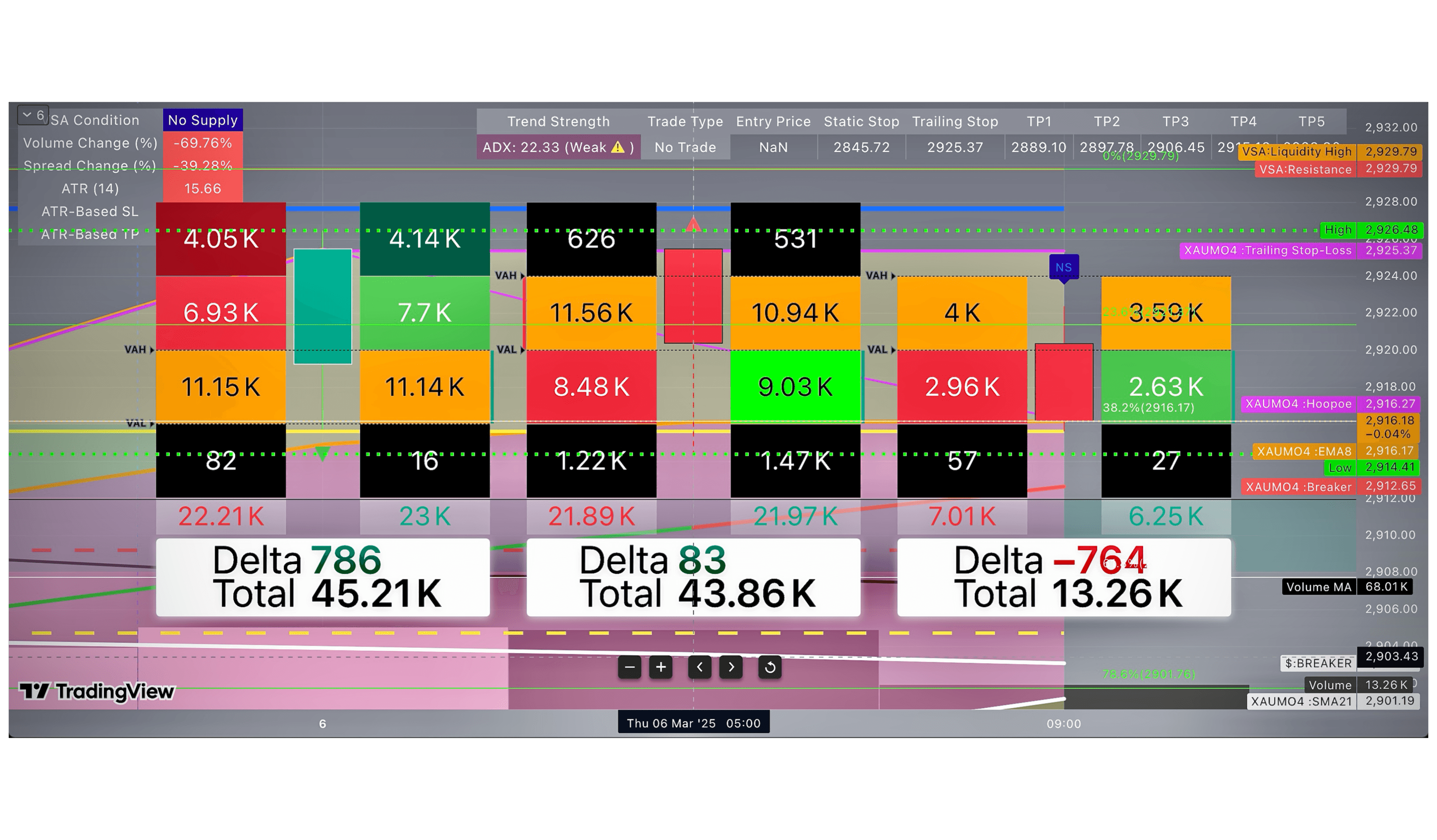

XAUMO – XAUUSD PLATINUM REPORT, PRE NON-FARM PAYROLL (NFP) RELEASE.

Trading Analysis Report – March 6 & 7 📍 March 6 Review: Smart Money Tracking 🔎 Verified OHLC Data Open2,899.00 High2,922.51 Low2,891.01 Close2,911.96 📊 Smart Money Playbook – March 6 StepAnalysis 1Early session liquidity grab below 2,900 →…

XAUMO (XAUUSD) INSTITUTIONAL MARKET OUTLOOK & TRADE PLAN

XAUMO INSTITUTIONAL PLATINUM PRO MAX – MARKET OUTLOOK & TRADE PLAN 🚨 XAUMO INSTITUTIONAL PLATINUM PRO MAX – MARKET OUTLOOK & TRADE PLAN 🔥 📅 Date: March 6, 2025 🕒 Current Time: 09:30 AM Cairo Time (GMT+2) 📍…

XAU/USD (GOLD) – Tokyo Session Playbook – Monday, March 3, 2025

Tokyo Session Playbook: Market Maker Strategy Tokyo Session Playbook: Market Maker Strategy 📅 Session Context ✅ Friday’s Closing Impact – End-of-week profit-taking & Smart Money positioning ✅ Monday’s Open Setup – Liquidity resets & possible stop hunts ✅…

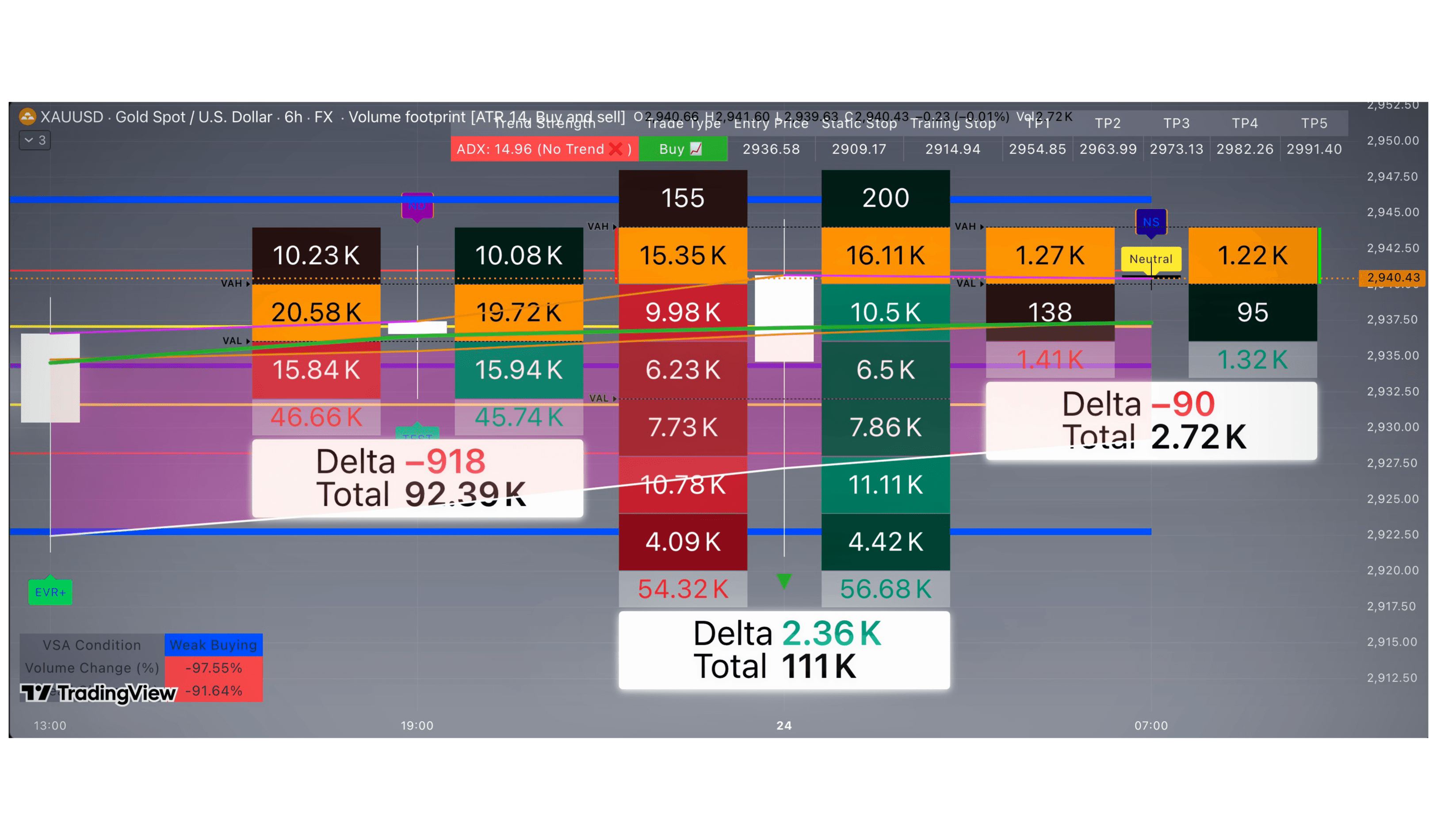

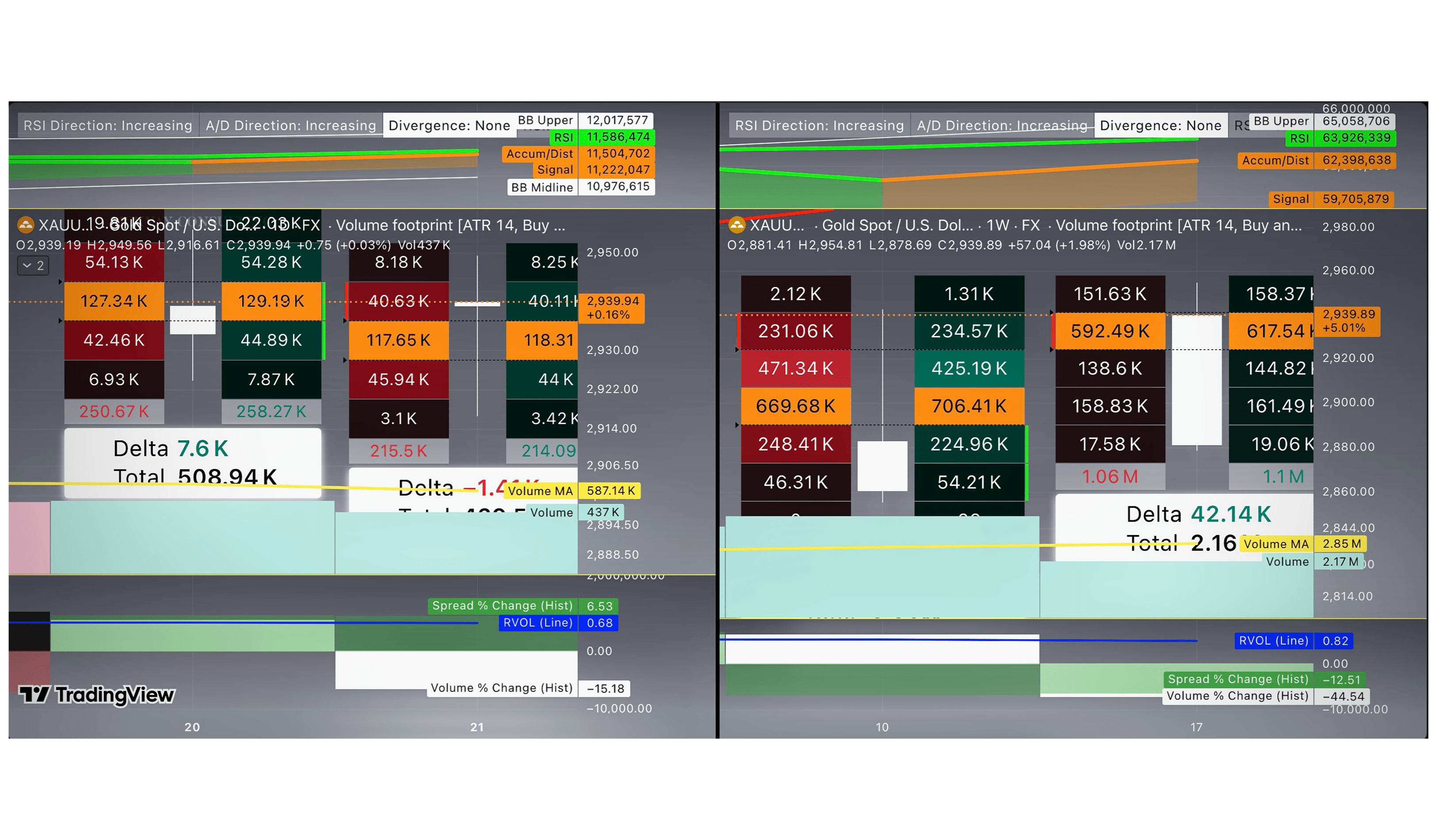

XAUMO – XAUUSD (GOLD SPOT) PLATINUM INSTITUTIONAL ANALYSIS

Section Details Session Transition ⚡ Session Transition: End of Week | End of Month | Entering New Trading Month | Pre-London Liquidity Setup SECTION 1: MACRO-LEVEL OUTLOOK 📊 Monthly FVRP & Market Context (February Recap → March Projections)…

XAUMO (XAU/USD) Platinum Report – The Ultimate Institutional Playbook

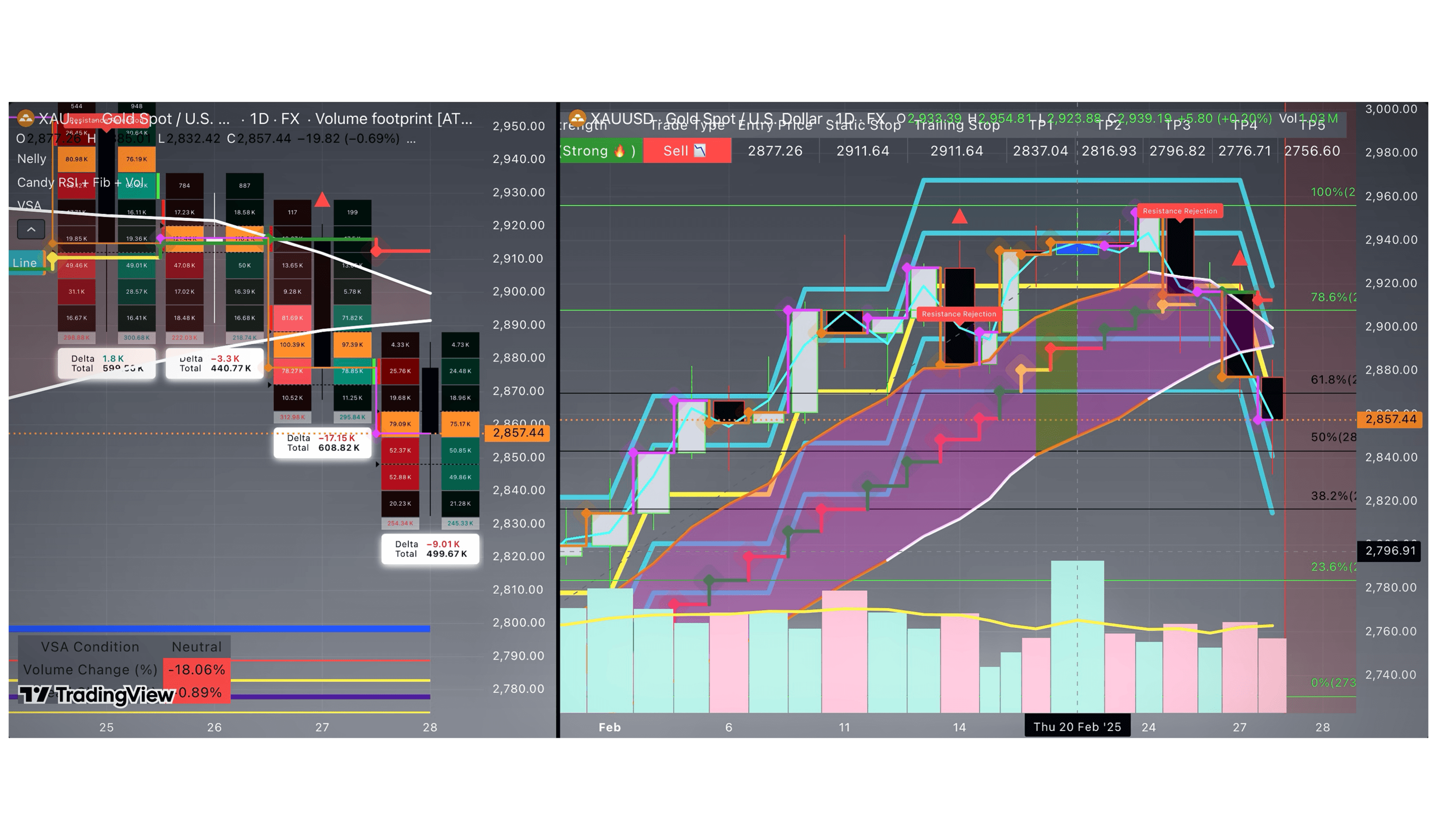

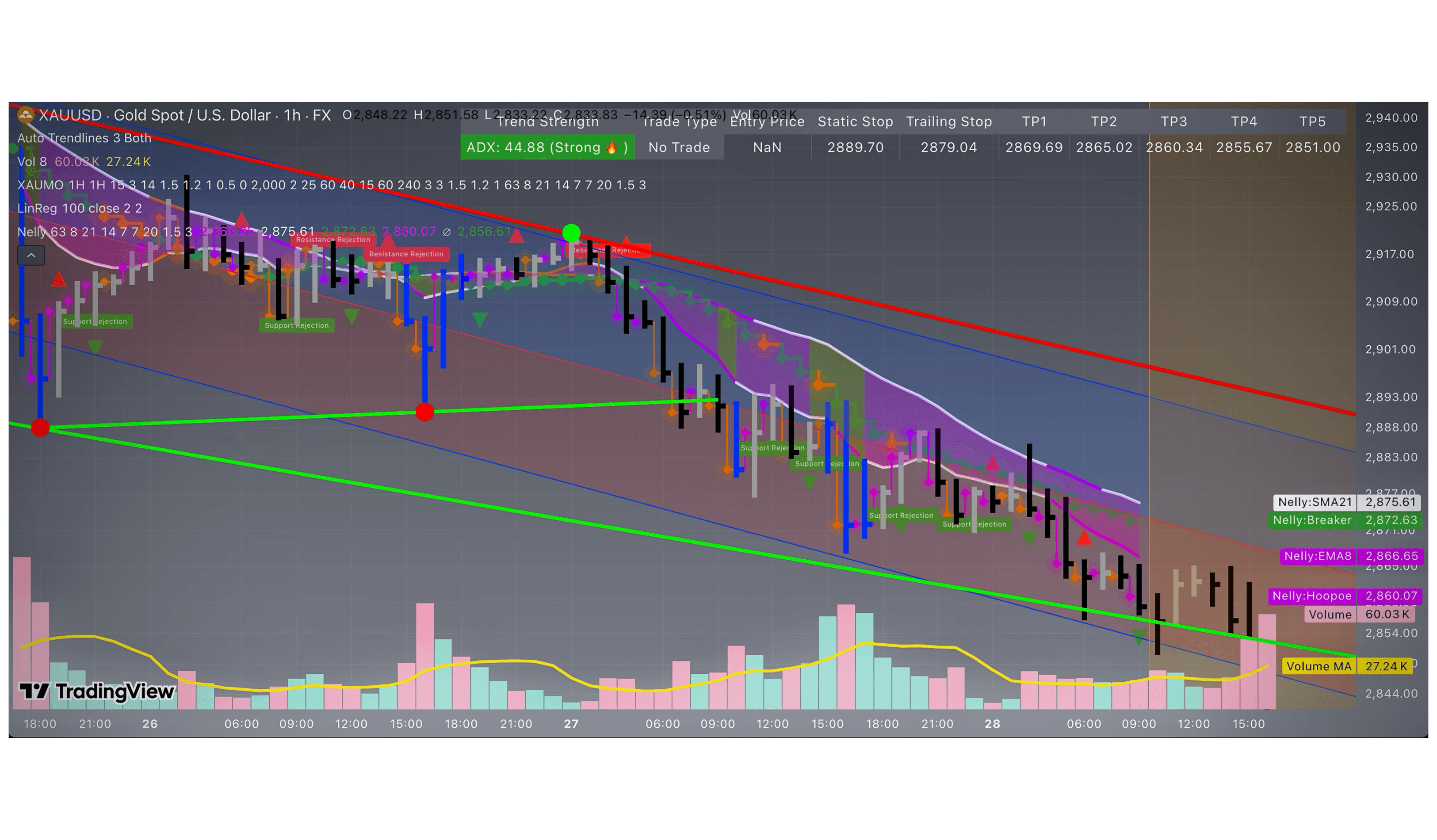

Section Details Date Friday, February 28, 2025 Market XAU/USD (Gold) Sessions Asia Session Recap → London Session Live → NYC Ahead Mission Capture Smart Money’s Next Move in Gold Before the Week & Month Close. 1️⃣ Macro &…

Impact of yesterday’s Piercing Bar – XAUUSD (Gold/USD 1D Chart)

Section Details Impact of Piercing Bar (Gold/USD 1D Chart) Analysis of yesterday’s price action and today’s bearish continuation. 1. Price Action & Candlestick Pattern Analysis The Piercing Line pattern is a bullish reversal signal that appears after a…

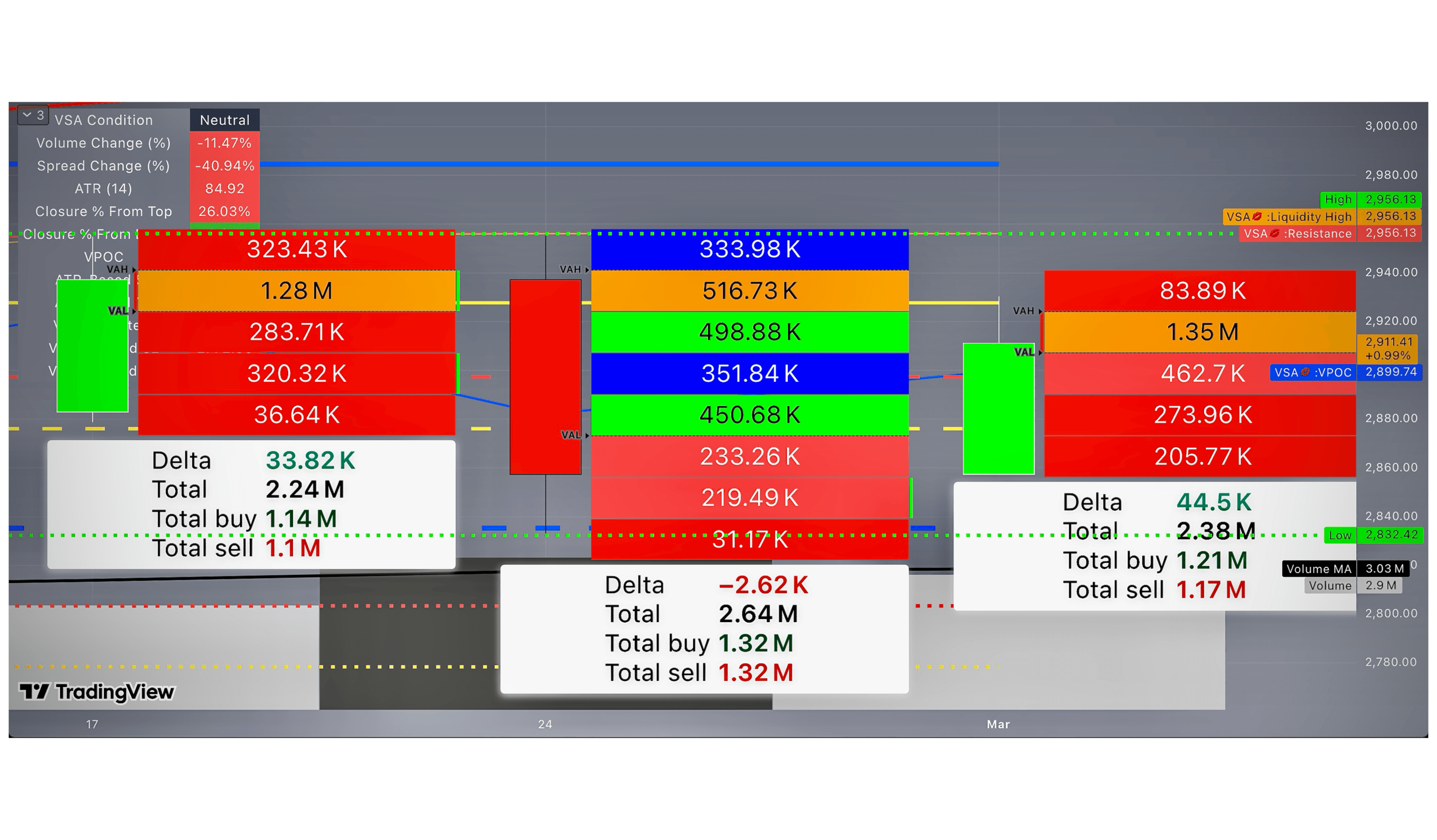

XAUMO – XAUUSD Daily Strategy Execution & Institutional Trading Report

Section Details Title 📌 XAUMO Daily Strategy Execution & Institutional Trading Report Date 📅 February 24, 2025 Market 📍 XAU/USD (Gold) Objective 🎯 Execute and document XAUMO’s FVRP (Fixed Volume Range Profile) Strategy, integrating POC, VAH, VAL, VWAP,…

XAUMO – XAUUSD Platinum Weekly Market Outlook Feb 26 – Mar 1, 2025

Section Details Title 🚀 XAUMO Platinum Weekly Market Outlook – The Ultimate Institutional Playbook 🚀 Week Feb 26 – Mar 1, 2025 Market XAU/USD (Gold) Objective Identify Institutional Liquidity Moves, Volume Footprint, and Smart Money Activity to Execute…

How to Identify Smart Money Moves & Execute High-Probability Trading

Mastering Institutional Liquidity and Volume Footprint Analysis in Gold (XAU/USD) Identifying Institutional Activity and Executing Strategic Trades 1. Introduction: Volume Footprint and Institutional Liquidity Dynamics Why Volume Footprint Matters Volume footprint analysis provides granular insights into buy/sell pressure…

XAUMO WEEKLY REP0RT (week of Jan 25-31) – (xau/usd Roadmap)

XAUMO Institutional Playbook (Redesigned) Scenario 1: Bullish Breakout Above $2,785 (VAH) Market-Maker Logic: Breakout above $2,785 (VAH) signals institutional buying, targeting stops around $2,790-$2,800 (Fibonacci TP Zone). Entry: Buy Stop at $2,786 Take Profit Levels: • $2,790: (Psychological…

The XAUUSD closed at $2,770.89 per troy ounce, marking a 0.40% increase from the previous close

As of January 24, 2025, the XAU/USD (Gold Spot to US Dollar) closed at $2,770.89 per troy ounce, marking a 0.40% increase from the previous close. This rise was driven by uncertainty over U.S. President Donald Trump’s tariff…

- September 21, 2025–September 27, 2025

- August 17, 2025–August 23, 2025

- July 13, 2025–July 19, 2025

- June 8, 2025–June 14, 2025

- June 1, 2025–June 7, 2025

- May 18, 2025–May 24, 2025

- May 11, 2025–May 17, 2025

- May 4, 2025–May 10, 2025

- April 27, 2025–May 3, 2025

- April 20, 2025–April 26, 2025

- April 13, 2025–April 19, 2025

- April 6, 2025–April 12, 2025

- March 30, 2025–April 5, 2025

- March 16, 2025–March 22, 2025

- March 9, 2025–March 15, 2025

- March 2, 2025–March 8, 2025

- February 23, 2025–March 1, 2025

- January 26, 2025–February 1, 2025

- January 19, 2025–January 25, 2025

- January 12, 2025–January 18, 2025

- January 5, 2025–January 11, 2025

- December 29, 2024–January 4, 2025

- December 29, 2024–January 4, 2025

- December 22, 2024–December 28, 2024

- December 15, 2024–December 21, 2024

- December 8, 2024–December 14, 2024

- December 1, 2024–December 7, 2024

- November 24, 2024–November 30, 2024

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions