EGX30 EXPECTED MOVE

Published By Mohamed Elhusseini.

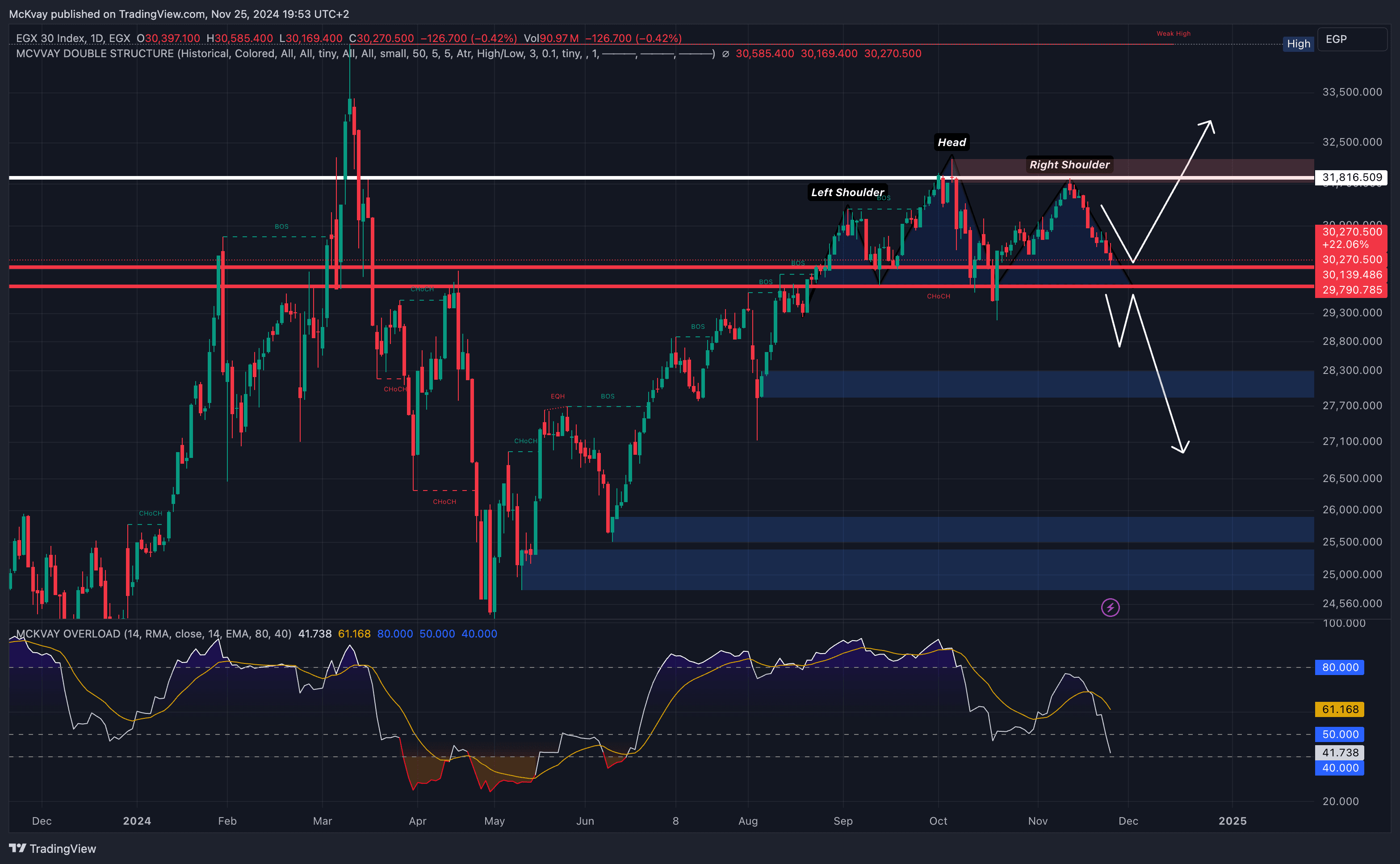

As of November 19, 2024, the technical analysis for the EGX 30 Index indicates a strong sell signal.

Key Indicators:

• MACD (12,26): With a value of -170.59, the MACD indicates a downward momentum.

• Moving Averages: All monitored periods (5, 10, 20, 50, 100, and 200) show sell signals, reinforcing the bearish outlook.

• Average Directional Index (ADX): At 63.243, the ADX reflects a strong prevailing trend.

• Relative Strength Index (RSI): At 22.857, the RSI suggests the index is in an oversold condition.

These indicators collectively point to a bearish sentiment for the EGX 30 Index as of the specified date.

What We Expect?

First Scenario:

The index is expected to decline to approximately 30,139 points before rebounding, with an initial target of 31,816 points. This suggests a continued upward trend over the next two months.

Second Scenario:

• If the index breaks below 30,100 points, it will enter a danger zone ⚠️.

• an exit point would be at 29,800 points.

• Should this level also be breached, the index is likely to drop further to around 29,340 points, where it would test the neckline of the pattern before experiencing a sharp decline.

Note: Both scenarios highlight critical thresholds and require close monitoring of market movements to align strategies accordingly !

Disclaimer.

The information and recommendations provided on this platform are for educational and informational purposes only and should not be considered as personalized investment advice or a solicitation to buy or sell any financial instruments.

1. No Guarantee of Profit:

Trading in financial markets involves substantial risk, and there is no guarantee of profit or protection against losses. Past performance is not indicative of future results.

2. Independent Decision-Making:

All investment decisions are your sole responsibility. You are encouraged to perform your own research and consult with a qualified financial advisor before making any trading decisions.

3. Market Risks:

Financial markets are subject to volatility, economic conditions, and unforeseen factors that may impact your investments.

4. No Liability:

Mckvay Consulting will not be held liable for any losses or damages resulting from reliance on the information provided. Use the recommendations at your own risk.

5. Educational Purpose Only:

The recommendations are intended to provide insight into market trends and strategies, not to serve as actionable investment directives.

By using this platform, you acknowledge that you have read and understood this disclaimer and accept the associated risks of trading. Always trade responsibly and within your financial means.

Straight To The Top.

Sources

Routers, EGX.com.eg, mubasher.info

Copyright © 2024 Mckvay. All rights reserved.