- Chart

- Summary

- Analysis

- News

- Overview

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions

Gold Price Weekly Market Summary (AUG 23th, 2025)

Gold (XAU/USD) — Weekly Wrap | Week Ending Aug 23, 2025 (Jackson Hole Week)

1) Prices & Weekly Move

- Spot gold (XAU/USD): $3,373.89/oz at 1:31 p.m. ET (17:31 GMT) Fri, Aug 22, +1.1% on the day after Powell’s Jackson Hole remarks.

- COMEX Dec futures (GCZ5): $3,418.50/oz settlement on Fri, +1.1% on the day.

- Weekly change (London LBMA PM fix): $3,334.25/oz on Aug 22 vs $3,335.50 on Aug 15 → ~-0.04% (virtually flat).

Note: U.S. spot/futures rallied late Friday on Powell’s speech, but LBMA fix is set earlier in the day, providing the cleanest week-over-week benchmark.

2) What Drove the Week

- Jackson Hole — Powell’s “balance of risks” tilt: Markets read his remarks as raising odds of a September cut → USD fell ~1% Friday → Gold rallied (spot +1.1%, futures +1.1%).

- Rate-cut probabilities: CME FedWatch odds for a 25 bp September cut climbed to ~85% post-speech (from ~75%).

- Earlier in the week:

- Tue (Aug 19): Dollar firmed → Spot -0.4% ($3,317.71); Futures -0.6% ($3,358.7).

- Wed (Aug 20): Dollar eased → Spot +0.9% ($3,344.37); Futures +0.9% ($3,388.50).

3) Market Tone by Category

- Dollar & Yields: USD down ~1% Friday; lower yields improved bullion’s appeal.

- Physical/Regional: Asian demand muted during August volatility; activity subdued into Jackson Hole week until Friday’s easing.

- Benchmarks: LBMA PM (Aug 22): $3,334.25 vs Aug 15: $3,335.50.

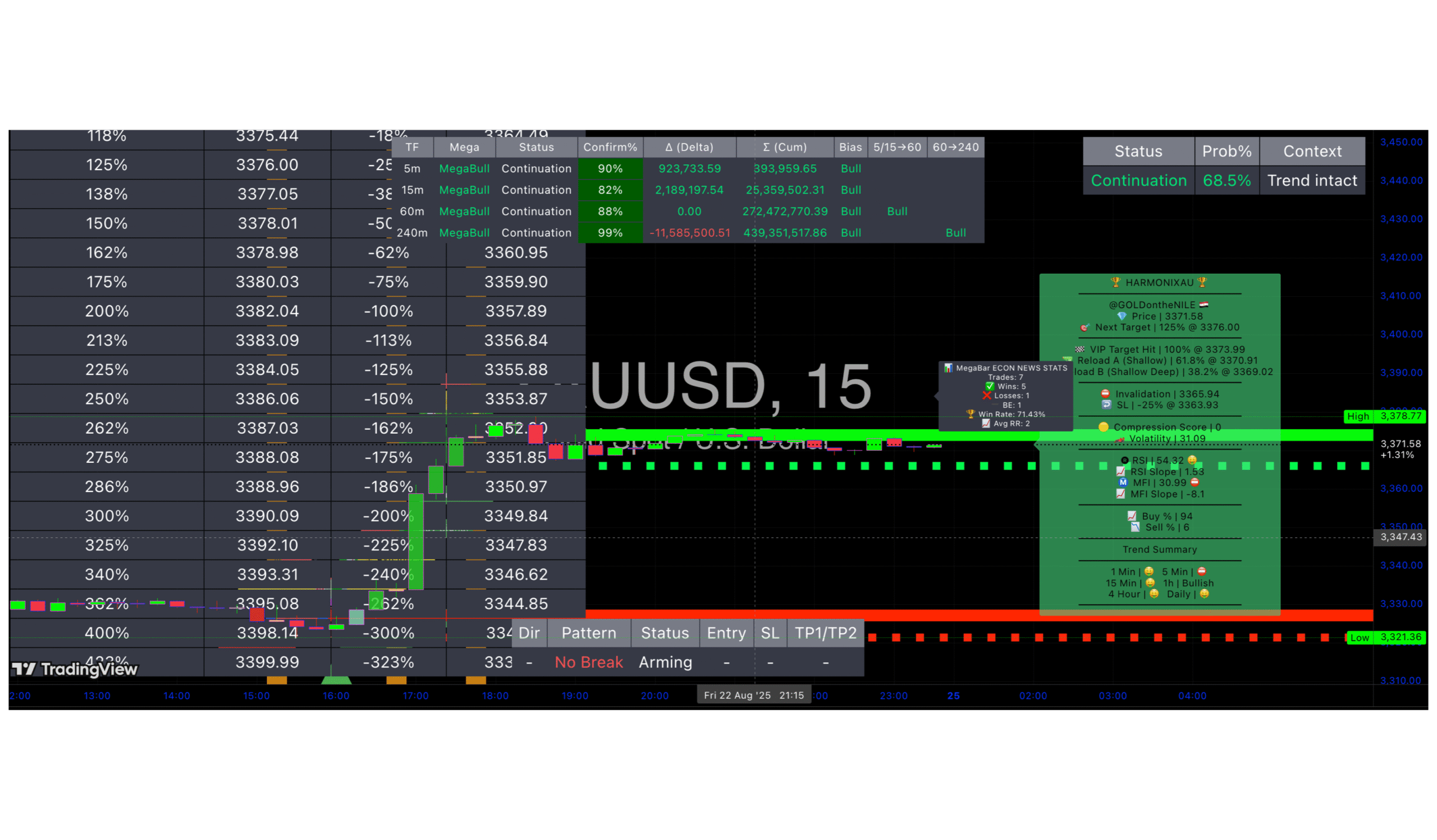

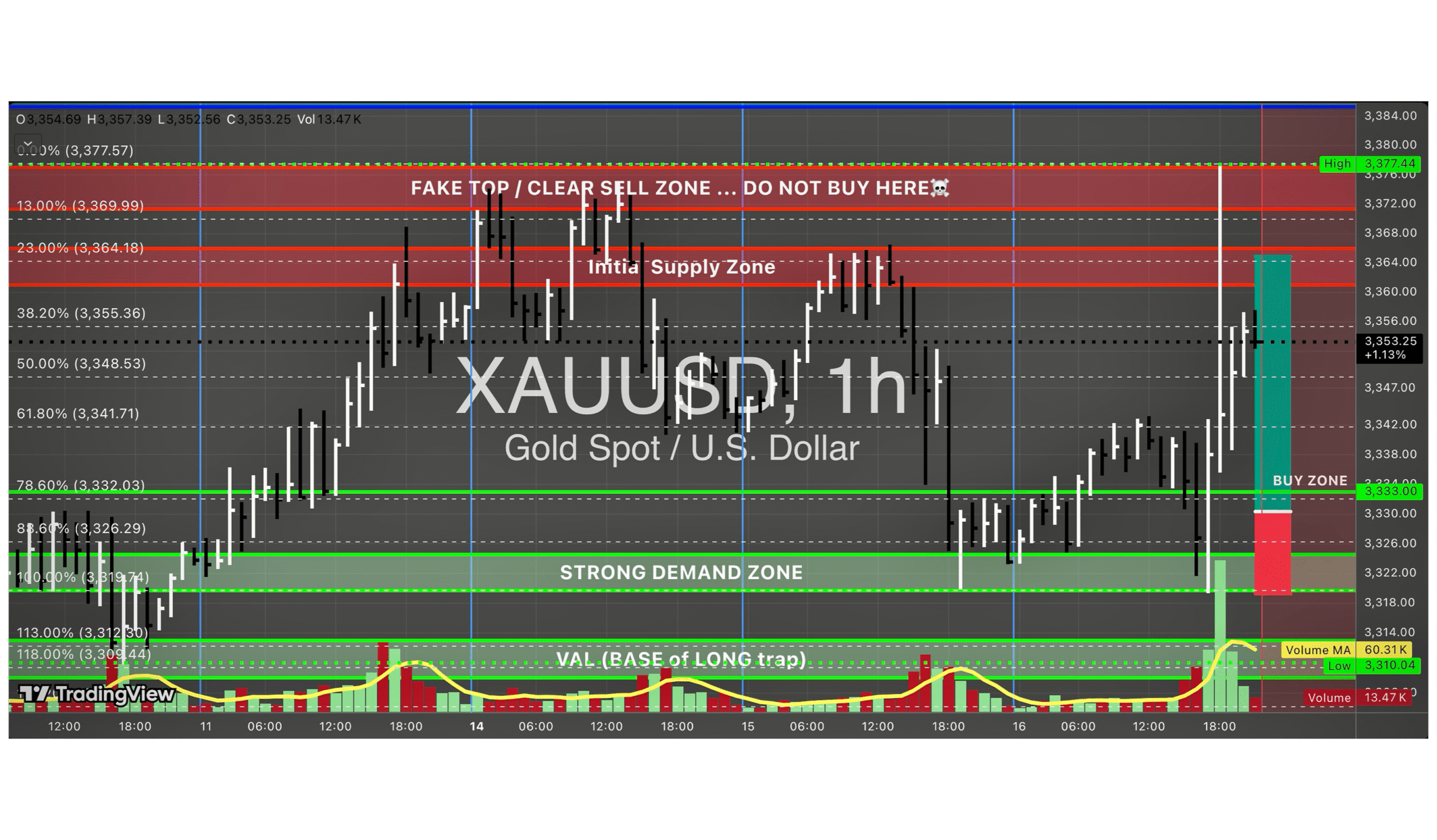

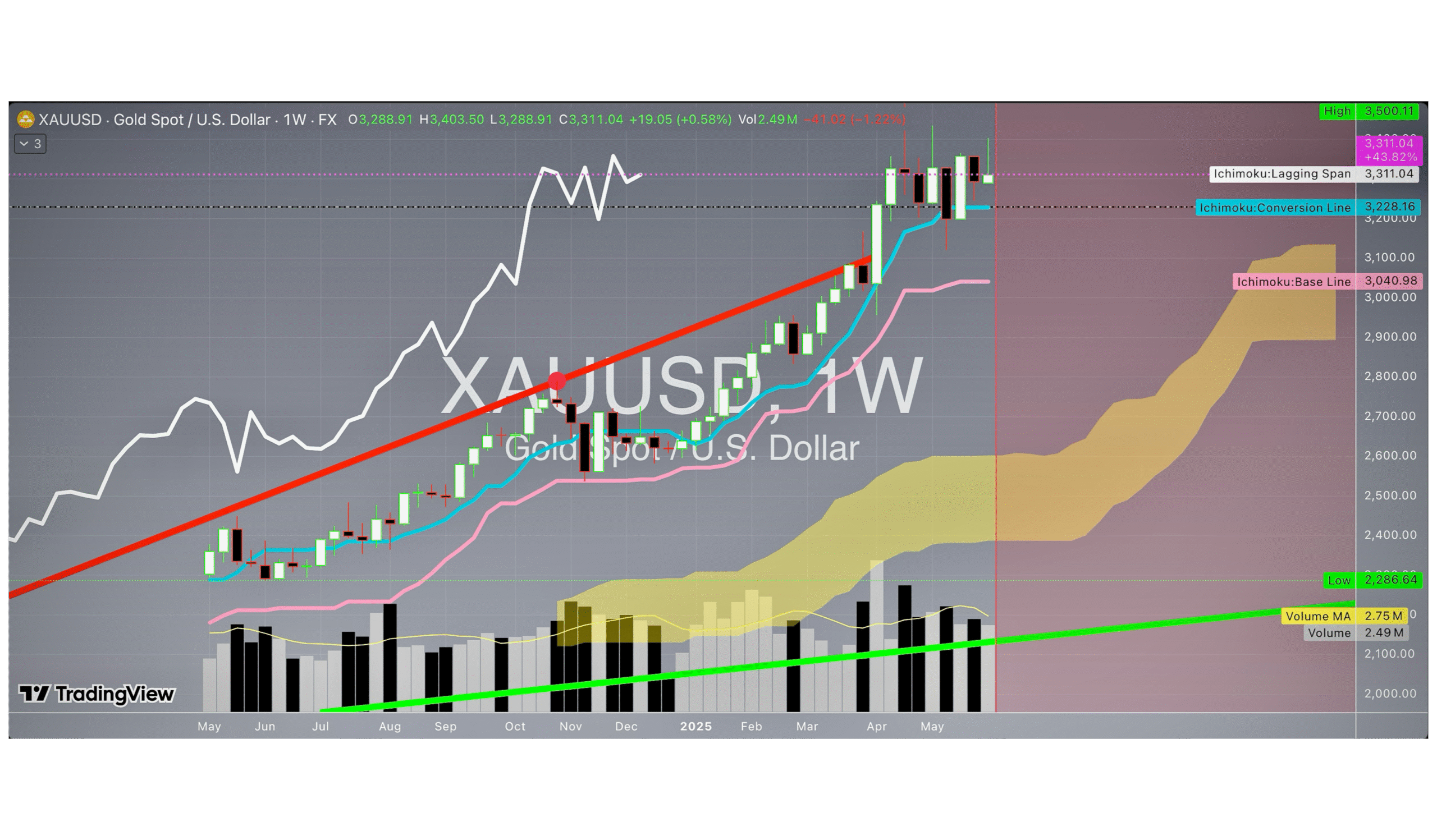

4) Technical Snapshot

Gold oscillated into Jackson Hole; Powell’s remarks triggered bounce. Key focus: $3,340–$3,380.

A close above ~$3,380 opens path to $3,400+; failure below ~$3,340 reopens range trade.

5) Weekly Reference Table

| Item | Fri Aug 22 (U.S. session) | W/W Change Note |

|---|---|---|

| Spot gold (intra-U.S.) | $3,373.89/oz (+1.1% D/D) | Late-day rally post-Powell drove close higher. |

| COMEX Dec futures settle | $3,418.50/oz (+1.1% D/D) | Same driver: Powell’s tone shift. |

| LBMA Gold PM (benchmark) | $3,334.25/oz | ≈-0.04% W/W (vs $3,335.50 on Aug 15). |

Bottom Line

- Headline: Jackson Hole tone boosted September cut odds, sparking Friday’s U.S. rally.

- Weekly Tally: LBMA benchmark shows gold essentially flat week-over-week due to fix timing vs. late Friday surge.

Disclaimer

The information and recommendations provided on this platform are for educational and informational purposes only and should not be considered as personalized investment advice or a solicitation to buy or sell any financial instruments.

1. No Guarantee of Profit:

Trading in financial markets involves substantial risk, and there is no guarantee of profit or protection against losses. Past performance is not indicative of future results.

2. Independent Decision-Making:

All investment decisions are your sole responsibility. You are encouraged to perform your own research and consult with a qualified financial advisor before making any trading decisions.

3. Market Risks:

Financial markets are subject to volatility, economic conditions, and unforeseen factors that may impact your investments.

4. No Liability:

Mckvay Consulting will not be held liable for any losses or damages resulting from reliance on the information provided. Use the recommendations at your own risk.

5. Educational Purpose Only:

The recommendations are intended to provide insight into market trends and strategies, not to serve as actionable investment directives.

By using this platform, you acknowledge that you have read and understood this disclaimer and accept the associated risks of trading. Always trade responsibly and within your financial means.

Sources

- Bloomberg Terminal

- Reuters

- Investopedia

- Mckvay

- MarketWatch

- DailyForex

- MacroTrends

- Trading Economics

- Acuity Knowledge Partners

- Longforecast.com

- Cboe Global Markets

- TradingView

- Central Bank Websites

- World Gold Council

- Refinitiv Eikon

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions

In-Depth Analysis

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions

- Gold: Weekly Hammer Signals Buyers in Control as New Upside Targets Come Into Viewby Fawad Razaqzada on February 23, 2026 at 15:01

- Gold Climbs to $5,183 as Tariff and Iran Risks Reinforce Haven Demandby Khasay Hashimov on February 23, 2026 at 13:30

- Gold Tests Rising Wedge Resistanceby Carl Dupoin on February 23, 2026 at 12:37

- US Oil Drilling Activity Still Going Nowhereby OilPrice.com on February 23, 2026 at 10:02

- Copper Unlikely to Follow Near-Term Gold Rallyby OilPrice.com on February 23, 2026 at 09:59

- Natural Gas: Europe Set for Another Record LNG Import Monthby OilPrice.com on February 23, 2026 at 09:57

- Oil Traders May Be Pricing Iran Risk Too Lightlyby OilPrice.com on February 23, 2026 at 09:55

- Oil Softens Ahead of Further US-Iran Talks, Rising Tariff Uncertaintyby ING Economic and Financial Analysis on February 23, 2026 at 07:31

- Oil Markets Price Geopolitical Risk, Not Supply Disruptionby Khasay Hashimov on February 23, 2026 at 07:20

- The Gold Update: Yellow Metal’s Key Near-Term Trend Rotates to Negativeby Mark Mead Baillie on February 23, 2026 at 07:03

- Newcore Gold Develops the Promising Enchi Gold Project in Ghana – PFS to be Completed by Summeron February 20, 2026 at 13:45

This video is produced and paid for on behalf of Newcore Gold. Newcore Gold is developing the Enchi Gold Project in Ghana – Africa’s No. 1 gold producer – directly on the productive […]

- Massive & Beautiful: 2019 5 oz Mexican Silver Libertadon February 20, 2026 at 10:26

The 2019 5 oz Mexican Libertad stands out for a reason. ✨ Low mintage, impressive weight, and a design that continues to …

- Mayfair Gold: Top Development Project in Canada with Great Potentialon February 19, 2026 at 13:08

This video is produced and paid for on behalf of Mayfair Gold. Efficiency meets high-grade gold potential: Mayfair Gold and the Fenn-Gib Project in the heart of the productive Timmins […]

- Gold Co. Moves Toward Productionon February 19, 2026 at 08:00

Source: Bob Moriarty 02/19/2026Bob Moriarty of 321Gold.com explains why he likes ESGold Corp. (ESAU:CSE; ESAUF:OTCQB; Z7D:FSE).In a sensible universe, gold and silver would be […]

- Gold Co.'s Black Pine MRE Shows 17% Resource Growth Ahead of 2026 Feasibility Studyon February 19, 2026 at 08:00

Source: Brian Quast 02/19/2026Liberty Gold Corp. (LGD:TSX; LGDTF:OTCQX) announced a significant update to the Black Pine Mineral Resource Estimate. The updated MRE reveals a […]

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions

MORE INFORMATION

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions