XAUMO WEEKLY REP0RT (week of Jan 25-31) – (xau/usd Roadmap)

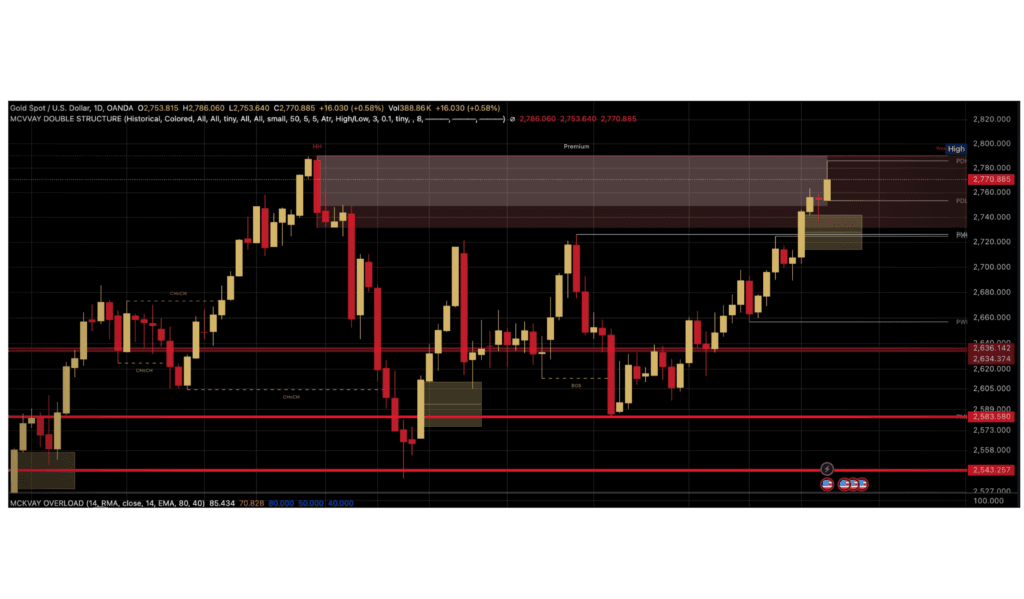

XAUMO Institutional Playbook (Redesigned) Scenario 1: Bullish Breakout Above $2,785 (VAH) Market-Maker Logic: Breakout above $2,785 (VAH) signals institutional buying, targeting stops around $2,790-$2,800 (Fibonacci TP Zone). Entry: Buy Stop at $2,786 Take Profit Levels: • $2,790: (Psychological Level & FVG Midpoint) • $2,800: (Fibonacci Extension 161.8%) Stop Loss: $2,771 (POC) Shark Moves: Fake breakouts […]

XAUMO WEEKLY REP0RT (week of Jan 25-31) – (xau/usd Roadmap) Read More »