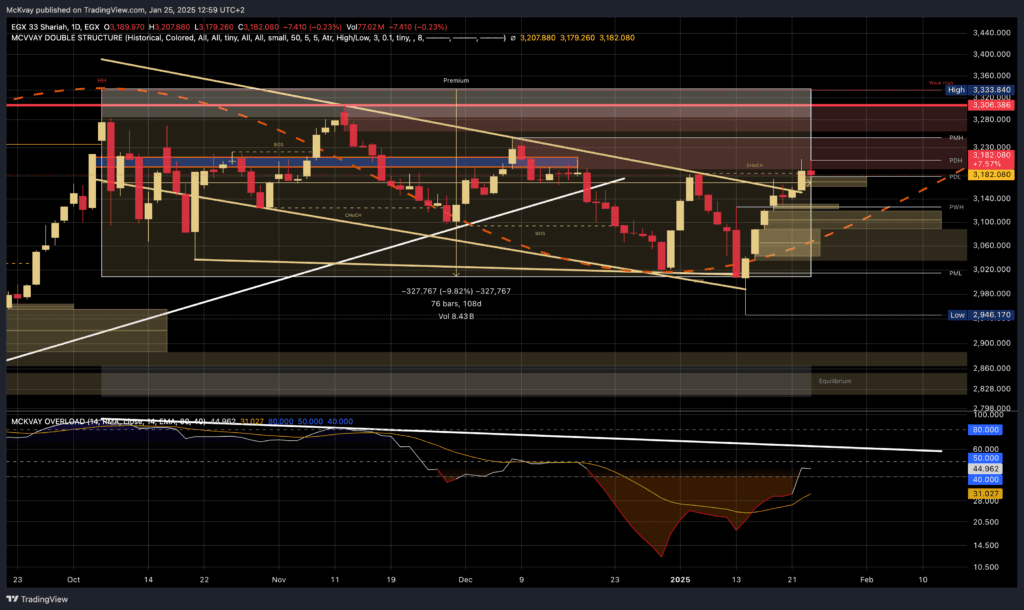

EGX33 (shariah) Index UPDATED on a DAILY timeframe, Key Support & Resistance, AND Price Action & Volume.

EGX33 Shariah Daily Chart – Comprehensive Technical Analysis Date of Analysis January 25, 2025 Confidence Level 8/10 – Based on clear technical signals (market structure, momentum, breakout patterns). Nonetheless, macroeconomic factors or policy changes can impact the index significantly. Market Structure The EGX33 Shariah Index has been in a broad downtrend since October, peaking around […]