XAUMO – XAUUSD (GOLD SPOT) | Tactical Market Report – Friday, April 25, 2025

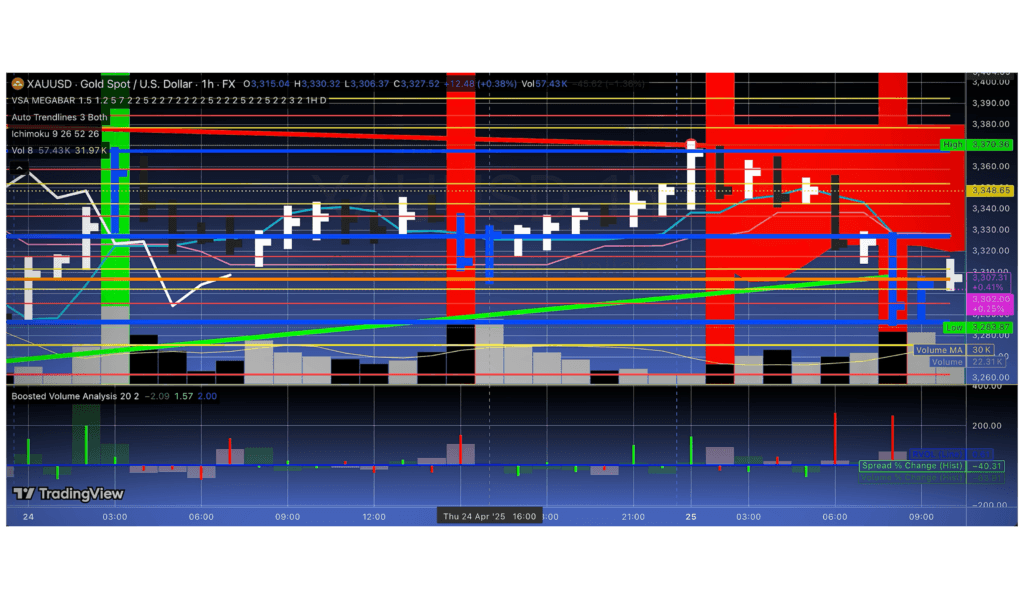

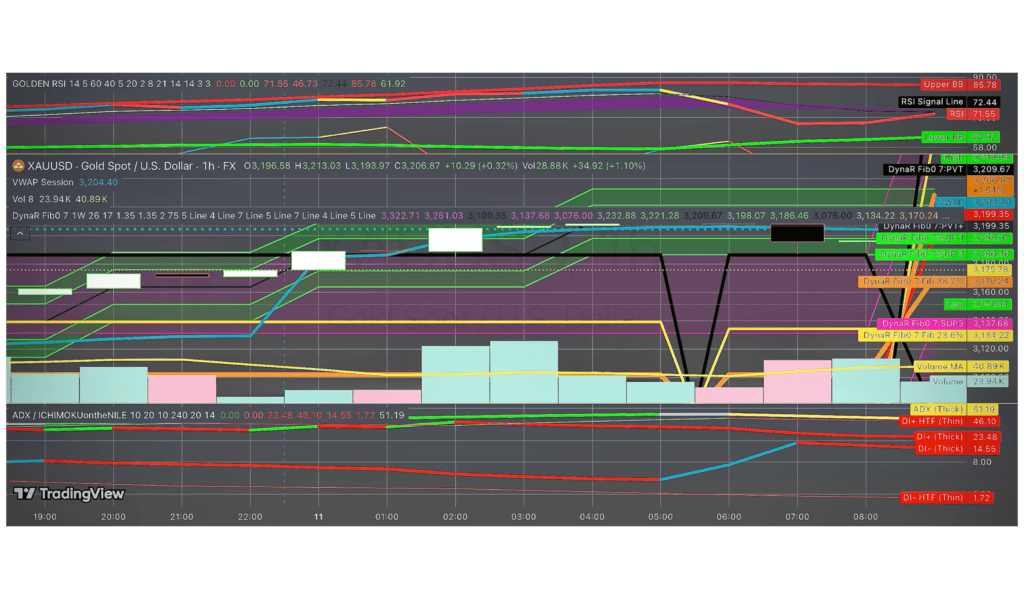

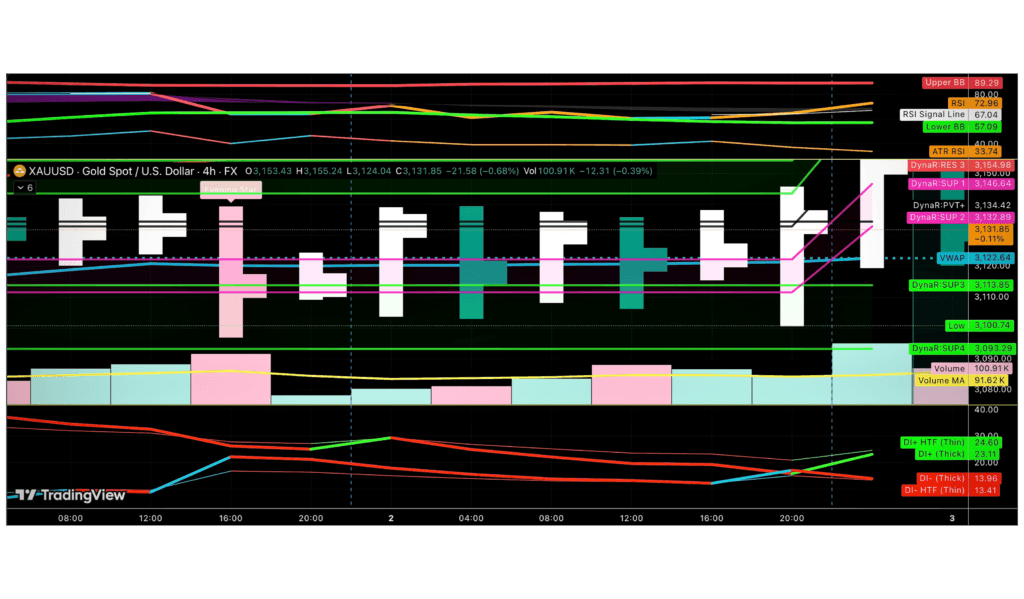

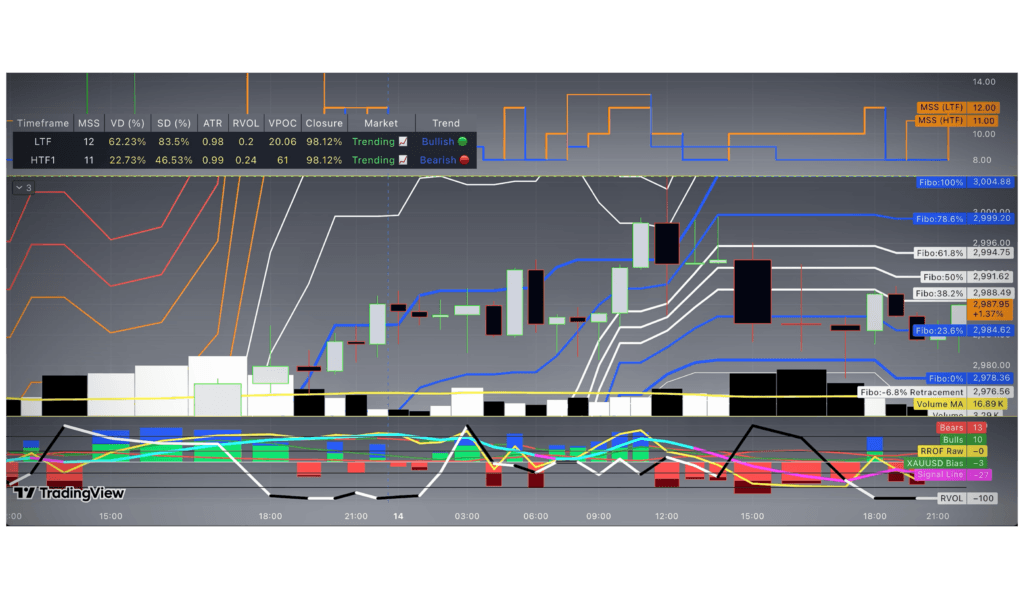

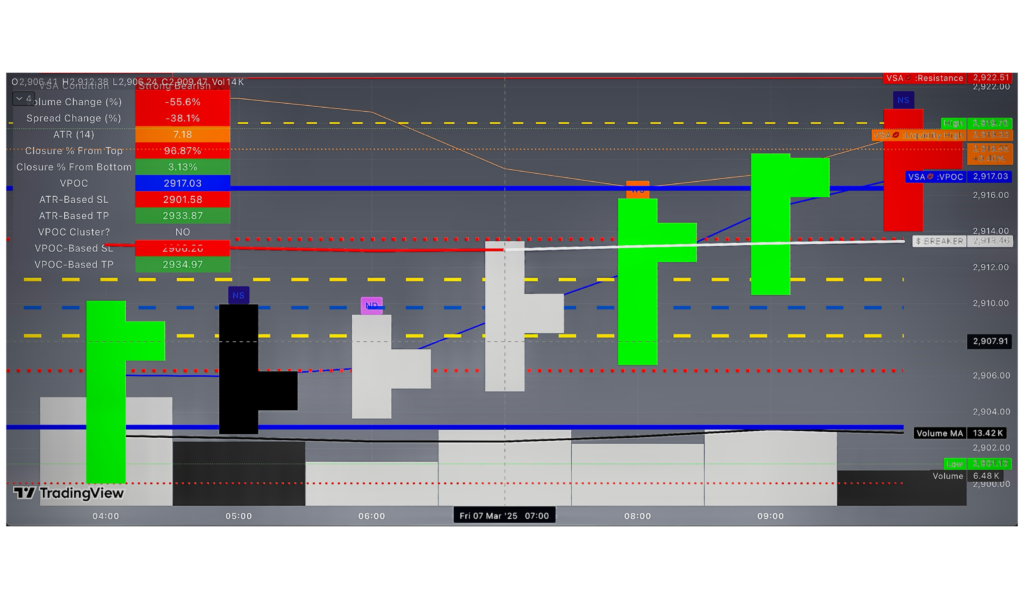

Overall Market Outlook & Session Plan The market is currently moving in a clear distribution zone, between 3,337 and 3,346. There’s strong evidence of a bull trap near the 3,346 high. Price is failing to stay above the VWAP, and we’re seeing overlapping signals between the HMA5 and EMA21. A close below 3,329.00 would be […]

XAUMO – XAUUSD (GOLD SPOT) | Tactical Market Report – Friday, April 25, 2025 Read More »