| Overall Market Outlook & Session Plan | |

|---|---|

| The market is currently moving in a clear distribution zone, between 3,337 and 3,346. There’s strong evidence of a bull trap near the 3,346 high. Price is failing to stay above the VWAP, and we’re seeing overlapping signals between the HMA5 and EMA21. A close below 3,329.00 would be a major reversal signal, possibly kicking off a wide downward move. | |

| Session-Based Behavior (Cairo Time) | |

|

1. London (10:00 – 13:00) |

Expected: Fake breakout to attract buyers Tactics: • Watch fast moves into 3,337–3,345 • Sell if rejection candles appear (Shooting Star, Engulfing) • Confirm with divergence or support break on 15-min chart |

|

2. Pre-NY (13:00 – 15:00) |

Expected: Tight consolidation & position building Tactics: • Monitor 3,320–3,329 • Stay short under VWAP • No longs unless clean breakout + strong volume & RSI confirmation |

|

3. NY Open (15:30 – 16:30) |

Expected: Initial fake move → strong momentum Tactics: • Sell after break below 3,306 + retest • RSI < 40 confirms bearish momentum |

|

4. NY Continuation (After 16:30) |

Expected: Continuation in dominant dir. Tactics: • If < 3,306.50 → keep selling • Use trailing TP, adjust to price action |

| Trading Scenarios | |

| Main Bearish Scenario (Primary Setup) | |

| Entry Options |

• Sell Limit at 3,329 • Sell Stop at 3,306 |

| Stop Loss |

SL1: 3,341.12 SL2 (Trailing): 3,345.35 |

| Take Profit |

TP1: 3,294 TP2: 3,278 TP3: 3,255.74 TP4: 3,226.88 TP5: 3,198.01 |

| Confidence | 85% |

| Why? Failed breakout, clear distribution signals, confirmed bull trap above 3,342.82. | |

| Alternative Bullish Reversal (Low Prob.) | |

| Entry | Buy Stop at 3,346 |

| Stop Loss | SL at 3,337 |

| Take Profit |

TP1: 3,355 TP2: 3,367.45 |

| Confidence | 50% |

| Structural Outlook (10:00 AM) | |

|

• MA Cluster (HMA5+EMA21): 3,307–3,310 • Institutional Resistance: 3,337–3,346 • Bull Traps at 3,342.82 & 3,338.70 • VWAP rejected; VPOC shifted to 3,294; Large sell vol 246.69K | |

| Key Economic Events Today (Cairo Time) | |

|

• 16:00 – US Consumer Confidence (Apr): Strong = USD↑→Gold↓; Weak = USD↓→Gold↑ • Evening – US Oil Rig Count: Increase = inflation ↑→indirect Gold support; No change = minor impact. | |

| XAUMO | Bullish Tactical Plan | |

|

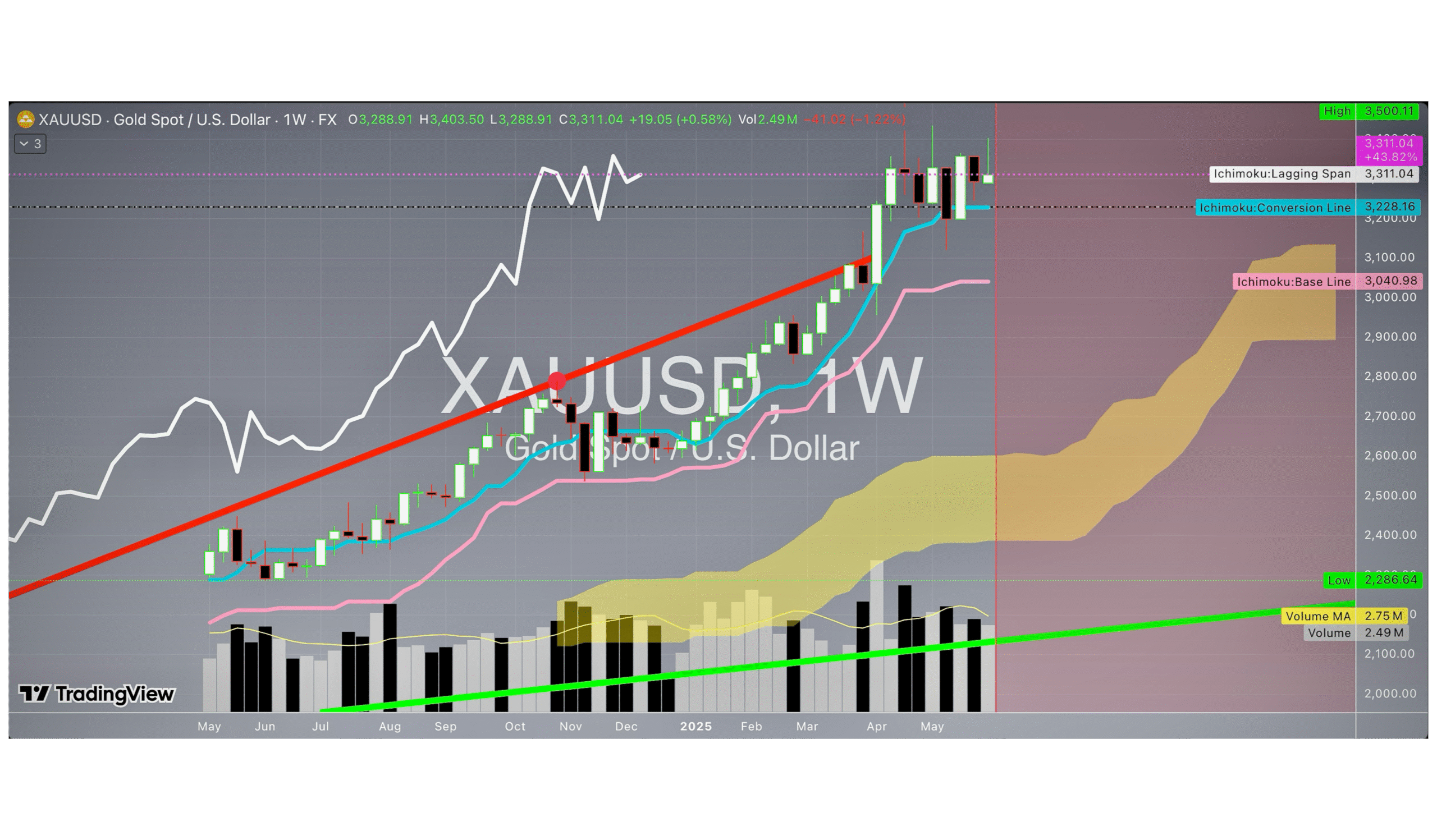

Even under heavy selling, a bullish counter-move can fire if: • Hammer or Bullish Engulfing near 3,294–3,286 support • Clean break above Ichimoku at 3,346 • RSI div + MACD cross | |

| Conditions: | |

|

• Close >3,346 on rising volume • HMA5, EMA8 & EMA21 cross up on 15m & 1h • Strong momentum + BBMA reversal confirm | |

| Buy Scenario: | |

|

Entry: Buy Stop at 3,346.20 SL1: 3,337; SL2 (Trailing): 3,333.15 TP1: 3,355; TP2: 3,367.45; TP3: 3,385 Confidence: 50–60% | |

| Final Note: | |

| “Below 3,306, price gets crushed. Above 3,346 is a distribution trap. Buying without breakout is tactical suicide. Read the chart, not your wishes.” | |

| Conclusion: | |

| If the bullish scenario plays today, Friday April 11, 2025, a short-term rally may follow. Key: confirmed close >3,346 + HMA5/EMA8/EMA21 cross + RSI>55 & MACD>0. Otherwise, bearish plan stays default. The price decides; we stay ready. | |

MORE IN-DEPTH ANALYSIS

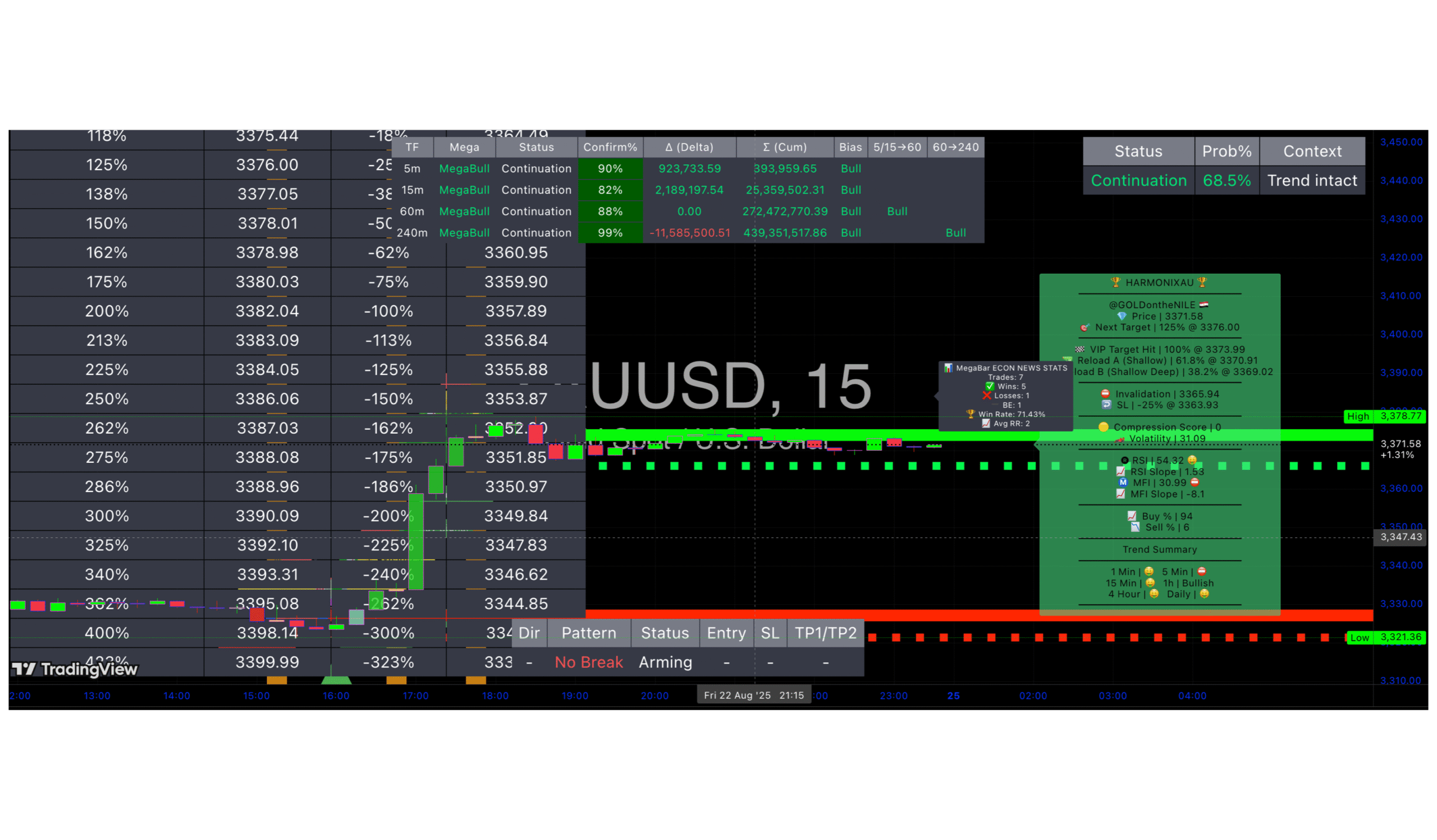

XAUMO MegaBar Suite Deluxe A complete intraday framework built for XAUUSD (Gold)

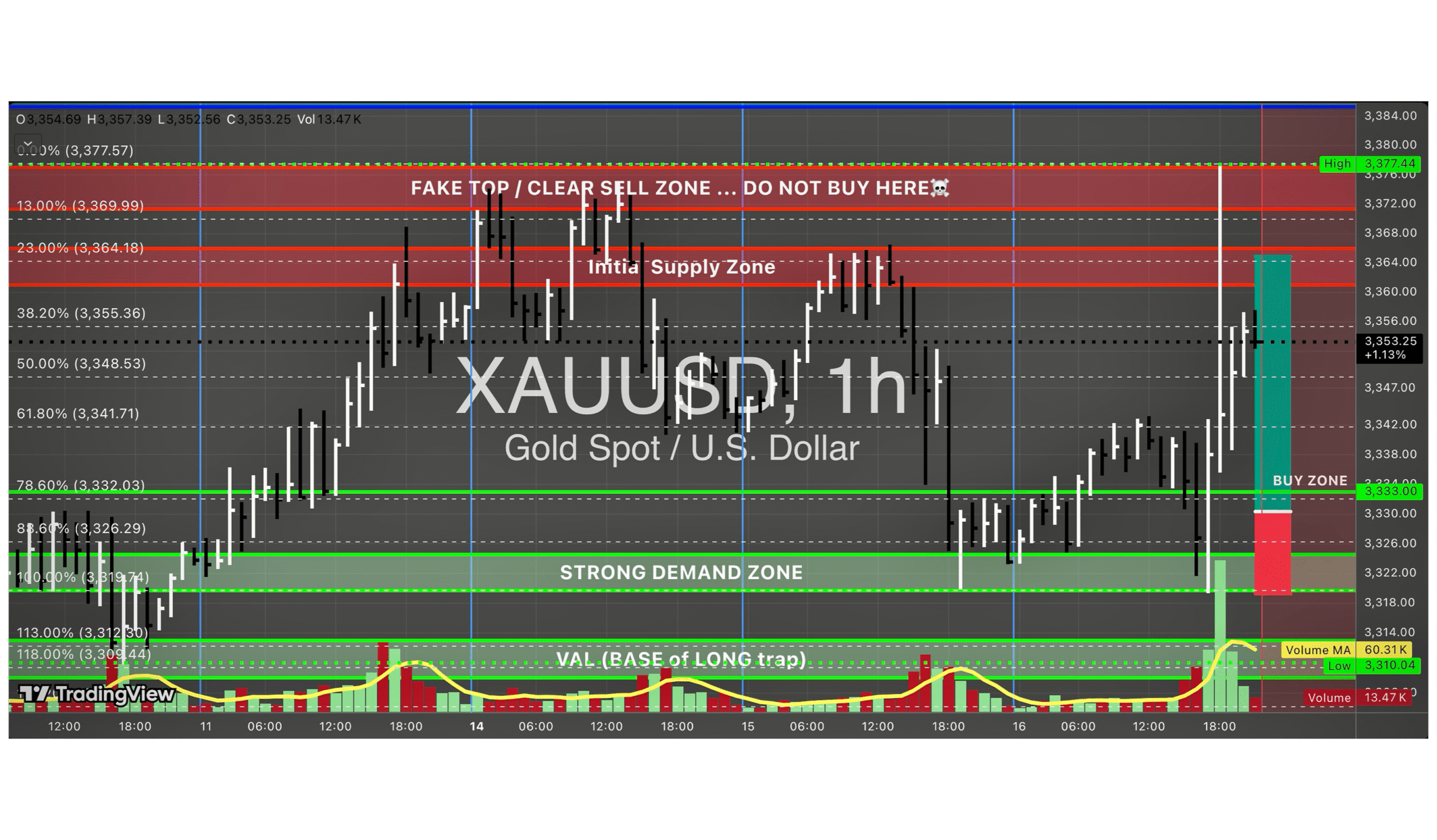

Xauusd (Gold Spot) Trap at 3,377 | XAUMO Thursday Setup

XAUUSD (Gold Spot) – XAUMO Weekly Institutional Liquidity Map | Supply & Demand

Xauusd (Gold Spot) Liquidity Map – June 2nd Battle Plan

XAU/USD (Gold Spot) Strategy – Ride with the Market Maker, Not Against Him

XAUMO – Xauusd (Gold Spot) x Heikin Ashi Chikou Fusion Strategy (Full Calibration)

XAUMO – XAUUSD (gold spot) Tactical Execution Plan – May 4, 2025

XAUMO (XAUUSD – GOLD SPOT) – Tactical Breakdown – April 30, 2025

XAUMO – XAUUSD (GOLD SPOT) | Tactical Market Report – Friday, April 25, 2025

XAUMO/XAUUSD (GOLD SPOT) STRATEGY UPDATE — FRIDAY, APRIL 11, 2025

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions