1. XAUMO Tactical Map

Red Zone – Bearish Rejection (Sell Trap Zone)

Upper Limit: 3314.60–3318.00

Strong historical rejection + VWAP & Ichimoku base rejections.

Yellow Zone – Liquidity Sweep Trap Area

Zone: 3297.50–3306.00

Price bounced repeatedly from this sweep zone; stop hunts likely.

Green Zone – Bullish Activation (Breakout)

Break Level: 3318.50+

Clean air above with strong upside potential to 3330+

2. Market Structure Overview

- Ichimoku Cloud: Bearish crossover confirmed, price below cloud.

- Volume Spike (RVOL): 1.93 on final leg = heavy sell interest.

- Price Action: Lower highs forming. Current candle series weak.

- VWAP Rejections: Ongoing rejection at 3305–3310.

- Momentum: Bearish, confirmed by RSI < 45 on M15 & M30.

3. Tactical Entry Setups (Live Ready)

A. Intraday Sell Setup – Trap Breakdown

Type: Sell Stop

Entry: 3280.00

SL: 3287.00

TPs: 3270.50 / 3259.00 / 3246.00

Confidence: 82%

Justification: Key liquidity shelf break + RVOL + trend confirmation

B. Breakout Reversal Long Setup

Type: Buy Stop

Entry: 3318.50

SL: 3310.00

TPs: 3326.50 / 3334.00 / 3341.00

Confidence: 71%

Justification: Break above compression cluster + cloud flip

C. Mean Reversion Scalp Play

Type: Sell Limit

Entry: 3305.00

SL: 3309.50

TPs: 3298.00 / 3292.00

Confidence: 75%

Justification: VWAP + red zone overlap with divergence

4. STRIKE | DEFEND | SCALP | SWING

- STRIKE: Enter Sell Stop @ 3280 if NY Open flushes. Only go long above 3318.50 with strong volume.

- DEFEND: Avoid chop zone 3298–3305 unless confirmed wick fakeout.

- SCALP: Wick traps near 3304–3305 or 3288–3290.

- SWING: Hold below 3280 after NY for potential swing down to 3259+.

5. Summary

Market still biased Bearish unless 3318.50+ breaks.

NY Open = trigger window for high-volatility move. Bias remains with sellers.

MORE IN-DEPTH ANALYSIS

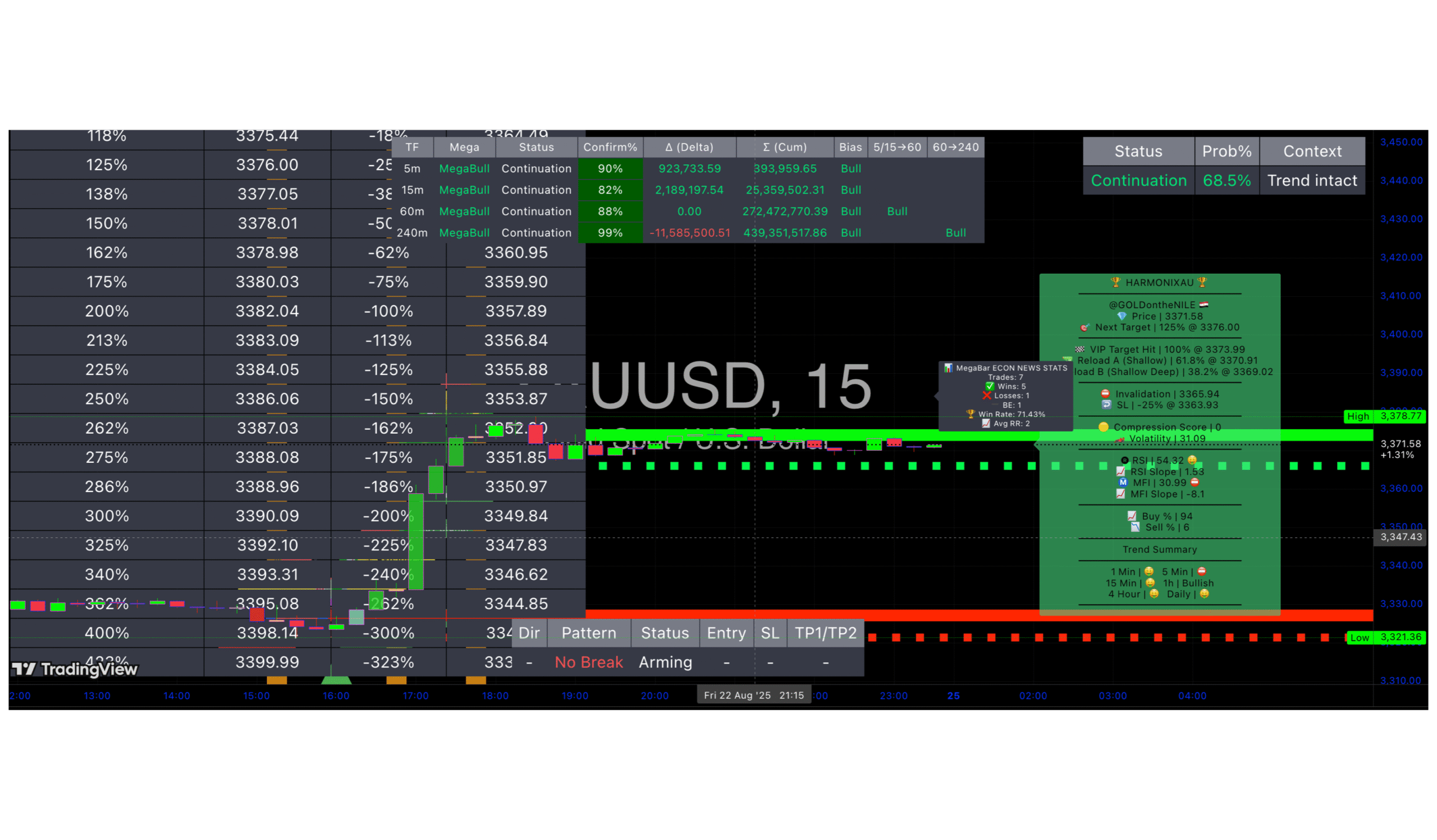

XAUMO MegaBar Suite Deluxe A complete intraday framework built for XAUUSD (Gold)

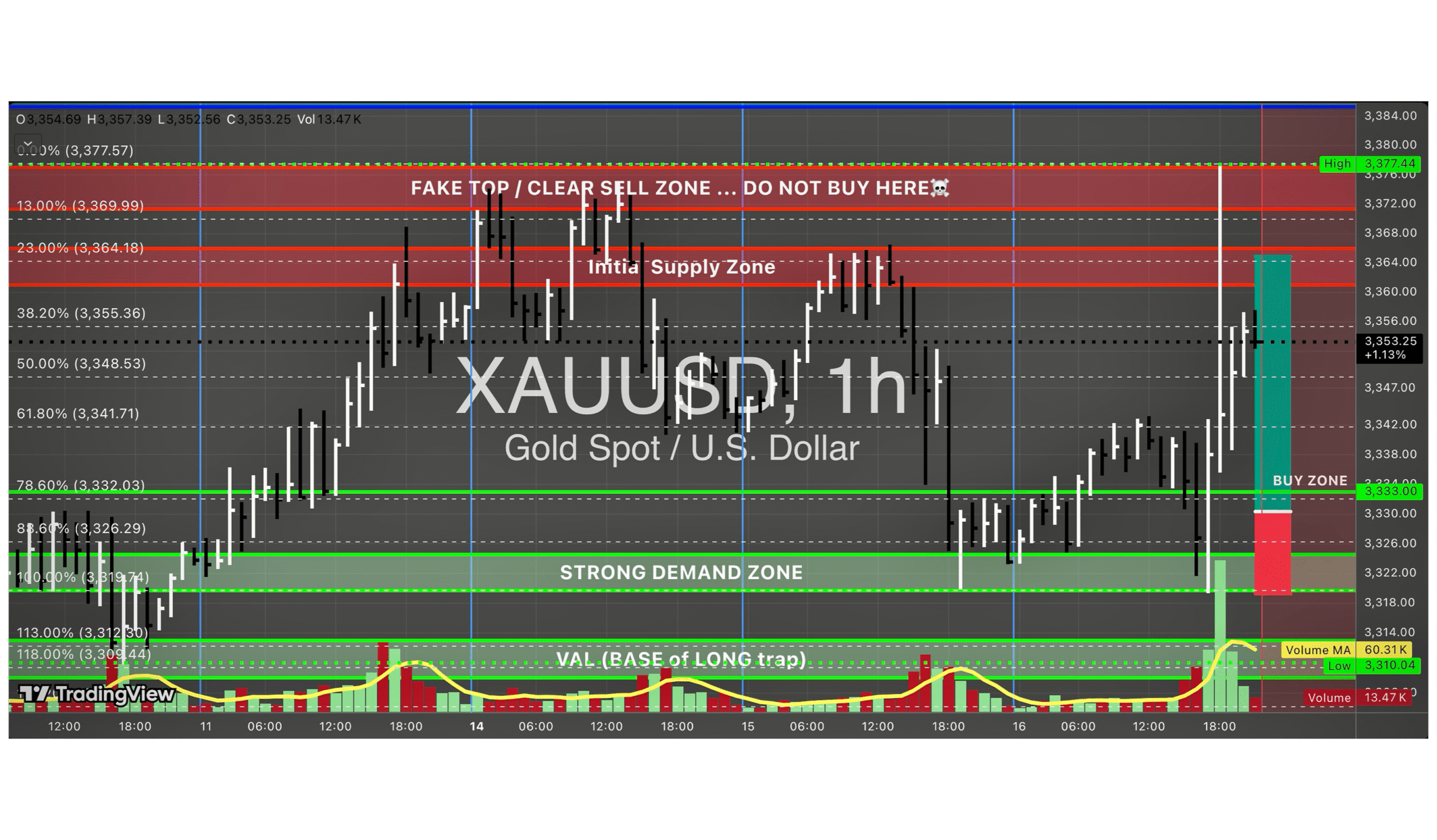

Xauusd (Gold Spot) Trap at 3,377 | XAUMO Thursday Setup

XAUUSD (Gold Spot) – XAUMO Weekly Institutional Liquidity Map | Supply & Demand

Xauusd (Gold Spot) Liquidity Map – June 2nd Battle Plan

XAU/USD (Gold Spot) Strategy – Ride with the Market Maker, Not Against Him

XAUMO – Xauusd (Gold Spot) x Heikin Ashi Chikou Fusion Strategy (Full Calibration)

XAUMO – XAUUSD (gold spot) Tactical Execution Plan – May 4, 2025

XAUMO (XAUUSD – GOLD SPOT) – Tactical Breakdown – April 30, 2025

XAUMO – XAUUSD (GOLD SPOT) | Tactical Market Report – Friday, April 25, 2025

XAUMO/XAUUSD (GOLD SPOT) STRATEGY UPDATE — FRIDAY, APRIL 11, 2025

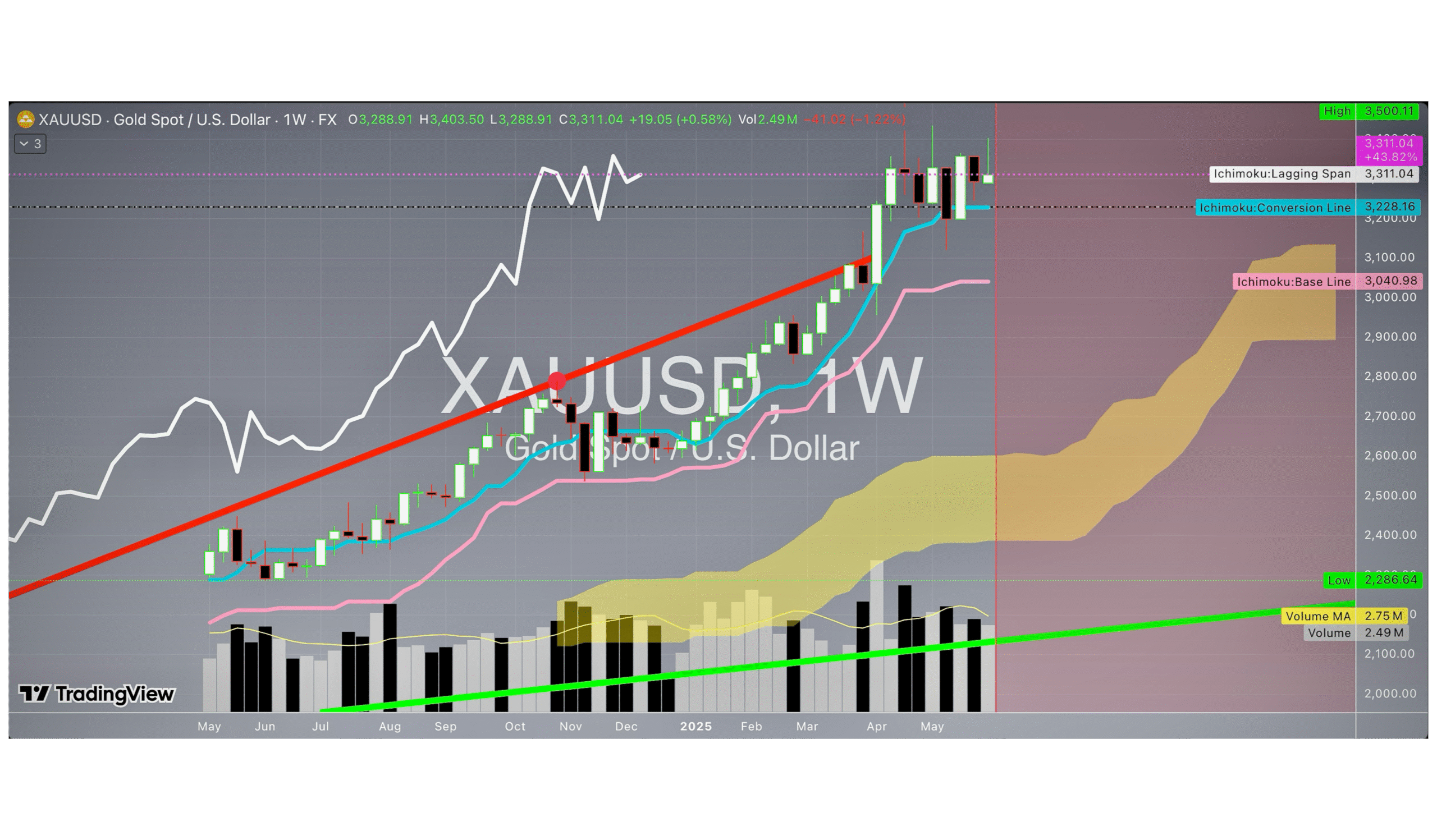

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions