Technical Analysis of EFIH (E-Finance for Digital and Financial Investments)

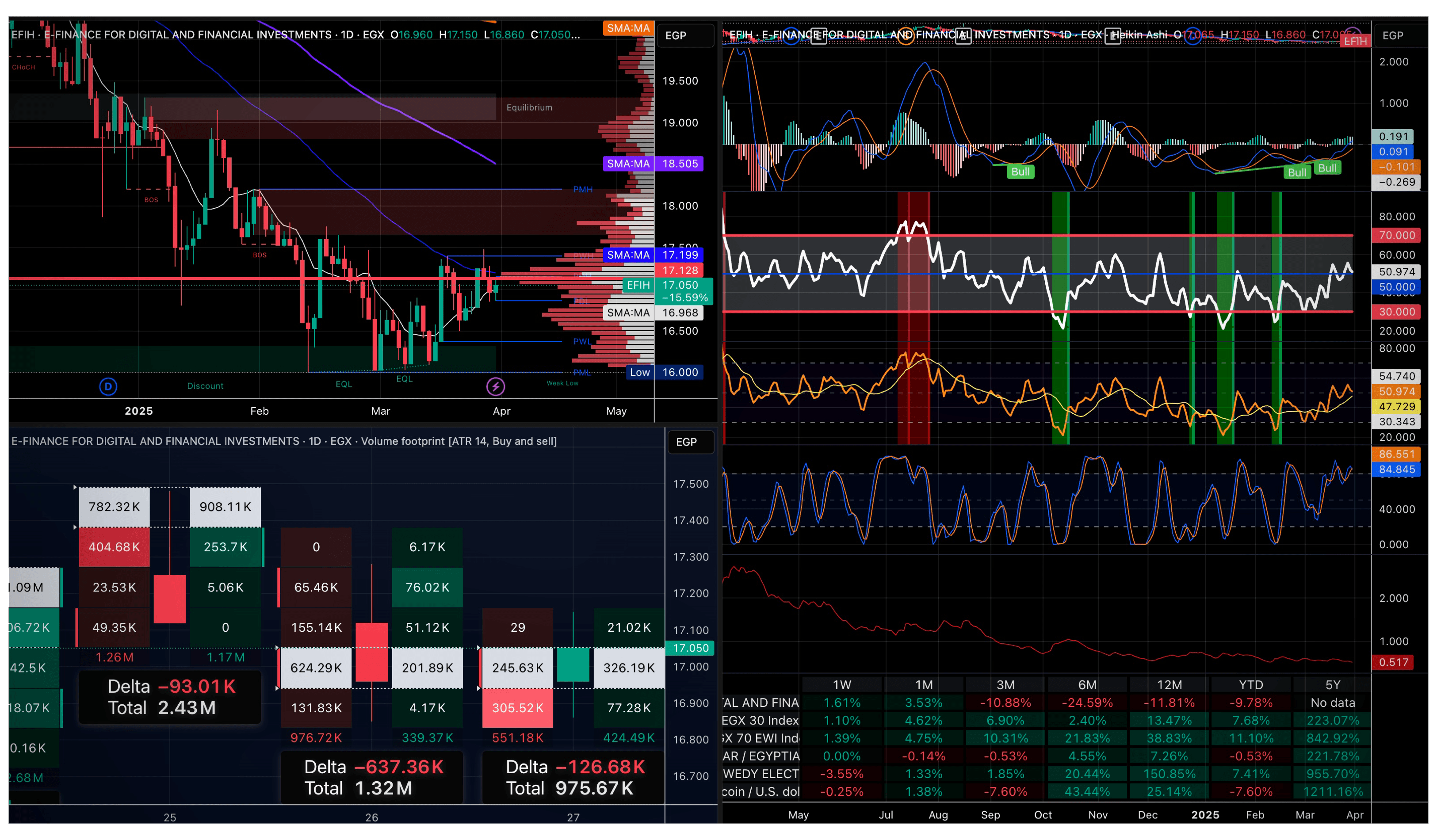

1. Trend Analysis

Overall Trend:

The stock has been in a downtrend since reaching highs around 27 EGP. The recent price action shows potential accumulation as the decline slows near 16-17 EGP.

Short-Term Trend:

The 1-hour chart shows a consolidation phase after a prolonged downtrend. Liquidity zones around 17.15 – 17.84 EGP suggest resistance.

Medium-Term Trend:

The 4-hour chart indicates aggressive entry signals on both bullish and bearish trends. A break above 18 EGP may signal a reversal, while failure could lead to further downside.

2. Support and Resistance Levels

Support Zones:

- 16.00 – 16.50 EGP (Strong historical support)

- 17.00 – 17.10 EGP (Current consolidation level)

Resistance Zones:

- 18.00 – 18.50 EGP (First key resistance)

- 20.00 – 21.00 EGP (Major resistance zone from previous sell-offs)

3. Volume and Liquidity Analysis

Volume Footprint:

Recent buying pressure at 17 EGP, with increasing volume. Higher sell-side liquidity observed near 18 EGP, indicating potential resistance.

Delta Volume:

Net negative delta in previous sessions suggests stronger selling pressure. Accumulation signs are appearing at lower levels.

4. Momentum Indicators

RSI (Relative Strength Index):

Hovering near 50, indicating a neutral stance. Previous bounces occurred near RSI 30, suggesting a possible upturn if support holds.

MACD (Moving Average Convergence Divergence):

Shows a bullish crossover, hinting at potential upside momentum. Needs confirmation with increasing price action.

Stochastic Oscillator:

Overbought conditions were met in past rallies, leading to corrections. Currently approaching a bullish cycle.

5. Market Sentiment & Order Flow

Institutional Activity:

Large orders were absorbed in the 16.5 – 17.0 EGP range. Potential smart money accumulation in this zone.

Liquidity and Smart Money:

Sell-side liquidity observed at 17.84 – 18.5 EGP, where previous reversals happened. Buy-side liquidity concentrated below 16.5 EGP, making it a key defense zone.

6. Key Takeaways & Potential Strategies

✅ Bullish Scenario:

A break above 18 EGP with strong volume could trigger further upside. Target: 20.5 – 21 EGP (major resistance zone).

❌ Bearish Scenario:

Failure to hold 17 EGP may result in a retest of 16 EGP or lower. Breakdown below 16 EGP could accelerate further losses.

🎯 Trading Strategy Considerations:

- Aggressive traders may enter near 17 EGP with a stop-loss below 16.5 EGP.

- Conservative traders may wait for a confirmed breakout above 18 EGP.

Conclusion:

EFIH stock is at a critical decision point between accumulation and further decline. If bullish momentum sustains, it may aim for 18.5 – 20.5 EGP, while a rejection at resistance could lead to lower support retests. Volume, liquidity, and price action will be key to confirming the next move.

Key Financials

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total Revenues | 2,059.5 M | 2,320.9 M | 2,601.5 M | 2,644.0 M | 2,852.4 M | 3,117.4 M | 3,470.9 M | 3,898.6 M | 4,279.9 M | 4,446.5 M | 4,577.1 M | 5,209.5 M | 5,209.5 M |

| YoY Growth % | 42.48% | 41.86% | 51.66% | 34.67% | 38.50% | 34.32% | 33.42% | 47.45% | 50.04% | 42.63% | 31.87% | 33.62% | 33.62% |

| Gross Profit | 979.1 M | 1,167.4 M | 1,380.6 M | 1,354.8 M | 1,464.6 M | 1,598.6 M | 1,758.3 M | 2,083.9 M | 2,353.1 M | 2,333.4 M | 2,421.3 M | 2,766.2 M | 2,766.2 M |

| Gross Profit Margin | 47.54% | 50.30% | 53.07% | 51.24% | 51.35% | 51.28% | 50.66% | 53.45% | 54.98% | 52.48% | 52.90% | 53.10% | 53.10% |

| EBITDA | 748.8 M | 903.3 M | 1,013.5 M | 927.1 M | 1,039.2 M | 1,159.8 M | 1,390.4 M | 1,342.1 M | 1,548.3 M | 1,480.7 M | 1,595.0 M | 2,028.5 M | 2,028.5 M |

| EBITDA Margin | 36.36% | 38.92% | 38.96% | 35.07% | 36.43% | 37.21% | 40.06% | 34.43% | 36.18% | 33.30% | 34.85% | 38.94% | 38.94% |

| Net Income | 577.6 M | 720.6 M | 821.8 M | 803.9 M | 885.5 M | 1,042.6 M | 1,268.8 M | 1,257.7 M | 1,438.3 M | 1,302.0 M | 1,503.9 M | 1,776.0 M | 1,776.0 M |

| Net Income Margin | 28.05% | 31.05% | 31.59% | 30.41% | 31.05% | 33.44% | 36.56% | 32.26% | 33.61% | 29.28% | 32.86% | 34.09% | 34.09% |

| Diluted EPS | 0.23 | 0.29 | 0.33 | 0.32 | 0.36 | 0.43 | 0.53 | 0.49 | 0.53 | 0.60 | 0.56 | 0.71 | 0.71 |

| YoY Growth % | 58.66% | 81.98% | 122.41% | 34.39% | 59.14% | 44.98% | 58.39% | 52.70% | 44.98% | 40.98% | 6.23% | 44.61% | 44.61% |

| Price / Earnings – P/E | 59.3 x | 43.7 x | 39.3 x | 45.3 x | 38.8 x | 33.0 x | 27.0 x | 35.2 x | 38.3 x | 37.5 x | 36.6 x | 23.5 x | 24.1 x |

Capital Structure

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Market Capitalization | 30,204.4 M | 29,600.7 M | 30,116.8 M | 33,587.6 M | 32,700.4 M | 32,376.9 M | 32,739.9 M | 39,634.7 M | 46,476.3 M | 51,660.8 M | 46,995.7 M | 38,240.0 M | 39,182.2 M |

| Cash & Equivalents | 2,974.0 M | 2,904.9 M | 2,785.9 M | 3,234.4 M | 3,339.4 M | 2,955.3 M | 3,131.6 M | 2,707.1 M | 2,651.5 M | 2,184.9 M | 2,761.4 M | 2,285.3 M | 2,285.3 M |

| Total Debt | 189.1 M | 159.8 M | 110.8 M | 167.2 M | 101.4 M | 119.2 M | 105.8 M | 268.0 M | 316.8 M | 562.9 M | 153.8 M | 141.5 M | 141.5 M |

| Preferred Equity | – | – | – | – | – | – | – | – | – | – | – | – | – |

| Minority Interest | 48.9 M | 57.9 M | 60.0 M | 56.8 M | 58.2 M | 61.9 M | 66.4 M | 117.8 M | 119.5 M | 126.9 M | 129.6 M | 149.0 M | 149.0 M |

| Enterprise Value – EV | 27,605.5 M | 26,913.5 M | 27,501.7 M | 30,577.3 M | 29,520.6 M | 29,602.7 M | 29,780.5 M | 37,313.4 M | 44,261.1 M | 50,165.7 M | 44,517.6 M | 36,245.2 M | 37,187.4 M |

Cash Flow Analysis

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash from Operations | 401.4 M | 369.5 M | 403.5 M | 779.0 M | 864.5 M | 743.6 M | 821.2 M | 867.9 M | 379.6 M | 524.4 M | 1,290.0 M | 1,060.6 M | 1,060.6 M |

| YoY Growth % | (18.82)% | (41.57)% | (27.82)% | 142.47% | 115.36% | 101.26% | 103.49% | 11.41% | (56.09)% | (29.48)% | 57.10% | 22.21% | 22.21% |

| Capital Expenditure | (251.5) M | (123.2) M | (122.6) M | (104.3) M | (110.7) M | (123.4) M | (106.5) M | (455.9) M | (167.9) M | (306.0) M | (538.4) M | (304.1) M | (304.1) M |

| YoY Growth % | 359.27% | (31.76)% | (46.88)% | (57.87)% | (55.98)% | 0.18% | (13.14)% | 337.03% | 51.64% | 148.01% | 405.69% | (33.29)% | (33.29)% |

Fiscal Quarters

| Fiscal Quarter | Period Ending | Report Date | Restatement Type |

|---|---|---|---|

| 4Q FY2018 | Dec-31-2018 | Dec-31-2018 | Original |

| 4Q FY2019 | Dec-31-2019 | Dec-31-2019 | Original |

| 4Q FY2020 | Dec-31-2020 | Oct-06-2021 | Reclassified |

| 1Q FY2021 | Mar-31-2021 | Jul-06-2021 | Restated |

| 2Q FY2021 | Jun-30-2021 | Oct-06-2021 | Restated |

| 3Q FY2021 | Sep-30-2021 | Nov-11-2021 | Restated |

| 4Q FY2021 | Dec-31-2021 | Mar-08-2022 | Reclassified |

| 1Q FY2022 | Mar-31-2022 | May-21-2022 | Restated |

| 2Q FY2022 | Jun-30-2022 | Aug-21-2022 | Restated |

| 3Q FY2022 | Sep-30-2022 | Nov-21-2022 | Reclassified |

| 4Q FY2022 | Dec-31-2022 | Feb-21-2023 | No Change from Original |

| 1Q FY2023 | Mar-31-2023 | Jun-01-2023 | Restated |

| 2Q FY2023 | Jun-30-2023 | Sep-01-2023 | Restated |

| 3Q FY2023 | Sep-30-2023 | Dec-01-2023 | Restated |

| 4Q FY2023 | Dec-31-2023 | Mar-01-2024 | Reclassified |

| 1Q FY2024 | Mar-31-2024 | May-26-2024 | Restated |

| 2Q FY2024 | Jun-30-2024 | Aug-26-2024 | Restated |

| 3Q FY2024 | Sep-30-2024 | Nov-26-2024 | Original |

| 4Q FY2024 | Dec-31-2024 | Feb-26-2025 | Original |

| Current/LTM | Apr-01-2025 | Apr-01-2025 | Current/LTM |

Sales & Valuation Metrics

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EV / Sales (LTM) | 13.4 x | 11.6 x | 10.6 x | 11.6 x | 10.3 x | 9.5 x | 8.6 x | 9.6 x | 10.3 x | 11.3 x | 9.7 x | 7.0 x | 7.1 x |

| EV / Sales (NTM) | 9.1 x | 8.0 x | 7.4 x | 9.4 x | 7.6 x | 7.2 x | 6.7 x | 7.6 x | 8.5 x | – | 6.9 x | 5.5 x | – |

| Price / Sales (LTM) | 14.7 x | 12.8 x | 11.6 x | 12.7 x | 11.5 x | 10.4 x | 9.4 x | 10.2 x | 10.9 x | 11.6 x | 10.3 x | 7.3 x | 7.5 x |

| Price / Sales (NTM) | 10.0 x | 8.8 x | 8.1 x | 10.4 x | 8.4 x | 7.8 x | 7.4 x | 8.1 x | 8.9 x | – | 7.3 x | 5.8 x | – |

Returns

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return on Assets | – | 13.96% | 15.42% | 9.83% | 10.49% | 11.82% | 13.48% | 11.30% | 12.30% | 11.28% | 11.56% | 13.81% | 13.81% |

| Return on Equity | 22.37% | 26.58% | 29.07% | 18.89% | 21.80% | 23.45% | 27.17% | 24.77% | 29.04% | 24.14% | 26.12% | 29.48% | 29.48% |

| Return on Total Capital | 16.16% | 18.50% | 19.95% | 12.06% | 14.14% | 14.58% | 16.84% | 14.38% | 16.95% | 14.16% | 14.81% | 17.95% | 17.95% |

| Return on Common Equity | 19.05% | 23.41% | 25.92% | 16.88% | 20.05% | 21.55% | 25.38% | 22.06% | 24.26% | 19.81% | 21.96% | 26.37% | 26.37% |

Margins

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EBITDA Margin | 36.36% | 38.92% | 38.96% | 35.07% | 36.43% | 37.21% | 40.06% | 34.43% | 36.18% | 33.30% | 34.85% | 38.94% | 38.94% |

| EBITA Margin | 34.27% | 36.95% | 37.09% | 33.01% | 34.32% | 35.19% | 37.99% | 32.48% | 34.34% | 31.42% | 32.99% | 37.23% | 37.23% |

| EBIT Margin | 34.07% | 36.72% | 36.81% | 32.66% | 33.79% | 34.53% | 37.35% | 31.47% | 33.06% | 29.71% | 31.13% | 35.40% | 35.40% |

| Gross Profit Margin | 47.54% | 50.30% | 53.07% | 51.24% | 51.35% | 51.28% | 50.66% | 53.45% | 54.98% | 52.48% | 52.90% | 53.10% | 53.10% |

| SG&A Margin | 13.00% | 13.26% | 12.53% | 12.30% | 11.65% | 10.45% | 10.41% | 10.13% | 11.05% | 11.54% | 12.34% | 10.45% | 10.45% |

| Net Income Margin | 28.05% | 31.05% | 31.59% | 30.41% | 31.05% | 33.44% | 36.56% | 32.26% | 33.61% | 29.28% | 32.86% | 34.09% | 34.09% |

| Net Avail. For Common Margin | 23.27% | 27.14% | 28.11% | 26.99% | 28.54% | 30.52% | 33.93% | 28.46% | 27.87% | 24.04% | 27.77% | 30.80% | 30.80% |

| Normalized Net Income Margin | 26.17% | 28.71% | 29.80% | 28.20% | 28.30% | 30.06% | 32.07% | 29.39% | 29.88% | 26.56% | 28.80% | 29.09% | 29.09% |

Asset Turnovers

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Receivables Turnover (Avg) | – | 2.2 x | 2.2 x | 1.9 x | 2.1 x | 2.1 x | 2.1 x | 2.2 x | 2.4 x | 2.2 x | 2.2 x | 2.3 x | 2.3 x |

| Fixed Assets Turnover (Avg) | – | 4.8 x | 5.1 x | 5.1 x | 5.6 x | 6.0 x | 6.4 x | 5.0 x | 7.4 x | 6.6 x | 5.8 x | 4.7 x | 4.7 x |

| Inventory Turnover (Avg) | – | 12.4 x | 13.5 x | 20.5 x | 21.2 x | 16.4 x | 18.4 x | 17.4 x | 13.8 x | 11.4 x | 9.8 x | 13.0 x | 13.0 x |

| Asset Turnover | – | 0.6 x | 0.7 x | 0.5 x | 0.5 x | 0.5 x | 0.6 x | 0.6 x | 0.6 x | 0.6 x | 0.6 x | 0.6 x | 0.6 x |

| Days Outstanding Inventory (Avg) | – | 29.5 | 27.0 | 17.8 | 17.2 | 22.2 | 19.8 | 21.0 | 26.5 | 32.2 | 37.3 | 28.2 | 28.2 |

Short-term Liquidity

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Current Ratio | 3.6 x | 4.9 x | 5.0 x | 4.8 x | 3.4 x | 5.2 x | 4.7 x | 3.7 x | 2.9 x | 3.2 x | 3.6 x | 3.7 x | 3.7 x |

| Quick Ratio | 3.4 x | 4.6 x | 4.6 x | 4.7 x | 3.2 x | 4.8 x | 4.3 x | 3.3 x | 2.4 x | 2.6 x | 3.1 x | 3.2 x | 3.2 x |

| Days Sales Outstanding (Avg) | – | 168.4 | 164.2 | 195.9 | 176.3 | 177.6 | 178.0 | 167.9 | 153.6 | 163.5 | 163.9 | 162.2 | 162.2 |

| Days Payable Outstanding (Avg) | – | 72.9 | 66.0 | 78.5 | 75.9 | 72.0 | 70.1 | 80.1 | 73.0 | 86.9 | 88.5 | 72.0 | 72.0 |

| Cash Conversion Cycle (Avg Days) | – | 125.0 | 125.2 | 135.2 | 117.7 | 127.7 | 127.8 | 108.8 | 107.1 | 108.8 | 112.6 | 118.4 | 118.4 |

| Operating Cash Flow to Current Liabilities | 0.3% | 0.4% | 0.4% | 0.8% | 0.6% | 0.8% | 0.7% | 0.6% | 0.2% | 0.3% | 0.8% | 0.7% | 0.7% |

Return on Invested Capital (ROIC)

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Operating Profit After Tax (NOPAT) | 417.3 M | 499.7 M | 529.4 M | 468.6 M | 548.3 M | 613.1 M | 776.3 M | 644.0 M | 795.5 M | 717.7 M | 797.5 M | 1,159.5 M | 1,159.5 M |

| Invested Capital, Average | 4,109.2 M | 4,195.9 M | 4,377.8 M | 4,614.0 M | 4,625.2 M | 4,677.5 M | 5,046.9 M | 5,529.6 M | 5,923.1 M | 6,368.5 M | 6,799.0 M | 6,908.7 M | 6,978.2 M |

| Return on Invested Capital (ROIC) | 10.15% | 11.91% | 12.09% | 10.16% | 11.85% | 13.11% | 15.38% | 11.65% | 13.43% | 11.27% | 11.73% | 16.78% | 16.62% |

Debt Analysis

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total Debt / Equity | 4.9% | 3.8% | 2.6% | 3.6% | 2.3% | 2.5% | 2.1% | 4.8% | 5.6% | 9.1% | 2.3% | 2.1% | 2.1% |

| Total Debt / Capital | 4.7% | 3.7% | 2.5% | 3.5% | 2.3% | 2.4% | 2.0% | 4.6% | 5.3% | 8.3% | 2.2% | 2.0% | 2.0% |

| Long-Term Debt / Equity | 0.8% | 0.6% | 0.6% | 1.3% | 1.1% | 1.2% | 1.1% | 1.9% | 1.7% | 1.3% | 1.0% | 0.9% | 0.9% |

| Long-Term Debt / Capital | 0.8% | 0.6% | 0.5% | 1.2% | 1.1% | 1.2% | 1.1% | 1.8% | 1.6% | 1.2% | 1.0% | 0.9% | 0.9% |

| Total Liabilities / Total Assets | 27.7% | 21.7% | 20.8% | 22.0% | 29.0% | 21.2% | 22.7% | 26.7% | 31.4% | 27.7% | 24.4% | 24.5% | 24.5% |

| EBIT / Interest Expense | 49.9 x | 53.7 x | 60.6 x | 55.4 x | 53.4 x | 57.1 x | 63.2 x | 46.0 x | 37.7 x | 21.3 x | 15.8 x | 21.1 x | 21.1 x |

| EBITDA / Interest Expense | 55.5 x | 59.0 x | 66.3 x | 61.7 x | 59.5 x | 63.3 x | 69.5 x | 51.9 x | 42.4 x | 24.7 x | 18.3 x | 23.8 x | 23.8 x |

| (EBITDA – Capex) / Interest Expense | 37.6 x | 51.2 x | 58.5 x | 55.0 x | 53.3 x | 56.8 x | 64.3 x | 34.8 x | 37.9 x | 19.8 x | 12.3 x | 20.4 x | 20.4 x |

| Total Debt / (EBITDA – Capex) | 0.4 x | 0.2 x | 0.1 x | 0.2 x | 0.1 x | 0.1 x | 0.1 x | 0.2 x | 0.2 x | 0.4 x | 0.1 x | 0.1 x | 0.1 x |

| Net Debt / (EBITDA – Capex) | – | – | – | – | – | – | – | – | – | – | – | – | – |

Bankruptcy Risk

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Altman Z-Score | 13.99 | 17.67 | 17.60 | 15.52 | 12.19 | 16.73 | 15.45 | 11.68 | 9.79 | 11.16 | 13.67 | 14.49 | 14.49 |

Assets

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total Cash And Short Term Investments | 2,974.0 M | 2,904.9 M | 2,785.9 M | 3,234.4 M | 3,339.4 M | 2,955.3 M | 3,131.6 M | 2,707.1 M | 2,651.5 M | 2,184.9 M | 2,761.4 M | 2,285.3 M | 2,285.3 M |

| Cash And Equivalents | 1,752.8 M | 795.6 M | 653.8 M | 877.8 M | 812.6 M | 1,485.0 M | 1,819.9 M | 1,505.2 M | 1,570.4 M | 1,583.8 M | 1,754.3 M | 1,205.8 M | 1,205.8 M |

| Short Term Investments | 1,221.2 M | 2,109.3 M | 2,132.1 M | 2,356.6 M | 2,526.9 M | 1,470.3 M | 1,311.7 M | 737.9 M | 511.6 M | – | – | – | – |

| Trading Asset Securities | – | – | – | – | – | – | – | 464.0 M | 569.5 M | 601.0 M | 1,007.1 M | 1,079.5 M | 1,079.5 M |

| Total Receivables | 1,348.8 M | 1,368.3 M | 1,473.2 M | 1,663.1 M | 1,414.8 M | 1,681.4 M | 1,922.2 M | 1,928.7 M | 2,180.7 M | 2,531.9 M | 2,178.3 M | 2,791.7 M | 2,791.7 M |

| Accounts Receivable | 1,343.8 M | 1,358.8 M | 1,464.2 M | 1,663.1 M | 1,411.9 M | 1,674.8 M | 1,921.7 M | 1,922.9 M | 2,180.7 M | 2,298.4 M | 2,178.0 M | 2,695.3 M | 2,695.3 M |

| Other Receivables | 5.0 M | 9.5 M | 9.0 M | – | 2.7 M | 5.9 M | – | 5.4 M | – | 233.5 M | – | – | – |

| Inventory | 58.1 M | 76.5 M | 65.0 M | 70.7 M | 73.0 M | 108.2 M | 121.1 M | 137.7 M | 206.0 M | 263.2 M | 317.9 M | 238.6 M | 238.6 M |

| Restricted Cash | – | – | – | – | – | – | – | – | – | – | – | – | – |

| Prepaid Expenses | 67.3 M | 77.4 M | 72.6 M | – | 93.7 M | 91.7 M | 87.5 M | 71.0 M | 77.8 M | 104.6 M | 141.0 M | 153.0 M | 153.0 M |

| Other Current Assets | 148.8 M | 129.9 M | 178.7 M | 8.6 M | 249.6 M | 246.2 M | 286.6 M | 278.7 M | 740.5 M | 708.4 M | 426.8 M | 266.9 M | 266.9 M |

| Total Current Assets | 4,597.0 M | 4,557.1 M | 4,575.5 M | 4,976.8 M | 5,170.5 M | 5,082.8 M | 5,549.0 M | 5,123.3 M | 5,856.4 M | 5,793.0 M | 5,825.4 M | 5,735.5 M | 5,735.5 M |

| Net Property Plant And Equipment | 494.0 M | 482.9 M | 513.6 M | 522.9 M | 522.2 M | 561.7 M | 565.5 M | 1,031.2 M | 636.5 M | 777.0 M | 1,009.9 M | 1,170.4 M | 1,170.4 M |

| Gross Property Plant And Equipment | 885.0 M | 886.8 M | 931.2 M | 1,003.7 M | 973.5 M | 1,028.4 M | 1,054.9 M | 1,598.4 M | 1,165.3 M | 1,326.3 M | 1,583.1 M | 1,876.6 M | 1,876.6 M |

| Accumulated Depreciation | (391.0) M | (403.8) M | (417.6) M | (480.8) M | (451.3) M | (466.7) M | (489.4) M | (567.2) M | (528.8) M | (549.3) M | (573.2) M | (706.2) M | (706.2) M |

| Long-term Investments | 215.8 M | 229.5 M | 294.3 M | 294.7 M | 302.5 M | 306.1 M | 326.7 M | 1,291.1 M | 1,520.1 M | 1,777.8 M | 1,795.4 M | 1,936.4 M | 1,936.4 M |

| Goodwill | – | – | – | – | – | – | – | – | – | – | – | – | – |

| Other Intangibles | 19.9 M | 42.3 M | 51.0 M | 76.3 M | 75.3 M | 71.7 M | 94.1 M | 188.3 M | 243.3 M | 218.9 M | 206.4 M | 212.9 M | 212.9 M |

| Loans Receivable Long-Term | – | – | – | – | 17.9 M | 6.4 M | 3.1 M | – | – | – | – | – | – |

| Deferred Tax Assets Long-Term | 25.9 M | – | 11.3 M | 4.4 M | 11.4 M | – | 3.5 M | – | – | – | – | – | – |

| Deferred Charges Long-Term | 6.2 M | 5.5 M | 4.8 M | 4.1 M | 3.4 M | 2.7 M | 2.1 M | 1.3 M | 0.6 M | 0.2 M | 2.4 M | 2.8 M | 2.8 M |

| Other Long-Term Assets | – | – | – | 55.6 M | – | – | – | – | – | – | – | – | – |

| Total Assets | 5,358.8 M | 5,317.2 M | 5,450.6 M | 5,934.8 M | 6,124.6 M | 6,070.3 M | 6,574.5 M | 7,635.0 M | 8,256.8 M | 8,566.8 M | 8,839.6 M | 9,058.0 M | 9,058.0 M |

Liabilities

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Accounts Payable | 203.4 M | 236.4 M | 244.0 M | 369.5 M | 379.6 M | 375.7 M | 435.0 M | 456.2 M | 442.1 M | 701.3 M | 703.3 M | 544.3 M | 544.3 M |

| Accrued Expenses | 99.0 M | 88.6 M | 94.3 M | 122.8 M | 111.0 M | 104.6 M | 136.3 M | 219.4 M | 204.5 M | 163.9 M | 179.3 M | 204.6 M | 204.6 M |

| Current Portion of Long-Term Debt | – | – | – | – | – | – | – | – | – | – | – | – | – |

| Current Portion of Leases | 32.7 M | 28.9 M | 24.6 M | 32.1 M | 31.9 M | 38.4 M | 29.6 M | 56.3 M | 55.6 M | 62.0 M | 63.7 M | 56.7 M | 56.7 M |

| Current Income Taxes Payable | 254.4 M | 163.7 M | 229.7 M | 221.2 M | 312.6 M | 179.5 M | 329.5 M | 343.0 M | 522.5 M | 279.3 M | 460.2 M | 490.8 M | 490.8 M |

| Unearned Revenue Current, Total | 63.3 M | 82.8 M | 63.1 M | 42.5 M | 80.0 M | 87.6 M | 65.0 M | 50.0 M | 482.6 M | 87.5 M | 72.1 M | 73.6 M | 73.6 M |

| Other Current Liabilities | 482.8 M | 221.3 M | 202.8 M | 174.0 M | 566.7 M | 165.5 M | 163.9 M | 165.2 M | 164.4 M | 95.8 M | 114.4 M | 172.6 M | 172.6 M |

| Total Current Liabilities | 1,259.5 M | 925.8 M | 921.0 M | 1,037.4 M | 1,503.1 M | 972.7 M | 1,180.5 M | 1,394.8 M | 2,035.9 M | 1,809.8 M | 1,616.2 M | 1,564.1 M | 1,564.1 M |

| Long-Term Debt | – | – | – | 31.9 M | 24.4 M | 20.7 M | 16.9 M | 13.0 M | 8.8 M | 4.5 M | 0.1 M | – | – |

| Long-Term Leases | 32.5 M | 26.9 M | 23.8 M | 27.8 M | 23.8 M | 38.8 M | 38.0 M | 94.0 M | 88.4 M | 76.4 M | 66.8 M | 63.2 M | 63.2 M |

| Unearned Revenue Non Current | – | – | – | – | – | – | – | – | – | – | – | – | – |

| Deferred Tax Liability Non Current | – | 1.3 M | – | – | – | 12.9 M | – | 220.7 M | 223.3 M | 257.8 M | 241.2 M | 267.0 M | 267.0 M |

| Other Non Current Liabilities | – | – | – | – | – | – | – | – | – | – | – | – | – |

| Total Liabilities | 1,481.8 M | 1,151.3 M | 1,131.4 M | 1,304.0 M | 1,773.8 M | 1,286.7 M | 1,489.2 M | 2,035.0 M | 2,595.5 M | 2,370.9 M | 2,154.1 M | 2,221.3 M | 2,221.3 M |

Equity

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Equity | 3,828.0 M | 4,108.0 M | 4,259.1 M | 4,574.0 M | 4,292.6 M | 4,721.6 M | 5,018.9 M | 5,482.3 M | 5,541.8 M | 6,069.0 M | 6,556.0 M | 6,687.7 M | 6,687.7 M |

| Common Stock | 924.4 M | 924.4 M | 924.4 M | 924.4 M | 924.4 M | 924.4 M | 924.4 M | 924.4 M | 924.4 M | 924.4 M | 1,155.6 M | 1,155.6 M | 1,155.6 M |

| Additional Paid In Capital | 1,956.5 M | 1,956.5 M | 1,956.5 M | 1,956.5 M | 1,956.5 M | 1,956.5 M | 1,956.5 M | 1,956.5 M | 1,956.5 M | 1,956.5 M | 1,956.5 M | 1,956.5 M | 1,956.5 M |

| Retained Earnings | 865.7 M | 1,145.1 M | 1,240.4 M | 1,364.2 M | 1,147.2 M | 1,583.6 M | 1,868.0 M | 1,607.6 M | 1,472.7 M | 1,821.8 M | 2,300.9 M | 2,118.7 M | 2,118.7 M |

| Treasury Stock | – | – | (1.3) M | (5.0) M | (5.0) M | (14.4) M | (9.5) M | (196.5) M | (194.5) M | – | – | – | – |

| Comprehensive Income and Other | 81.4 M | 82.0 M | 139.1 M | 333.9 M | 269.6 M | 271.5 M | 279.4 M | 1,190.3 M | 1,382.7 M | 1,135.2 M | 1,143.0 M | 1,457.0 M | 1,457.0 M |

| Total Equity | 3,876.9 M | 4,165.9 M | 4,319.2 M | 4,630.8 M | 4,350.9 M | 4,783.5 M | 5,085.3 M | 5,600.1 M | 5,661.3 M | 6,195.9 M | 6,685.5 M | 6,836.7 M | 6,836.7 M |

| Total Liabilities And Equity | 5,358.8 M | 5,317.2 M | 5,450.6 M | 5,934.8 M | 6,124.6 M | 6,070.3 M | 6,574.5 M | 7,635.0 M | 8,256.8 M | 8,566.8 M | 8,839.6 M | 9,058.0 M | 9,058.0 M |

Supplemental Items

| Metric | 4Q FY2018 | 4Q FY2019 | 4Q FY2020 | 1Q FY2021 | 2Q FY2021 | 3Q FY2021 | 4Q FY2021 | 1Q FY2022 | 2Q FY2022 | 3Q FY2022 | 4Q FY2022 | 1Q FY2023 | 2Q FY2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ECS Total Shares Outstanding on Filing Date | 2,311.1 M | 2,311.1 M | 2,311.0 M | 2,310.7 M | 2,310.7 M | 2,310.0 M | 2,309.5 M | 2,297.9 M | 2,298.1 M | 344.1 M | 4,205.5 M | 2,238.7 M | 2,238.7 M |

| ECS Total Common Shares Outstanding | 2,311.1 M | 2,311.1 M | 2,311.0 M | 2,310.7 M | 2,310.7 M | 2,310.0 M | 2,309.5 M | 2,297.9 M | 2,298.1 M | 344.1 M | 4,205.5 M | 2,238.7 M | 2,238.7 M |

| Book Value / Share | 1.66 | 1.78 | 1.84 | 1.98 | 1.86 | 2.04 | 2.17 | 2.39 | 2.41 | 2.67 | 1.56 | 2.99 | 2.99 |

| Tangible Book Value | 3,808.1 M | 4,065.7 M | 4,208.1 M | 4,497.7 M | 4,217.4 M | 4,649.9 M | 4,924.8 M | 5,294.0 M | 5,298.6 M | 5,850.1 M | 6,349.6 M | 6,474.8 M | 6,474.8 M |

| Tangible Book Value Per Share | 1.65 | 1.76 | 1.82 | 1.95 | 1.83 | 2.01 | 2.13 | 2.30 | 2.31 | 2.57 | 1.51 | 2.89 | 2.89 |

| Total Debt | 189.1 M | 159.8 M | 110.8 M | 167.2 M | 101.4 M | 119.2 M | 105.8 M | 268.0 M | 316.8 M | 562.9 M | 153.8 M | 141.5 M | 141.5 M |

| Net Debt | (2,784.9) M | (2,745.1) M | (2,675.1) M | (3,067.2) M | (3,238.0) M | (2,836.1) M | (3,025.8) M | (2,439.1) M | (2,334.6) M | (1,622.0) M | (2,607.6) M | (2,143.8) M | (2,143.8) M |

| Equity Method Investments | 78.5 M | 89.3 M | 96.3 M | 96.7 M | 104.5 M | 108.2 M | 128.7 M | 216.7 M | 178.6 M | 471.5 M | 473.9 M | 574.9 M | 574.9 M |

Sources

- Bloomberg Terminal

- Reuters

- Investopedia

- Mckvay

- MarketWatch

- Trading Economics

- Acuity Knowledge Partners

- Koyfin

- Cboe Global Markets

- TradingView

- Central Bank Website

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions