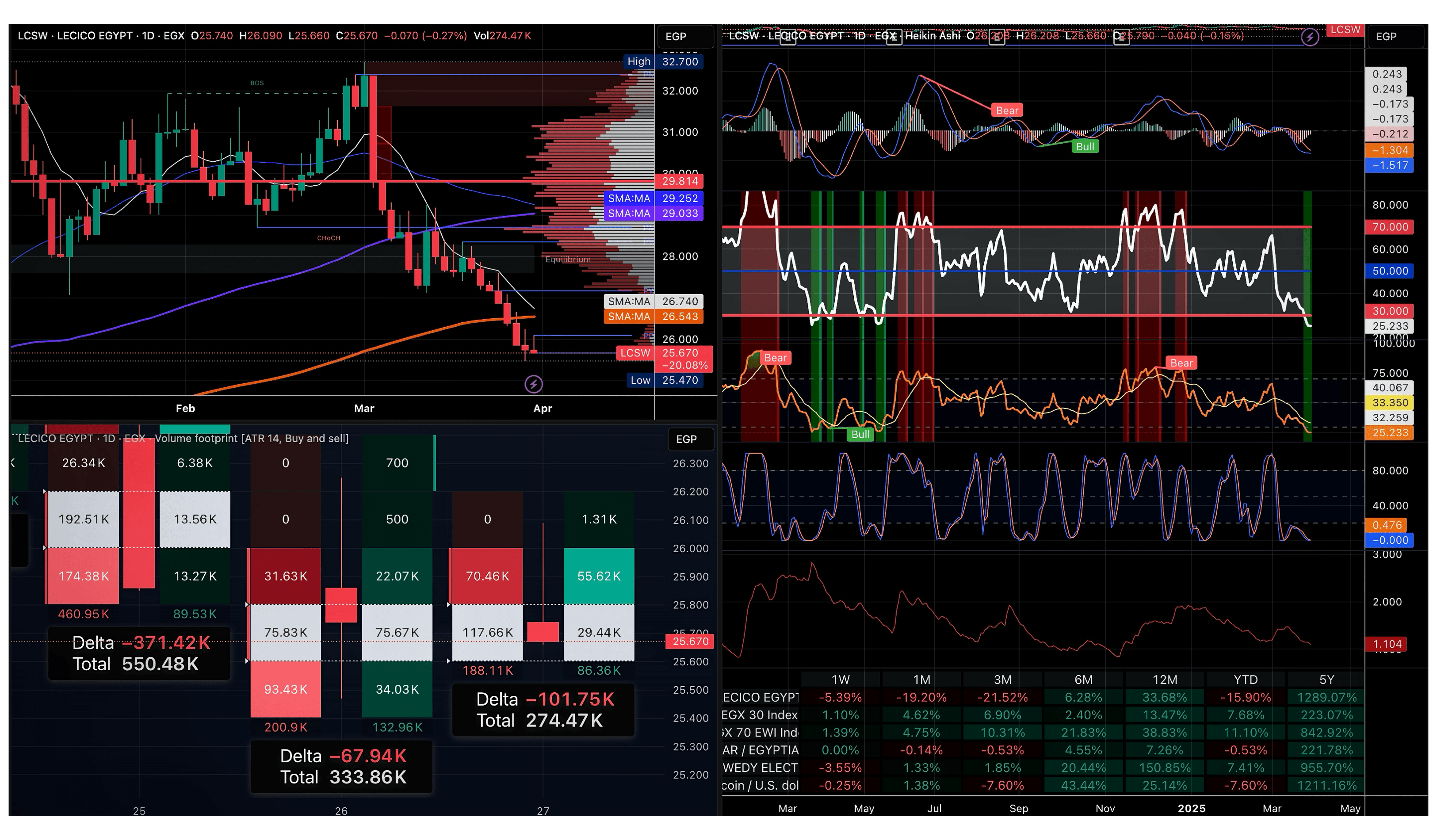

Price Action & Trend Analysis

Stock: LECICO EGYPT (LCSW)

- Timeframe: Daily (1D)

- Current Price: 25.670

- Change: -0.27% (-0.070)

- High of the Day: 26.090

- Low of the Day: 25.470

Trend Overview:

The stock has been in a downtrend since early March, with a significant decline from a high near 32.700.

Key Moving Averages:

- 50-day SMA: ~26.740

- 100-day SMA: ~26.543

- 200-day SMA: ~29.252 & 29.033 (Resistance Levels)

Price is trading below key moving averages, indicating strong bearish momentum.

Volume & Order Flow Analysis

- Volume: 274.47K (Moderate Trading Activity)

- Volume Footprint: Selling pressure is significantly higher than buying, as shown by the red-dominant volume bars.

- Large sell deltas:

- March 26: -371.42K

- March 27: -101.75K

- Limited buy orders: Visible at lower price levels, confirming weak demand.

Technical Indicators

A. Momentum & Strength Indicators

- MACD (Moving Average Convergence Divergence): The MACD line is below the signal line, indicating a bearish trend continuation.

- Relative Strength Index (RSI): RSI currently around 25.233 (Oversold Zone). A bounce may occur, but confirmation is needed.

B. Market Sentiment Indicators

- Bearish/Bullish Cycles: The “Bear” labels indicate strong selling momentum, and multiple red-highlighted areas signal periods of bearish activity.

- Stochastic Oscillator: Stochastic is in the oversold region, meaning a potential short-term rebound could happen. Needs confirmation before entering long positions.

Support & Resistance Levels

- Resistance Levels:

- Short-term: 26.740 (50-SMA), 26.543 (100-SMA)

- Medium-term: 29.252, 29.033 (200-SMA)

- Major Resistance: 32.700 (Last Significant High)

- Support Levels:

- Immediate: 25.470 (Today’s Low)

- Key Support: 25.000 (Psychological Support)

Market Comparison & Performance Metrics

- LCSW Performance Against Major Indices:

- 1W: -5.39%

- 1M: -19.20%

- 3M: -21.52%

- YTD: -15.90%

- 5Y: +1289.07% (Long-term Bullish)

- Comparison with EGX 30 Index:

- EGX 30 (1W): -1.39%

- EGX 30 (1M): +2.40%

LCSW is underperforming compared to EGX 30, showing weak relative strength.

Conclusion & Trading Outlook

Bearish Case (More Likely)

- The price is in a clear downtrend, trading below key moving averages.

- Strong selling pressure dominates the order flow.

- MACD and RSI confirm the bearish momentum.

- Potential Next Targets:

- Immediate support at 25.000

- If broken, a further decline towards 24.500-24.000 is possible.

Bullish Case (Less Likely – Needs Confirmation)

- RSI and Stochastic Oscillator indicate oversold conditions, which may cause a short-term bounce.

- A rebound toward the 26.500-27.000 range is possible, but only if buying pressure increases.

Final Recommendation:

- Short-term traders: Wait for confirmation before entering long positions.

- Swing traders: Look for a breakdown below 25.000 to confirm further downside potential.

- Long-term investors: Monitor for signs of reversal before considering accumulation.

Confidence Level: 95%

| Fiscal Years | |||

| Fiscal Year | Period Ending | Report Date | Restatement Type |

|---|---|---|---|

| FY 2022 | Dec-31-2022 | Mar-01-2023 | Reclassified |

| FY 2023 | Dec-31-2023 | Mar-03-2024 | Reclassified |

| FY 2024 | Dec-31-2024 | Mar-02-2025 | Original |

| Current/LTM | Apr-01-2025 | Apr-01-2025 | Current/LTM |

| Key Financials | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Total Revenues | 3,273.8 M | 4,842.9 M | 6,644.7 M | 6,644.7 M |

| YoY Growth % | 23.90 % | 47.93 % | 37.20 % | 37.20 % |

| Gross Profit | 520.8 M | 1,488.9 M | 1,875.2 M | 1,875.2 M |

| Gross Profit Margin | 15.91 % | 30.74 % | 28.22 % | 28.22 % |

| EBITDA | 100.4 M | 1,032.6 M | 1,293.8 M | 1,293.8 M |

| EBITDA Margin | 3.07 % | 21.32 % | 19.47 % | 19.47 % |

| Net Income | (3.2) M | 446.3 M | 890.3 M | 890.3 M |

| Net Income Margin | (0.10) % | 9.22 % | 13.40 % | 13.40 % |

| Diluted EPS | (0.04) | 5.58 | 11.13 | 11.13 |

| YoY Growth % | – | – | 99.50 % | 99.50 % |

| Price / Earnings – P/E | – | 4.7 x | 2.9 x | 2.3 x |

| Capital Structure | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Market Capitalization | 555.2 M | 1,999.9 M | 2,589.6 M | 2,053.6 M |

| Cash & Equivalents | 498.0 M | 456.3 M | 352.2 M | 352.2 M |

| Total Debt | 1,680.5 M | 1,913.7 M | 1,617.5 M | 1,617.5 M |

| Preferred Equity | – | – | – | – |

| Minority Interest | 57.3 M | 76.3 M | 122.0 M | 122.0 M |

| Enterprise Value – EV | 1,753.9 M | 3,533.5 M | 3,976.9 M | 3,440.9 M |

| Cash Flow Analysis | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Cash from Operations | 169.0 M | 137.3 M | 537.1 M | 537.1 M |

| YoY Growth % | 256.08 % | (18.77) % | 291.31 % | 291.31 % |

| Capital Expenditure | (103.8) M | (264.4) M | (285.0) M | (285.0) M |

| YoY Growth % | 58.84 % | 154.80 % | 7.77 % | 7.77 % |

| Revenues | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Total Revenues | 3,273.8 M | 4,842.9 M | 6,644.7 M | 6,644.7 M |

| YoY Growth | 23.90 % | 47.93 % | 37.20 % | 37.20 % |

| Finance Division Revenues | – | – | – | – |

| Insurance Division Revenues | – | – | – | – |

| Other Revenues | – | – | – | – |

| Gross Profit | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Cost of Revenues | 2,752.9 M | 3,354.0 M | 4,769.5 M | 4,769.5 M |

| Gross Profit (Loss) | 520.8 M | 1,488.9 M | 1,875.2 M | 1,875.2 M |

| YoY Growth | 8.94 % | 185.86 % | 25.95 % | 25.95 % |

| Operating Income & Expenses | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Selling, General & Admin Expenses | 507.7 M | 520.0 M | 668.0 M | 668.0 M |

| R&D Expenses | – | – | – | – |

| Depreciation & Amortization | – | – | – | – |

| Other Operating Expenses | 10.5 M | 30.6 M | 56.3 M | 56.3 M |

| Operating Income | 2.7 M | 938.3 M | 1,150.9 M | 1,150.9 M |

| Net Interest Expense | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Interest Expense | (100.1) M | (248.8) M | (275.0) M | (275.0) M |

| Interest and Investment Income | 5.0 M | – | 6.9 M | 6.9 M |

| Earnings Before Taxes (EBT) | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Income (Loss) on Equity Affiliates | – | – | 1.0 M | 1.0 M |

| Other Non-Operating Income (Expenses) | (104.2) M | – | – | – |

| Assets | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Total Cash And Short Term Investments | 498.0 M | 456.3 M | 352.2 M | 352.2 M |

| Cash And Equivalents | 498.0 M | 456.3 M | 352.2 M | 352.2 M |

| Short Term Investments | – | – | – | – |

| Trading Asset Securities | – | – | – | – |

| Total Receivables | 832.6 M | 1,050.0 M | 1,285.5 M | 1,285.5 M |

| Accounts Receivable | 483.7 M | 758.8 M | 872.2 M | 872.2 M |

| Other Receivables | 135.7 M | 187.0 M | 265.3 M | 265.3 M |

| Inventory | 1,238.2 M | 1,597.0 M | 2,543.4 M | 2,543.4 M |

| Restricted Cash | – | – | – | – |

| Prepaid Expenses | 14.7 M | 17.4 M | 41.0 M | 41.0 M |

| Other Current Assets | 103.0 M | 112.4 M | 117.4 M | 117.4 M |

| Total Current Assets | 2,686.4 M | 3,233.0 M | 4,339.5 M | 4,339.5 M |

| Net Property Plant And Equipment | 1,997.6 M | 2,204.6 M | 3,378.2 M | 3,378.2 M |

| Gross Property Plant And Equipment | 3,782.2 M | 4,285.3 M | 6,004.8 M | 6,004.8 M |

| Accumulated Depreciation | (1,784.7) M | (2,080.7) M | (2,626.6) M | (2,626.6) M |

| Long-term Investments | 0.0 M | 0.0 M | 0.0 M | 0.0 M |

| Goodwill | – | – | – | – |

| Other Intangibles | 10.9 M | 17.4 M | 29.7 M | 29.7 M |

| Loans Receivable Long-Term | 0.5 M | 0.4 M | – | – |

| Deferred Tax Assets Long-Term | – | – | – | – |

| Deferred Charges Long-Term | – | – | – | – |

| Other Long-Term Assets | – | – | – | – |

| Total Assets | 4,695.5 M | 5,455.4 M | 7,747.4 M | 7,747.4 M |

| Liabilities | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Accounts Payable | 464.7 M | 428.6 M | 755.9 M | 755.9 M |

| Accrued Expenses | 262.2 M | 367.6 M | 437.1 M | 437.1 M |

| Current Portion of Long-Term Debt | 71.4 M | 100.0 M | 200.0 M | 200.0 M |

| Current Portion of Leases | 16.4 M | 23.8 M | 35.4 M | 35.4 M |

| Current Income Taxes Payable | 41.4 M | 151.6 M | 280.3 M | 280.3 M |

| Unearned Revenue Current, Total | – | – | – | – |

| Other Current Liabilities | 213.8 M | 205.5 M | 270.0 M | 270.0 M |

| Total Current Liabilities | 2,317.2 M | 2,664.6 M | 2,897.2 M | 2,897.2 M |

| Long-Term Debt | 273.9 M | 317.4 M | 355.9 M | 355.9 M |

| Long-Term Leases | 71.5 M | 85.0 M | 107.7 M | 107.7 M |

| Unearned Revenue Non Current | – | – | – | – |

| Deferred Tax Liability Non Current | 111.2 M | 312.1 M | 520.4 M | 520.4 M |

| Other Non Current Liabilities | 21.3 M | 3.1 M | 9.6 M | 9.6 M |

| Total Liabilities | 2,795.1 M | 3,382.3 M | 3,890.8 M | 3,890.8 M |

| Common Equity | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Common Equity | 1,843.1 M | 1,996.9 M | 3,734.6 M | 3,734.6 M |

| Common Stock | 400.0 M | 400.0 M | 400.0 M | 400.0 M |

| Additional Paid In Capital | 181.2 M | 181.2 M | 181.2 M | 181.2 M |

| Retained Earnings | (319.9) M | 126.4 M | 991.3 M | 991.3 M |

| Treasury Stock | – | (25.4) M | – | – |

| Comprehensive Income and Other | 1,581.8 M | 1,314.7 M | 2,162.1 M | 2,162.1 M |

| Total Equity | 1,900.4 M | 2,073.2 M | 3,856.6 M | 3,856.6 M |

| Total Liabilities And Equity | 4,695.5 M | 5,455.4 M | 7,747.4 M | 7,747.4 M |

| Supplemental Items | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| ECS Total Shares Outstanding on Filing Date | 80.0 M | 76.8 M | 80.0 M | 80.0 M |

| ECS Total Common Shares Outstanding | 80.0 M | 76.8 M | 80.0 M | 80.0 M |

| Book Value / Share | 23.04 | 26.00 | 46.68 | 46.68 |

| Tangible Book Value | 1,832.2 M | 1,979.5 M | 3,704.9 M | 3,704.9 M |

| Tangible Book Value Per Share | 22.90 | 25.77 | 46.31 | 46.31 |

| Total Debt | 1,680.5 M | 1,913.7 M | 1,617.5 M | 1,617.5 M |

| Net Debt | 1,182.5 M | 1,457.4 M | 1,265.3 M | 1,265.3 M |

| Equity Method Investments | 0.0 M | 0.0 M | 0.0 M | 0.0 M |

| Operating & Non-Operating Items | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Depreciation & Amortization, Total | 109.5 M | 115.4 M | 175.0 M | 175.0 M |

| Depreciation & Amortization | 109.5 M | 115.4 M | 175.0 M | 175.0 M |

| Amortization of Goodwill and Intangible Assets | – | – | – | – |

| Net Income | (3.2) M | 446.3 M | 890.3 M | 890.3 M |

| Cash from Operations – Net Income | (3.2) M | 446.3 M | 890.3 M | 890.3 M |

| Depreciation & Amortization, Total (repeated) | 109.5 M | 115.4 M | 175.0 M | 175.0 M |

| (Gain) Loss From Sale Of Asset | 27.1 M | (2.8) M | (0.0) M | (0.0) M |

| (Gain) Loss on Sale of Investments | 6.9 M | – | – | – |

| Amortization of Deferred Charges, Total | 1.2 M | 2.8 M | 4.1 M | 4.1 M |

| Asset Writedown & Restructuring Costs | – | – | – | – |

| Stock-Based Compensation | – | – | – | – |

| Other Operating Activities, Total | 248.7 M | 204.6 M | (214.8) M | (214.8) M |

| Change In Accounts Receivable | (286.9) M | (27.0) M | (268.5) M | (268.5) M |

| Change In Inventories | (297.8) M | (227.2) M | (1,025.0) M | (1,025.0) M |

| Change In Accounts Payable | 333.9 M | (440.8) M | 940.4 M | 940.4 M |

| Change in Unearned Revenues | – | – | – | – |

| Change In Income Taxes | – | – | – | – |

| Change in Other Net Operating Assets | 29.7 M | 65.9 M | 35.6 M | 35.6 M |

| Cash from Operations (final) | 169.0 M | 137.3 M | 537.1 M | 537.1 M |

| Cash from Investing | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Capital Expenditure | (103.8) M | (264.4) M | (285.0) M | (285.0) M |

| Sale of Property, Plant, and Equipment | 19.2 M | 3.6 M | 0.0 M | 0.0 M |

| Cash Acquisitions | – | – | – | – |

| Divestitures | – | – | – | – |

| Investment in Mkt and Equity Securities, Total | – | – | – | – |

| Net (Increase) Decrease in Loans Orig / Sold | – | – | – | – |

| Other Investing Activities, Total | – | – | – | – |

| Cash from Investing (net) | (87.1) M | (264.8) M | (291.1) M | (291.1) M |

| Cash from Financing | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Total Debt Issued | 423.3 M | 218.9 M | 752.8 M | 752.8 M |

| Short Term Debt Issued, Total | 423.3 M | 140.2 M | – | – |

| Long-Term Debt Issued, Total | – | 78.6 M | 752.8 M | 752.8 M |

| Total Debt Repaid | (33.4) M | (107.6) M | (1,102.7) M | (1,102.7) M |

| Short Term Debt Repaid, Total | – | – | (469.0) M | (469.0) M |

| Long-Term Debt Repaid, Total | (33.4) M | (107.6) M | (633.7) M | (633.7) M |

| Issuance of Common Stock | – | – | – | – |

| Repurchase of Common Stock | – | (25.4) M | – | – |

| Common & Preferred Stock Dividends Paid | (46.8) M | – | – | – |

| Common Dividends Paid | (46.8) M | – | – | – |

| Preferred Dividends Paid | – | – | – | – |

| Special Dividends Paid | – | – | – | – |

| Other Financing Activities | (89.2) M | 30.0 M | – | – |

| Cash from Financing (net) | 254.0 M | 115.9 M | (350.0) M | (350.0) M |

| Net Change in Cash | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Foreign Exchange Rate Adjustments | – | – | – | – |

| Miscellaneous Cash Flow Adjustments | – | – | – | – |

| Net Change in Cash | 335.8 M | (11.7) M | (104.0) M | (104.0) M |

| Supplemental Cash Flow Items | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Free Cash Flow | 65.2 M | (127.2) M | 252.1 M | 252.1 M |

| Free Cash Flow per Share | 0.82 | (1.66) | 3.15 | 3.15 |

| Cash Interest Paid | 105.1 M | 248.8 M | 281.9 M | 281.9 M |

| Cash Income Tax Paid (Refund) | 55.3 M | 41.4 M | 201.4 M | 201.4 M |

| Change In Net Working Capital | 260.2 M | 417.0 M | 620.6 M | 620.6 M |

| Net Debt Issued / Repaid | 390.0 M | 111.2 M | (350.0) M | (350.0) M |

| Valuation Metrics | ||||

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

|---|---|---|---|---|

| Sales | Revenues | – | – | – | – |

| EV / Sales (LTM) | 0.5 x | 0.7 x | 0.6 x | 0.5 x |

| EV / Sales (NTM) | – | 0.7 x | 0.5 x | – |

| Price / Sales (LTM) | 0.2 x | 0.4 x | 0.4 x | 0.3 x |

| Price / Sales (NTM) | – | 0.4 x | 0.3 x | – |

| Earnings | – | – | – | – |

| EV / EBITDA (LTM) | 15.6 x | 3.4 x | 3.0 x | 2.6 x |

| EV / EBITDA (NTM) | – | 3.6 x | 2.5 x | – |

| EV / EBIT (LTM) | – | 3.8 x | 3.5 x | 3.0 x |

| EV / EBIT (NTM) | – | – | – | – |

| Price / Earnings (LTM) | – | 4.7 x | 2.9 x | 2.3 x |

| Price / Earnings (NTM) | – | 9.0 x | 3.9 x | – |

| Book Value | – | – | – | – |

| Price / Book (LTM) | 0.3 x | 1.0 x | 0.7 x | 0.5 x |

| Price / Tangible Book Value (LTM) | 0.3 x | 1.0 x | 0.7 x | 0.6 x |

| Metric | FY 2022 | FY 2023 | FY 2024 | Current/LTM |

| Market Capitalization | 555.2 M | 1,999.9 M | 2,589.6 M | 2,053.6 M |

| Cash & Short Term Investments | 498.0 M | 456.3 M | 352.2 M | 352.2 M |

| Total Debt | 1,680.5 M | 1,913.7 M | 1,617.5 M | 1,617.5 M |

| Preferred Equity | – | – | – | – |

| Minority Interest | 57.3 M | 76.3 M | 122.0 M | 122.0 M |

| Enterprise Value | 1,753.9 M | 3,533.5 M | 3,976.9 M | 3,440.9 M |

| Enterprise Value Multiples | ||||

| EV / Sales | 0.5 x | 0.7 x | 0.6 x | 0.5 x |

| EV / EBITDA | 15.6 x | 3.4 x | 3.0 x | 2.6 x |

| EV / EBIT | – | 3.8 x | 3.5 x | 3.0 x |

| Capitalization | ||||

| Total Capital | 3,580.9 M | 3,986.8 M | 5,474.1 M | 5,474.1 M |

| Total Common Equity | 1,843.1 M | 1,996.9 M | 3,734.6 M | 3,734.6 M |

| Total Preferred Equity | – | – | – | – |

| Total Debt | 1,680.5 M | 1,913.7 M | 1,617.5 M | 1,617.5 M |

| Minority Interest | 57.3 M | 76.3 M | 122.0 M | 122.0 M |

| Returns | ||||

| Return on Total Capital | 0.05 % | 15.50 % | 15.21 % | 15.21 % |

| Total Debt / Total Capital | 46.9 % | 48.0 % | 29.5 % | 29.5 % |

| Total Debt / Equity | 88.4 % | 92.3 % | 41.9 % | 41.9 % |

| Total Debt / EBITDA | 15.0 x | 1.8 x | 1.2 x | 1.2 x |

| Long-Term Debt / Total Capital | 9.6 % | 10.1 % | 8.5 % | 8.5 % |

| Returns | ||||

| Return on Assets | 0.04 % | 11.55 % | 10.90 % | 10.90 % |

| Return On Equity | 0.74 % | 23.80 % | 31.01 % | 31.01 % |

| Return on Total Capital | 0.05 % | 15.50 % | 15.21 % | 15.21 % |

| Return on Common Equity | (0.19) % | 23.24 % | 31.07 % | 31.07 % |

| Margins | ||||

| EBITDA Margin | 3.07 % | 21.32 % | 19.47 % | 19.47 % |

| EBITA Margin | 0.08 % | 19.37 % | 17.32 % | 17.32 % |

| EBIT Margin | 0.08 % | 19.37 % | 17.32 % | 17.32 % |

| EBT Margin | – | – | – | – |

| EBT Excl. Non-Recurring Items Margin | – | – | – | – |

| Gross Profit Margin | 15.91 % | 30.74 % | 28.22 % | 28.22 % |

| SG&A Margin | 14.21 % | 10.39 % | 9.94 % | 9.94 % |

| Net Income Margin | (0.10) % | 9.22 % | 13.40 % | 13.40 % |

| Net Avail. For Common Margin | (0.10) % | 9.22 % | 13.40 % | 13.40 % |

| Normalized Net Income Margin | 1.62 % | 7.90 % | 9.70 % | 9.70 % |

| Asset Turnovers | ||||

| Receivables Turnover (Average Receivables) | 7.6 x | 7.8 x | 8.1 x | 8.1 x |

| Fixed Assets Turnover (Average Fixed Assets) | 1.8 x | 2.3 x | 2.4 x | 2.4 x |

| Inventory Turnover (Average Inventory) | 2.5 x | 2.4 x | 2.3 x | 2.3 x |

| Asset Turnover | 0.8 x | 1.0 x | 1.0 x | 1.0 x |

| Days Outstanding Inventory (Avg) | 146.8 | 154.3 | 158.9 | 158.9 |

| Short-term Liquidity | ||||

| Current Ratio | 1.2 x | 1.2 x | 1.5 x | 1.5 x |

| Quick Ratio | 0.5 x | 0.5 x | 0.5 x | 0.5 x |

| Days Sales Outstanding (Average Receivables) | 48.0 | 46.8 | 44.9 | 44.9 |

| Days Payable Outstanding (Avg) | 44.3 | 43.9 | 37.9 | 37.9 |

| Cash Conversion Cycle (Average Days) | 150.5 | 157.2 | 165.9 | 165.9 |

| Operating Cash Flow to Current Liabilities | 0.1 % | 0.1 % | 0.2 % | 0.2 % |

| Return on Invested Capital (ROIC) | ||||

| Net Operating Profit After Tax (NOPAT) | (61.0) M | 724.3 M | 838.4 M | 838.4 M |

| Invested Capital, Average | – | 3,783.8 M | 4,730.5 M | 5,474.1 M |

| Return on Invested Capital (ROIC) | – | 19.14 % | 17.72 % | 15.32 % |

| Net Operating Profit After Tax (NOPAT) – repeated | (61.0) M | 724.3 M | 838.4 M | 838.4 M |

| EBIT | 2.7 M | 938.3 M | 1,150.9 M | 1,150.9 M |

| Income Tax Expense | 63.7 M | 214.0 M | 312.5 M | 312.5 M |

| Net Operating Profit After Tax (NOPAT) – again | (61.0) M | 724.3 M | 838.4 M | 838.4 M |

| Average Invested Capital (Components) |

Long Term Debt: 273.9 M Short Term Debt: 1,318.7 M Total Equity: 1,900.4 M Current Portion of Leases: 16.4 M Long Term Leases: 71.5 M |

Long Term Debt: 317.4 M Short Term Debt: 1,487.4 M Total Equity: 2,073.2 M Current Portion of Leases: 23.8 M Long Term Leases: 85.0 M |

Long Term Debt: 355.9 M Short Term Debt: 1,118.5 M Total Equity: 3,856.6 M Current Portion of Leases: 35.4 M Long Term Leases: 107.7 M |

Long Term Debt: 355.9 M Short Term Debt: 1,118.5 M Total Equity: 3,856.6 M Current Portion of Leases: 35.4 M Long Term Leases: 107.7 M |

| Invested Capital | 3,580.9 M | 3,986.8 M | 5,474.1 M | 5,474.1 M |

| Invested Capital, Average | – | 3,783.8 M | 4,730.5 M | 5,474.1 M |

| Debt Analysis | ||||

| Total Debt / Equity | 88.4 % | 92.3 % | 41.9 % | 41.9 % |

| Total Debt / Capital | 46.9 % | 48.0 % | 29.5 % | 29.5 % |

| Long-Term Debt / Equity | 18.2 % | 19.4 % | 12.0 % | 12.0 % |

| Long-Term Debt / Capital | 9.6 % | 10.1 % | 8.5 % | 8.5 % |

| Total Liabilities / Total Assets | 59.5 % | 62.0 % | 50.2 % | 50.2 % |

| Interest Rate Coverage | ||||

| EBIT / Interest Expense | 0.0 x | 3.8 x | 4.1 x | 4.1 x |

| EBITDA / Interest Expense | 1.1 x | 4.2 x | 4.7 x | 4.7 x |

| (EBITDA – Capex) / Interest Expense | 0.1 x | 3.2 x | 3.7 x | 3.7 x |

| Debt Coverage | ||||

| Total Debt / EBITDA | 15.0 x | 1.8 x | 1.2 x | 1.2 x |

| Net Debt / EBITDA | 10.5 x | 1.4 x | 1.0 x | 1.0 x |

| Total Debt / (EBITDA – Capex) | 199.9 x | 2.4 x | 1.6 x | 1.6 x |

| Net Debt / (EBITDA – Capex) | 140.7 x | 1.8 x | 1.2 x | 1.2 x |

| Bankruptcy Risk | ||||

| Altman Z-Score | 0.80 | 1.75 | 2.04 | 2.04 |

Sources

- Bloomberg Terminal

- Reuters

- Investopedia

- Mckvay

- MarketWatch

- Trading Economics

- Acuity Knowledge Partners

- Koyfin

- Cboe Global Markets

- TradingView

- Central Bank Website

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions