Expanded EGX30 Technical Analysis Report

- Market: EGX30 Index (EGP)

- Published: April 19, 2025

- Analyst Commentary: Multi‑timeframe, indicator‑supported breakdown with emphasis on structure, momentum, and projected zones.

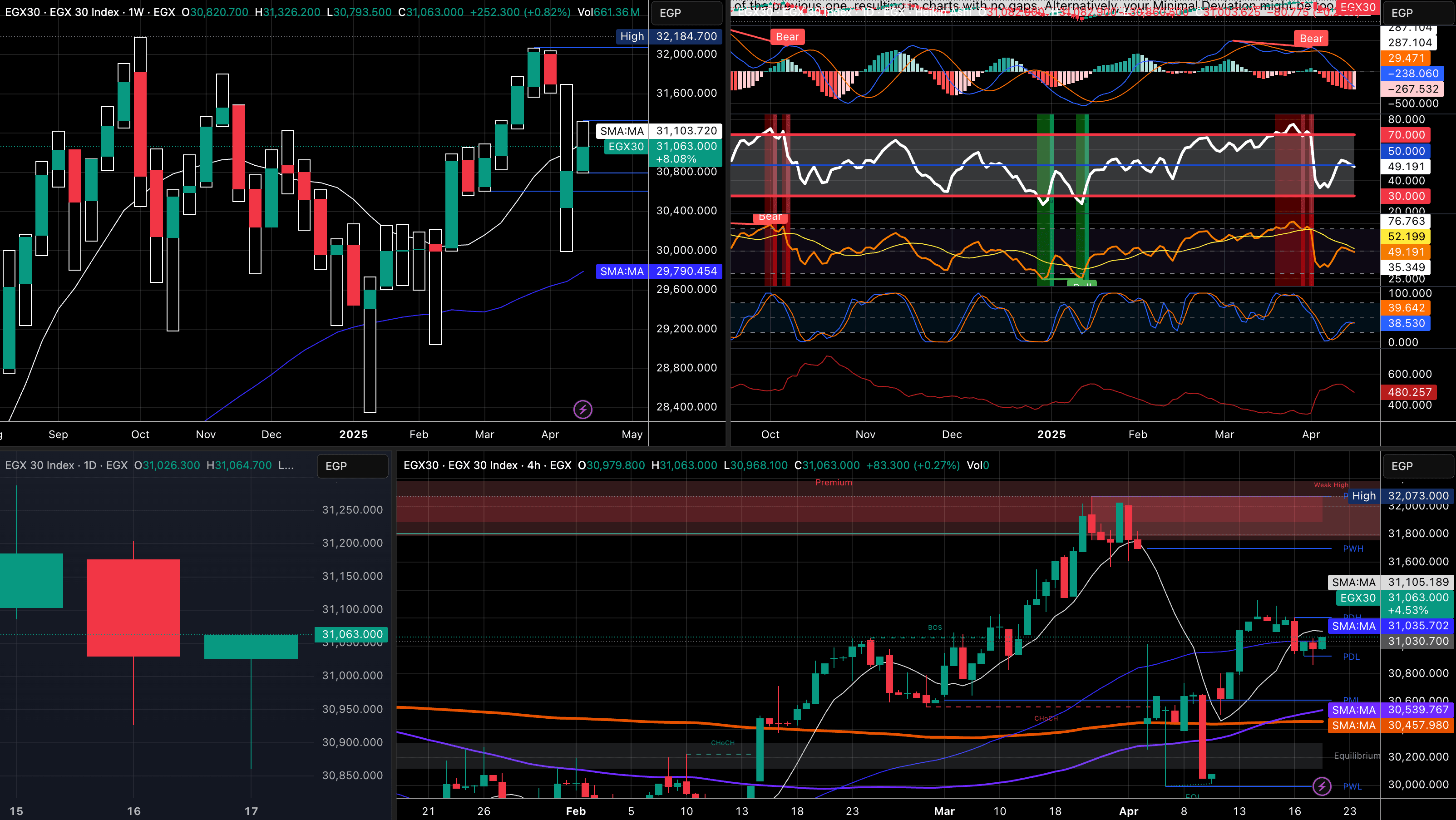

1. Weekly Chart Breakdown (Top Left)

- 🟢 Bullish Candle Formation:

- The current weekly candle closed higher than the previous one, forming a bullish continuation after bouncing from ~30,000 EGP lows.

- Volume: 661.36M suggests strong institutional interest during rebound.

- 🔄 Market Structure:

- Weekly trend remains bullish, following a clear V‑shaped recovery from mid‑March.

- A higher low vs. February indicates a new base for an upward leg.

- 📉 Moving Averages:

- SMA(10): 31,103 EGP (price just above)

- SMA(50): 29,790 EGP (well below)

- Short‑term MA flattening but still tilting up—consistent with a maturing uptrend.

- 🎯 Weekly Resistance/Support:

- Immediate Resistance: ~31,300 (Wick High)

- Support Zone: 30,600–30,900

- Weekly close above 31,300 could ignite further bullish momentum.

2. Indicators Analysis (Top Right)

- RSI: 49.19, near key pivot of 50—on the verge of sentiment shift.

- ADX: 52.19—strong trend presence, +DI > -DI signalling bull control.

- Stochastic RSI: Recovering from oversold (~39), no clean bullish crossover yet.

- ATR (14‑period): 480 pts—moderately low volatility near breakout zones.

3. Daily Chart Analysis (Bottom Left)

- Price hovered ~31,000 between April 15–17, forming support.

- April 17 closed as a bullish candle with long lower wick, rejecting 30,900 zone.

- Price now squeezed between 30,850 (support) and 31,150 (resistance); inside candle implies indecision.

4. 4H Intraday Breakdown (Bottom Right)

- Current Price: 31,063 (+3.46% intraday)

- Tested PDH and now challenging PMH (31,750) & PWH.

- Supply zone marked 31,100–31,750 with multiple past rejections.

| Level | Description | Value (EGP) |

|---|---|---|

| PMH | Prev. Month High (Resistance) | 31,750 |

| PDH | Prev. Day High (Current Resistance) | 31,063 |

| PDL | Prev. Day Low (Support) | 30,968 |

| PML | Prev. Month Low | 30,457 |

| PWL | Prev. Week Low | 30,250 |

| EQ | Equilibrium | ~30,500 |

- All 4H SMAs (20/50/200) align bullish—confirming medium‑term upward bias.

🔮 Strategic Forecast

- ✅ Bullish Case:

- Trigger: Confirmed close above 31,300 (weekly/daily).

- Targets: 31,750 → 32,000+

- Support: 30,900 / 30,457

- ⚠️ Bearish Contingency:

- Risk: Rejection from supply zone (PMH/PWH).

- Pullback Zones: 30,750 → 30,500 → 30,250

- Lower RSI & unconfirmed Stochastic may lead to brief consolidation.

✅ Final Thoughts

The EGX30 Index is set up for a potential breakout after this constructive recovery. Watch 31,300–31,750 for historical supply. A decisive push above could lead toward 32,000+, while failure may see a minor retracement.

Disclaimer.

The information and recommendations provided on this platform are for educational and informational purposes only and should not be considered as personalized investment advice or a solicitation to buy or sell any financial instruments.

1. No Guarantee of Profit:

Trading in financial markets involves substantial risk, and there is no guarantee of profit or protection against losses. Past performance is not indicative of future results.

2. Independent Decision-Making:

All investment decisions are your sole responsibility. You are encouraged to perform your own research and consult with a qualified financial advisor before making any trading decisions.

3. Market Risks:

Financial markets are subject to volatility, economic conditions, and unforeseen factors that may impact your investments.

4. No Liability:

Mckvay Consulting will not be held liable for any losses or damages resulting from reliance on the information provided. Use the recommendations at your own risk.

5. Educational Purpose Only:

The recommendations are intended to provide insight into market trends and strategies, not to serve as actionable investment directives.

By using this platform, you acknowledge that you have read and understood this disclaimer and accept the associated risks of trading. Always trade responsibly and within your financial means.

Sources

- Bloomberg Terminal

- Reuters

- Investopedia

- Mckvay

- MarketWatch

- DailyForex

- MacroTrends

- Trading Economics

- Acuity Knowledge Partners

- Longforecast.com

- Cboe Global Markets

- TradingView

- Central Bank Websites

- World Gold Council

- Refinitiv Eikon

MORE IN-DEPTH ANALYSIS

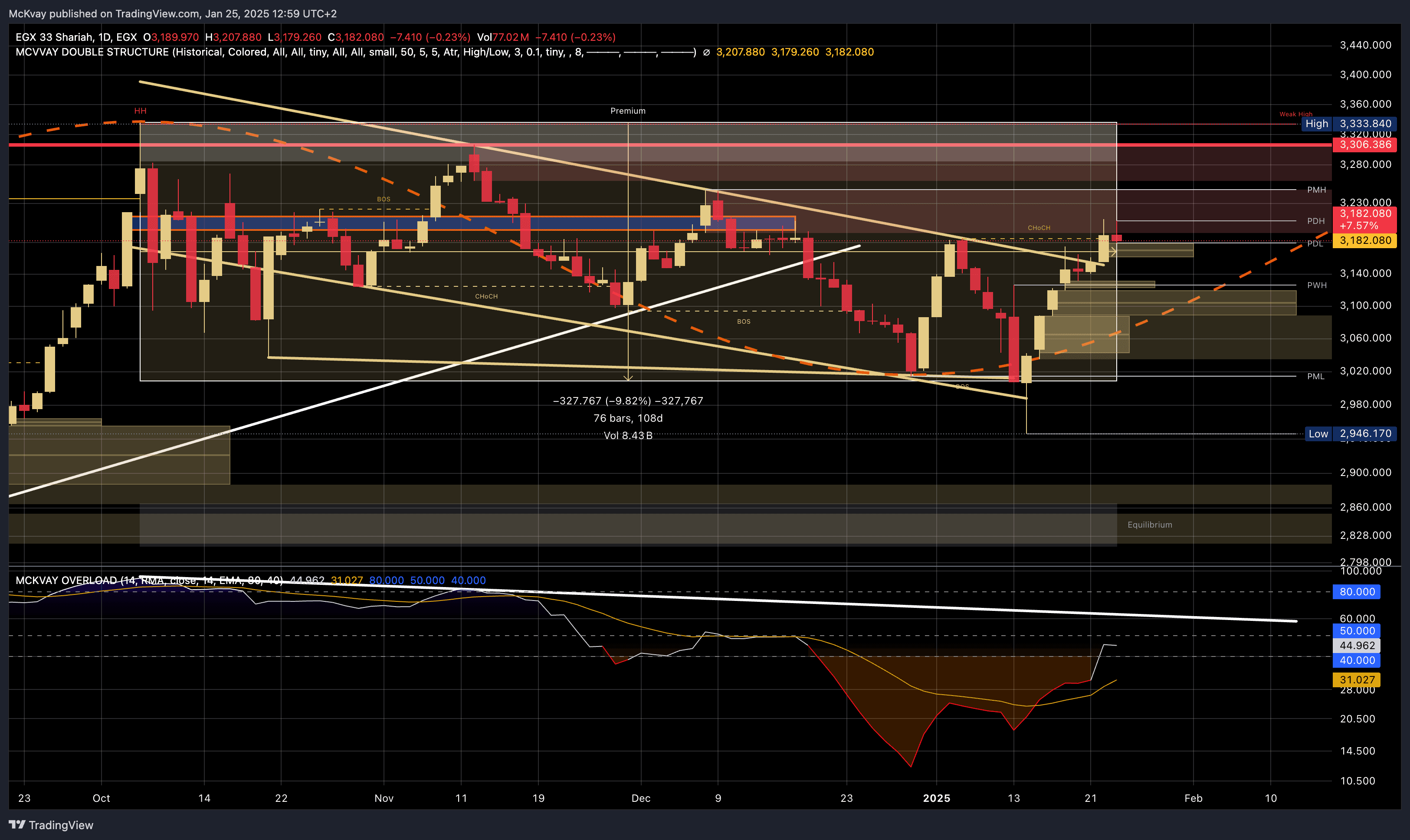

EGX33 (shariah) Index UPDATED on a DAILY timeframe, Key Support & Resistance, AND Price Action & Volume.

EGX70 EWI Index UPDATED on a DAILY timeframe, Short-Term & Medium-Term Outlook, AND Market Structure.

EGX30 Index UPDATED on a DAILY timeframe, Volatility & ATR, Market, Price Action & Volume, AND Market Structure.

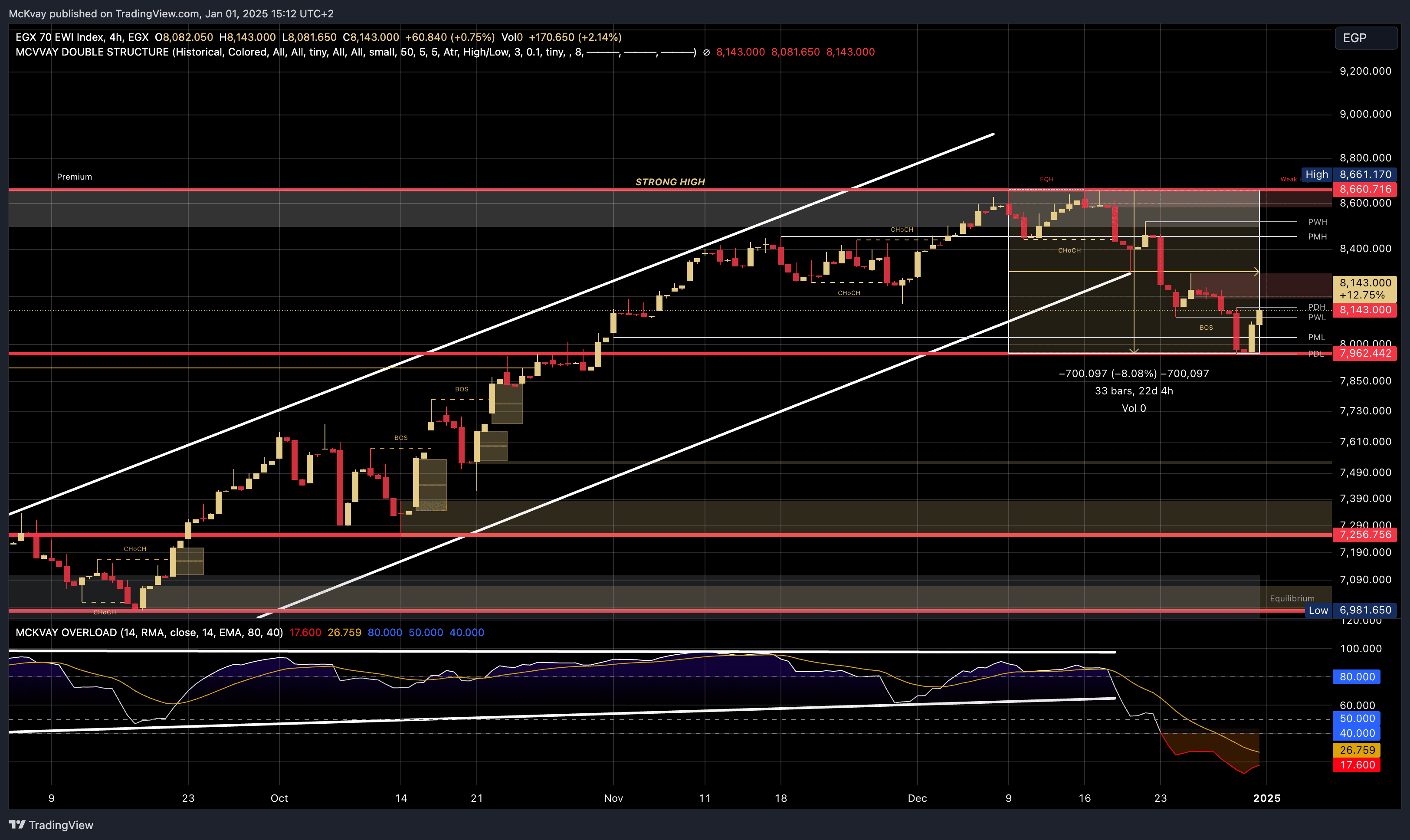

EGX70 Index on a 4-hour timeframe, key price structures, critical support and resistance levels, and momentum insights.

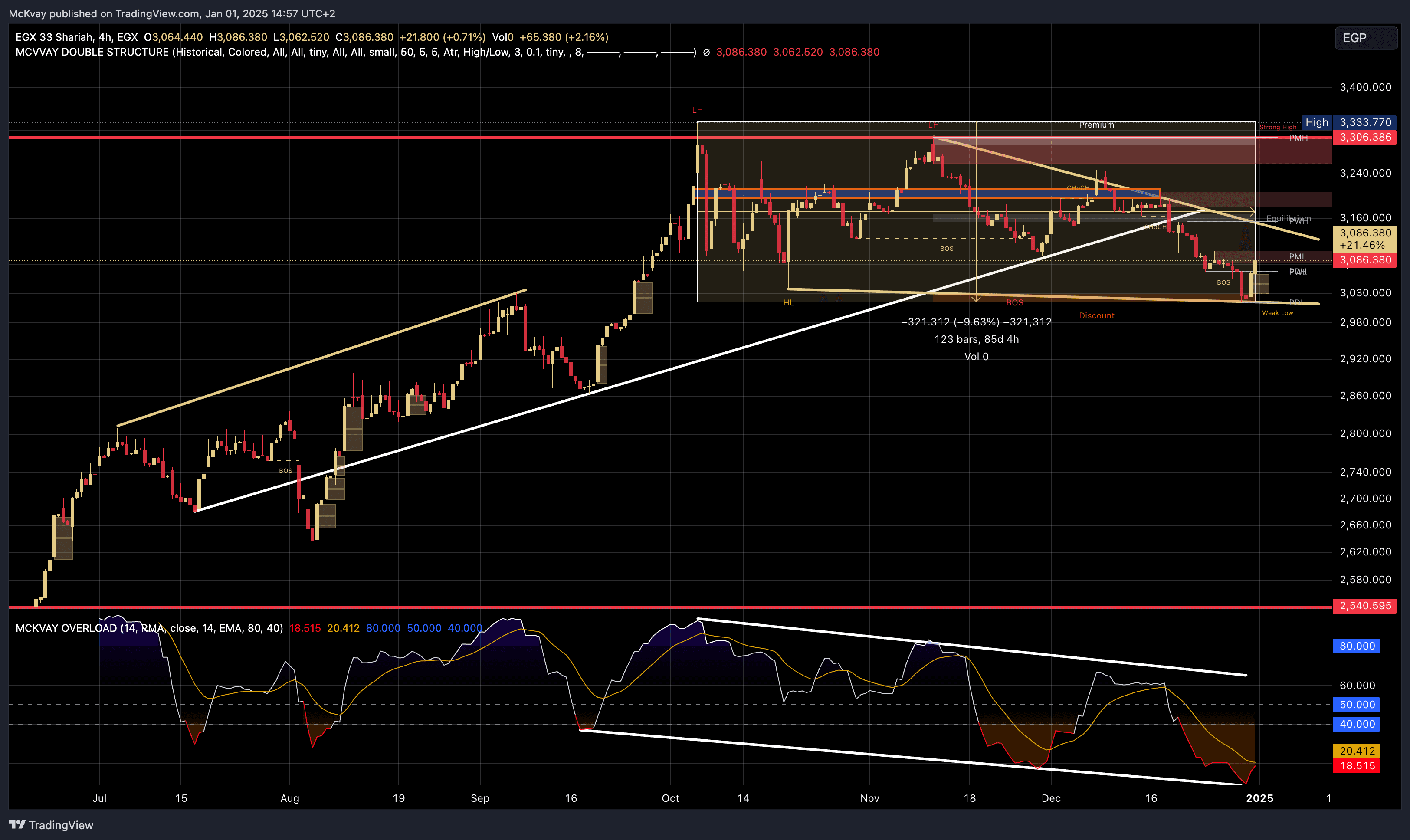

EGX 33 Shariah Index on a 4-hour timeframe, significant price action structures, key support and resistance levels, and momentum analysis.

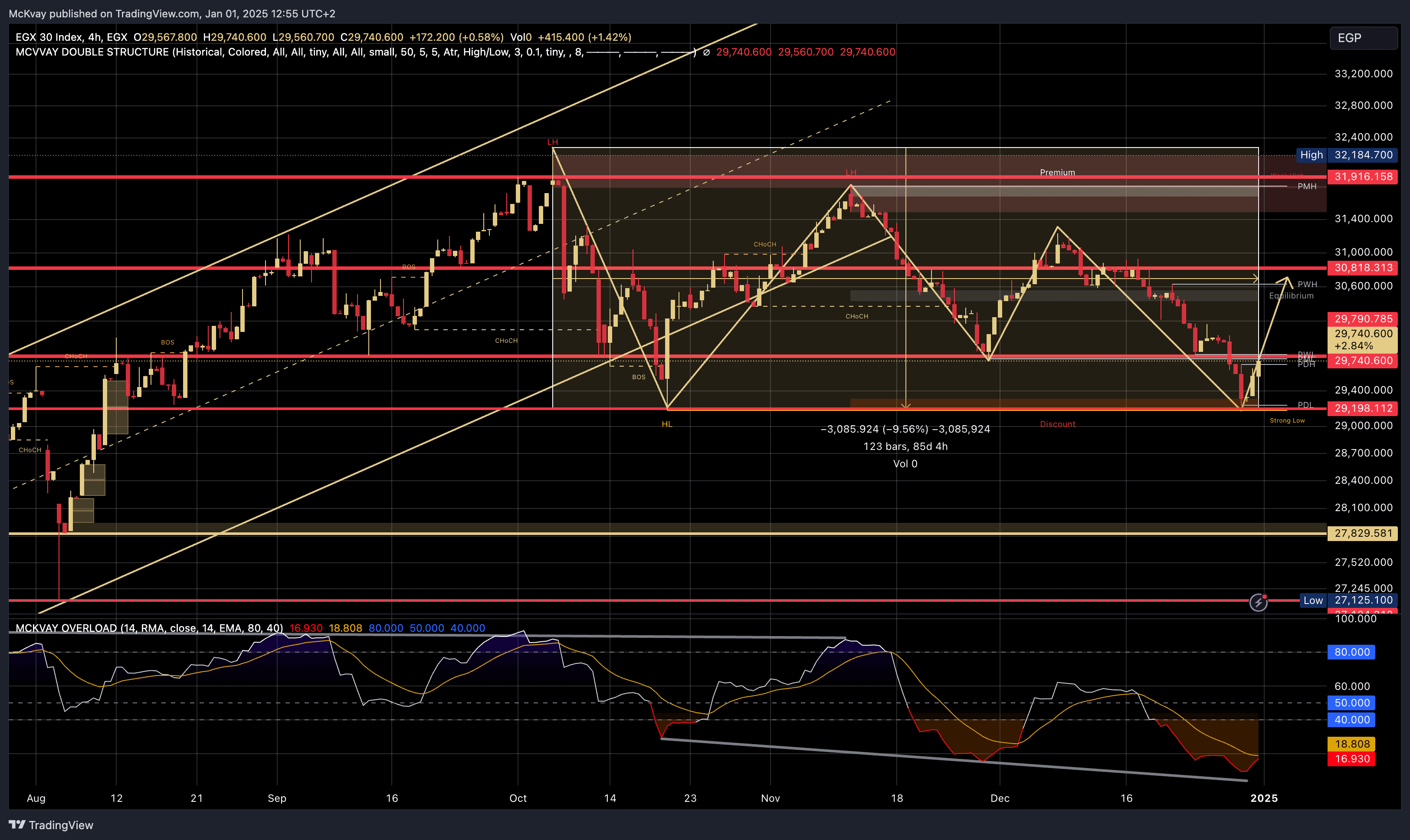

EGX30 Index on a 4-hour timeframe, emphasizing critical market dynamics, including price trends, key levels, and momentum shifts.

EGX30 Expected Move

Straight To The Top.

Copyright © 2025 Mckvay. All rights reserved.

Terms And Conditions