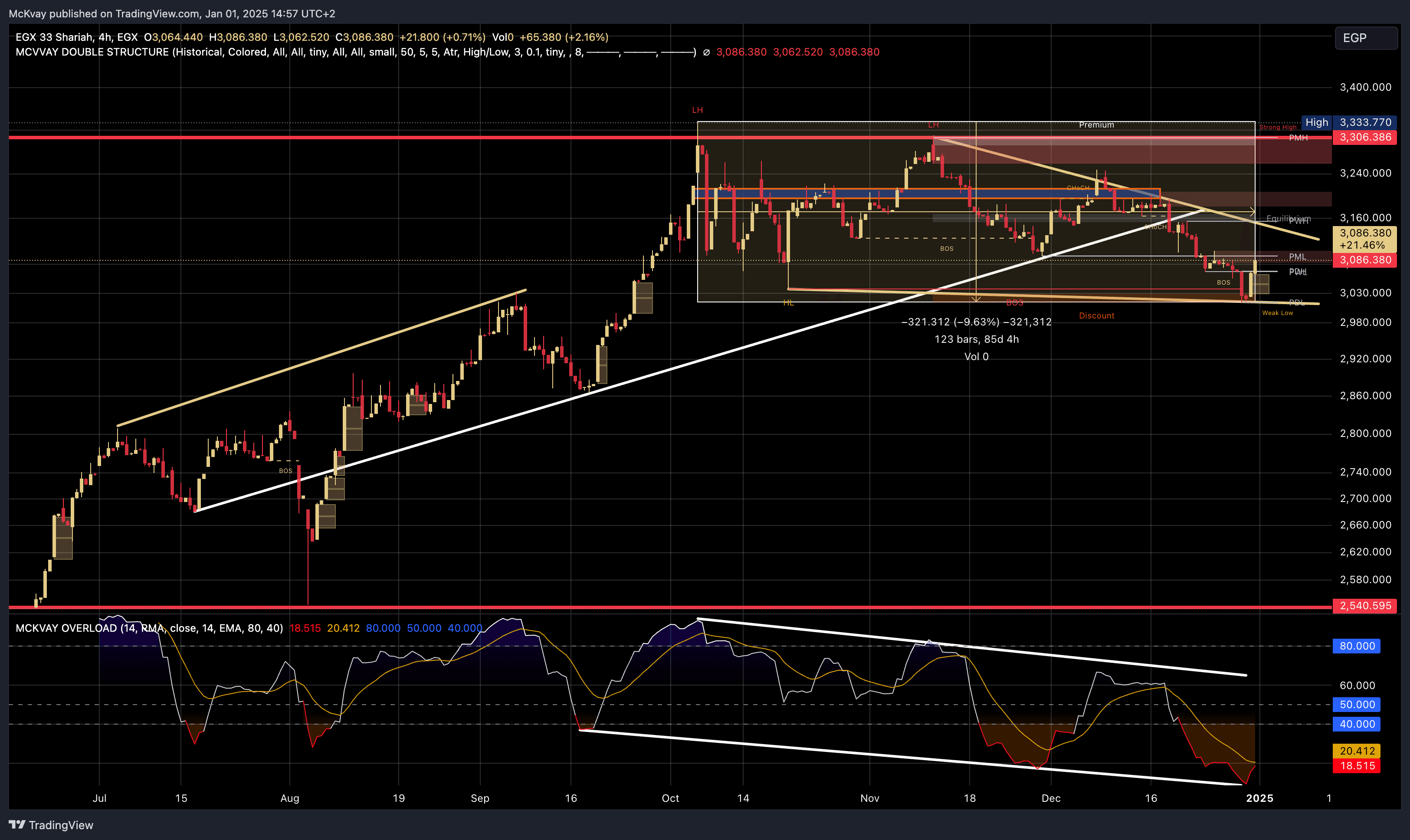

January 1, 2025

| 1. Overview |

|

| 2. Trend Analysis |

|

| 3. Key Price Zones |

|

| 4. Market Structure |

|

| 5. Momentum Analysis |

|

| 6. Volume Insights |

|

| 7. Outlook |

|

| Conclusion: The index is at a critical support level (~3,086.38). Stabilization and reclaiming equilibrium (~3,160) are essential for recovery, while failure to hold above key supports could lead to significant bearish continuation. |