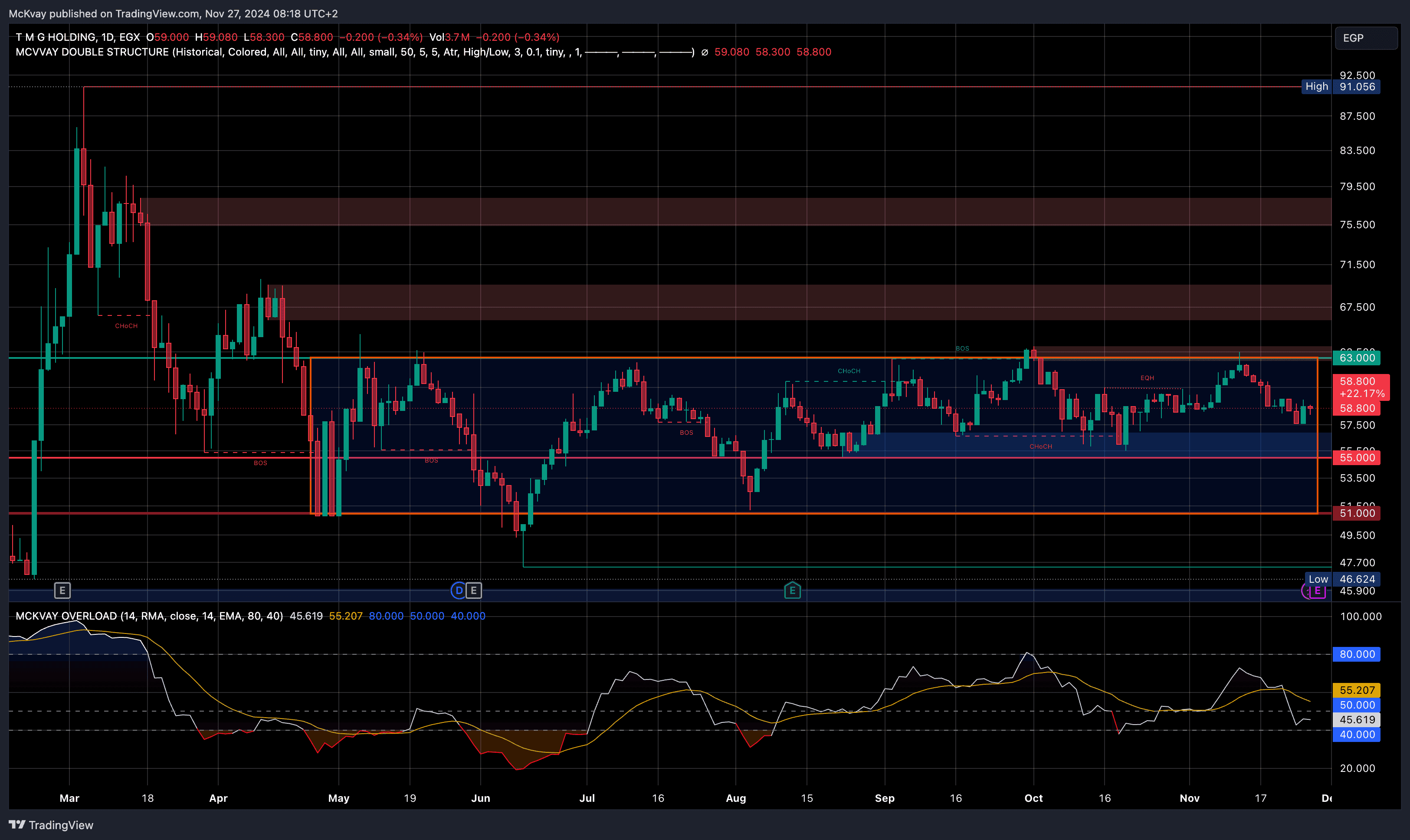

Talaat Moustafa Group Holding (TMGH) has demonstrated robust financial performance and strategic growth in 2024, solidifying its position as a leading real estate developer in Egypt.

Disclaimer.

The information and recommendations provided on this platform are for educational and informational purposes only and should not be considered as personalized investment advice or a solicitation to buy or sell any financial instruments.

1. No Guarantee of Profit:

Trading in financial markets involves substantial risk, and there is no guarantee of profit or protection against losses. Past performance is not indicative of future results.

2. Independent Decision-Making:

All investment decisions are your sole responsibility. You are encouraged to perform your own research and consult with a qualified financial advisor before making any trading decisions.

3. Market Risks:

Financial markets are subject to volatility, economic conditions, and unforeseen factors that may impact your investments.

4. No Liability:

Mckvay Consulting will not be held liable for any losses or damages resulting from reliance on the information provided. Use the recommendations at your own risk.

5. Educational Purpose Only:

The recommendations are intended to provide insight into market trends and strategies, not to serve as actionable investment directives.

By using this platform, you acknowledge that you have read and understood this disclaimer and accept the associated risks of trading. Always trade responsibly and within your financial means.

Straight To The Top.

Sources

Routers, TMG Holding, EGX.com.eg, mubasher.info

Copyright © 2024 Mckvay. All rights reserved.